October 8th, 2024

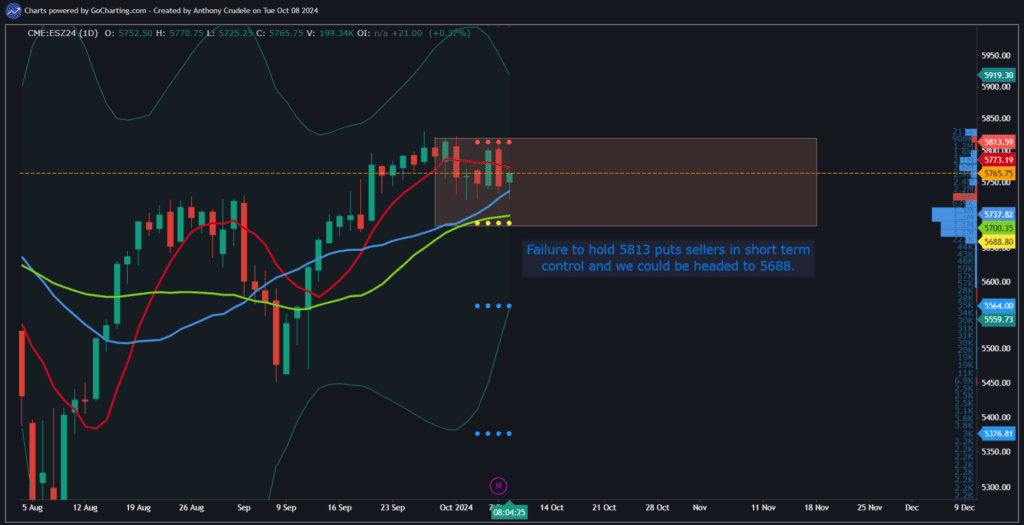

Sell rallies, not breaks. Buy breaks, not rallies. Momentum has stalled for the bulls, but they are far from beaten. We’re just in a mean reversion phase for now. As long as we remain below 5813 on a closing basis, I think we’re headed to 5688, which will be a key test for this market.

How do day traders navigate this environment? With daily Bollinger Bands in contraction and daily moving averages bunching, this tape can be traded on both sides for day traders. I believe rallies will continue to get faded until we test 5688 or achieve a daily close above 5813, so I would likely favor shorts in my strategy for now. If we approach 5688 and I see buy signals, my focus will shift to longs from that point.

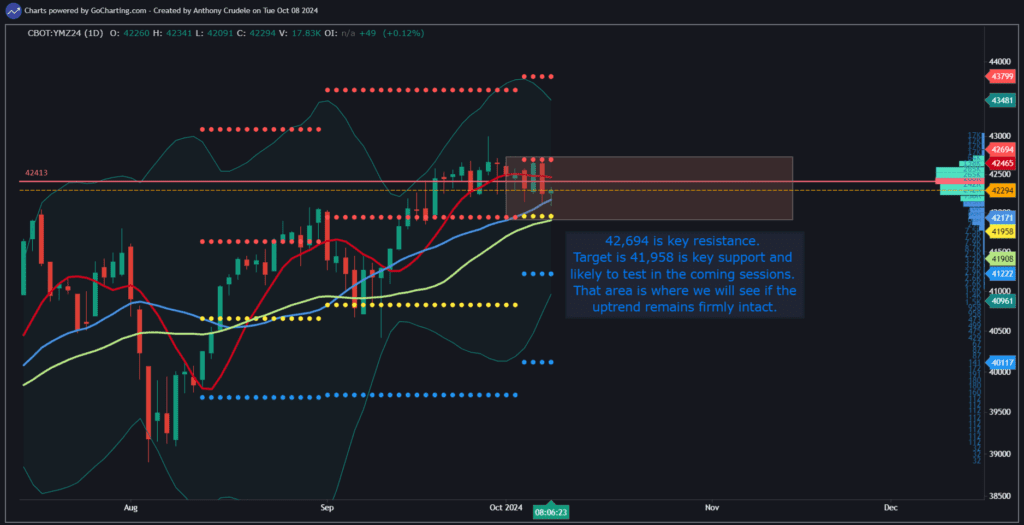

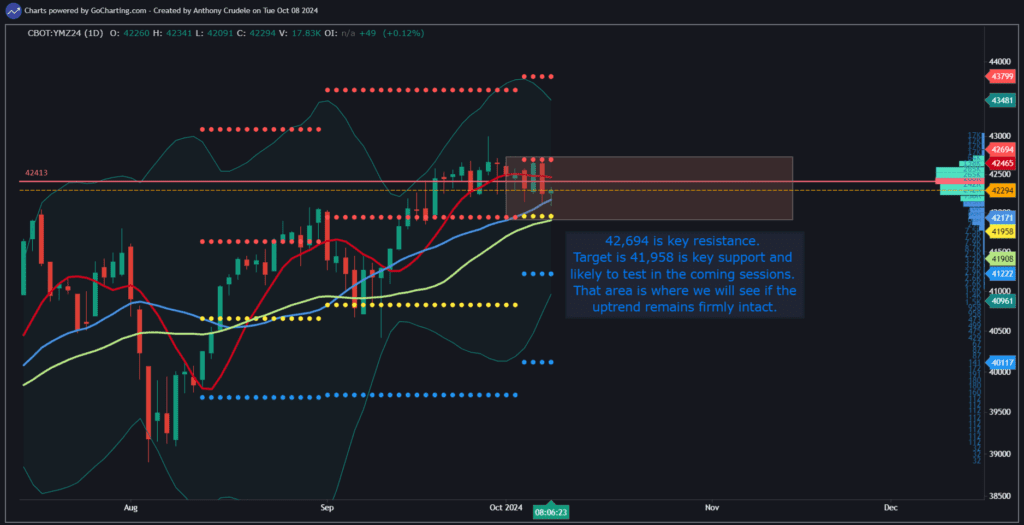

YM looks the same as ES right now; I think they’re temporarily in sell-the-rally mode. 42,694 is key resistance, and I’m looking for 41,958 to test in the coming sessions.

