October 17th, 2023

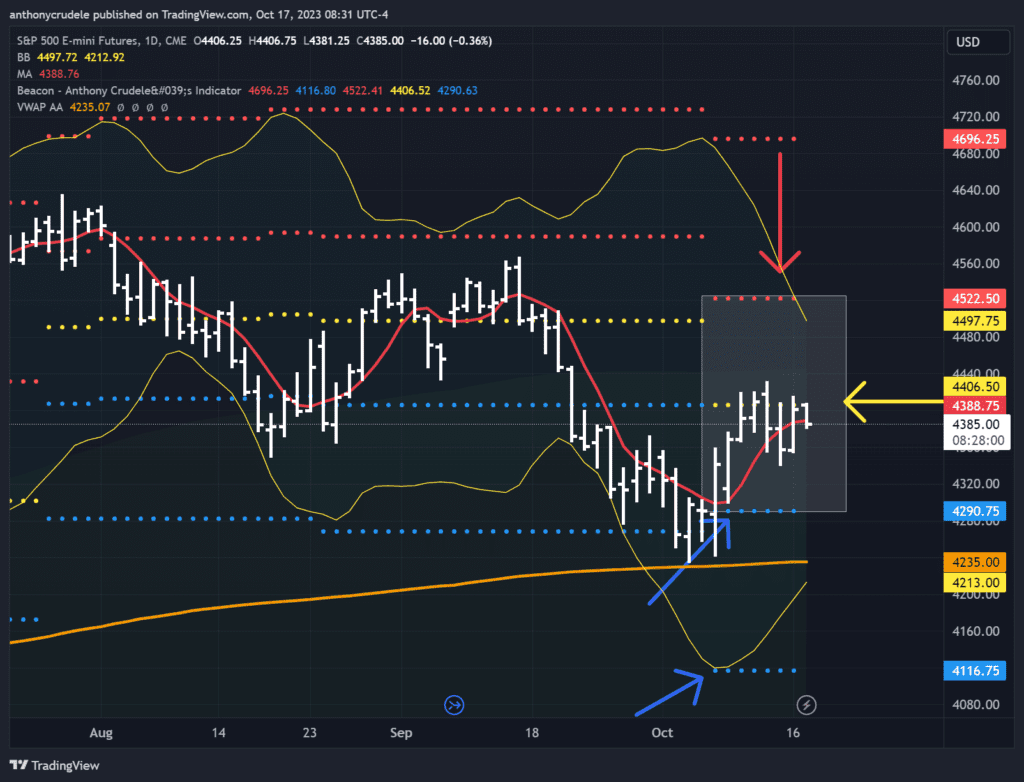

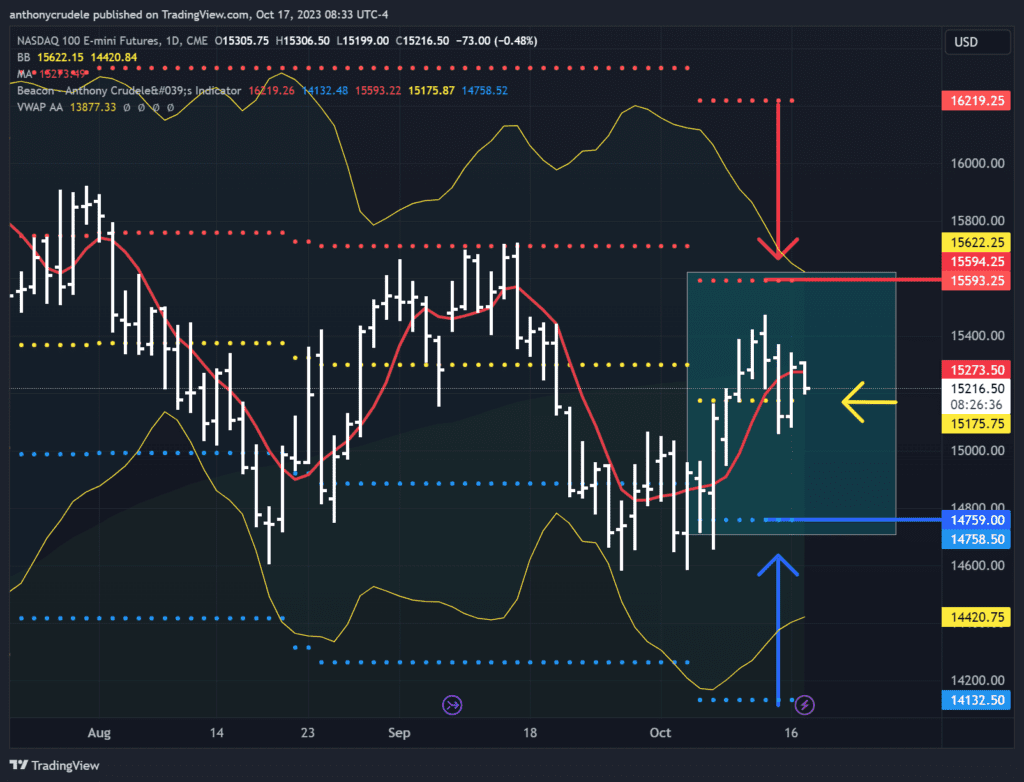

This morning, we have a tug of war between technicals within the indexes and the market leaders, namely interest rates. The daily charts have been consistently showing the same pattern over the past several sessions. The ES is currently slightly below its 5-day moving average (4388.75) and my neutral area of 4406.50. On the other hand, the NQ is sitting above its neutral area (15,175) and just below its 5-day moving average (15,272). Whenever the major indexes hover around neutral areas and fluctuate around a mere 5-day moving average, it’s a clear sign of a choppy market.

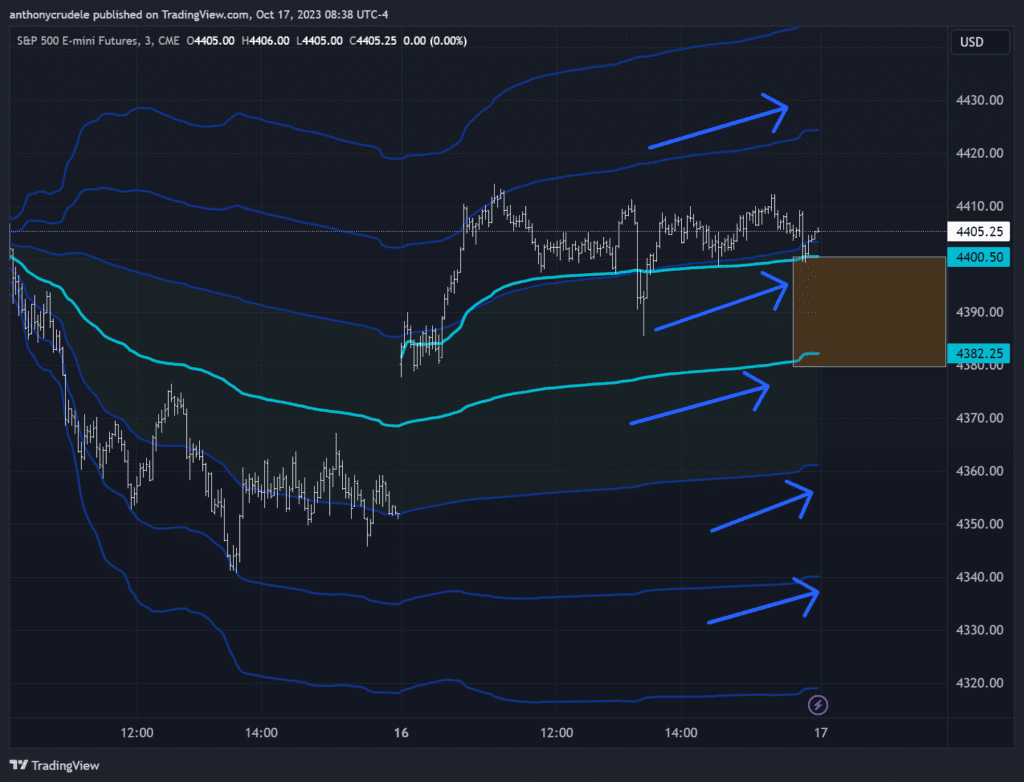

Looking at the 3-minute chart I shared, you can see the specific zone I highlighted between Monday’s and Friday’s VWAP (4401-4382). This area is expected to be a major chop zone, as indicated by the overnight action. When you examine the VWAPs and the standard deviation lines, they are pointing upward, suggesting bullish momentum. This favors longs, but the higher interest rates this morning create a contradiction with the technicals.

My strategy for today is as follows: If the 3-minute opening range can sustain above 4382, I will consider a small long position, with a focus on the 4382 area and a possible test of Monday’s VWAP at 4401. If the bulls can push through that level, we may witness an accelerated rally towards the upper standard deviation bands on the 3-minute chart. However, if the bulls fail to hold 4382 and we see the VWAPs and standard deviation lines begin to decline, I will start looking for short opportunities.

Remember that position sizing is always key, but in a situation where the technicals contradict the market leaders, it becomes even more crucial to keep positions small. Don’t succumb to FOMO (fear of missing out) and avoid becoming too attached to any particular trade. Stay nimble and adapt to changing market conditions.