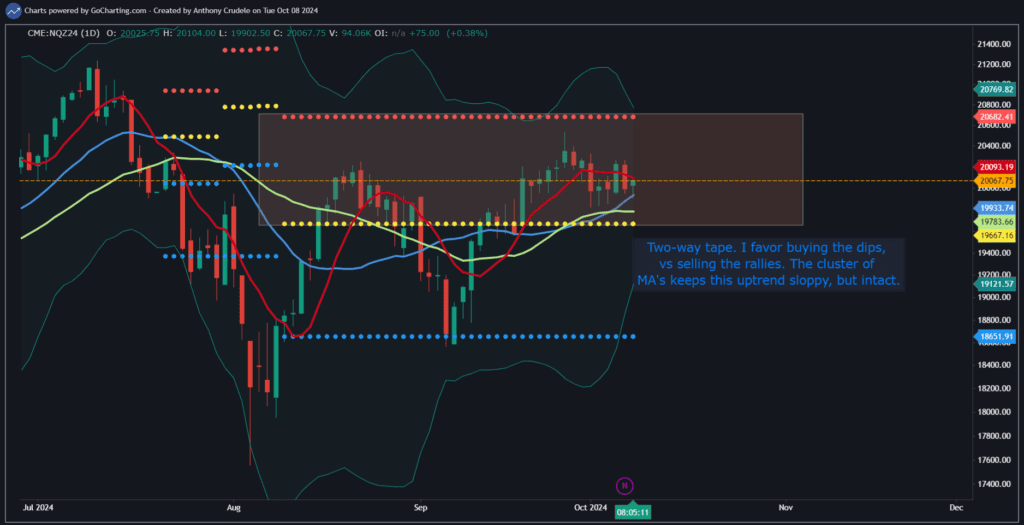

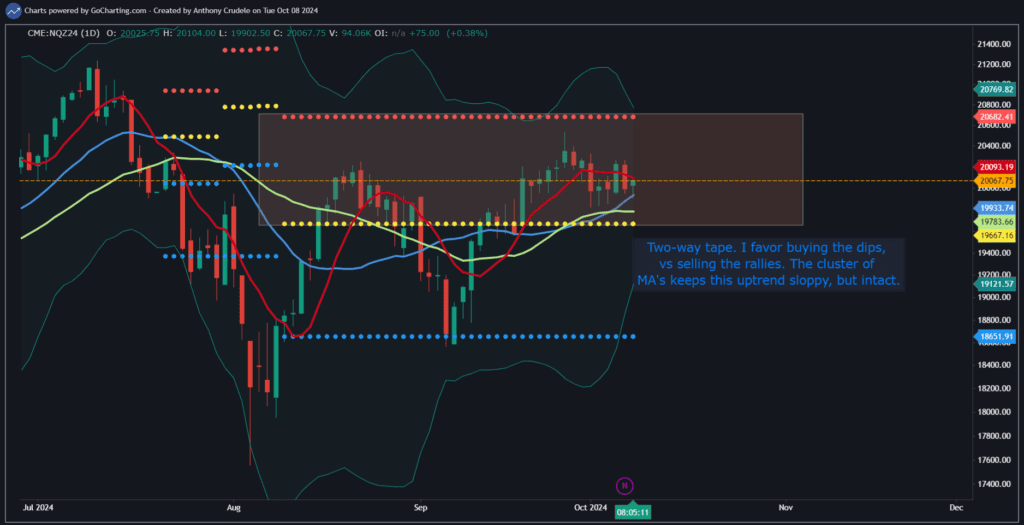

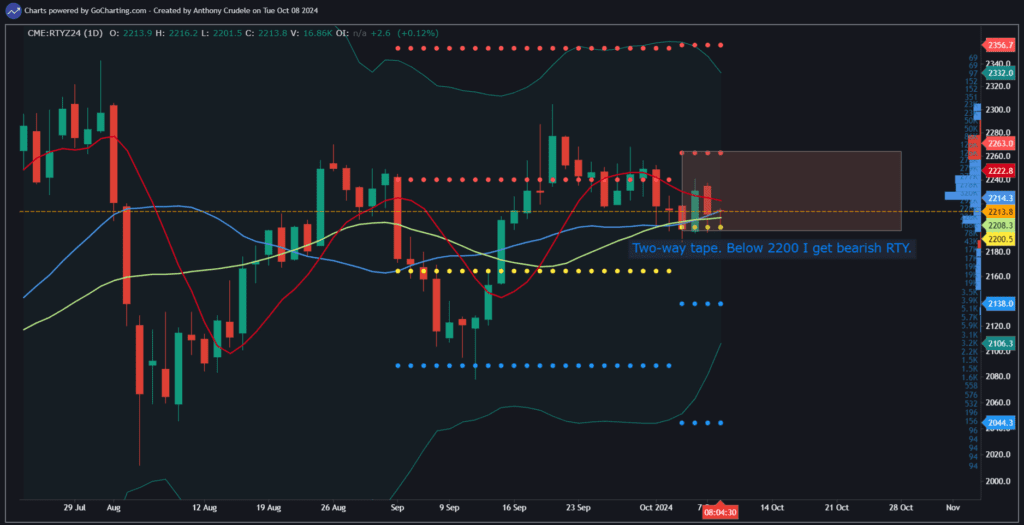

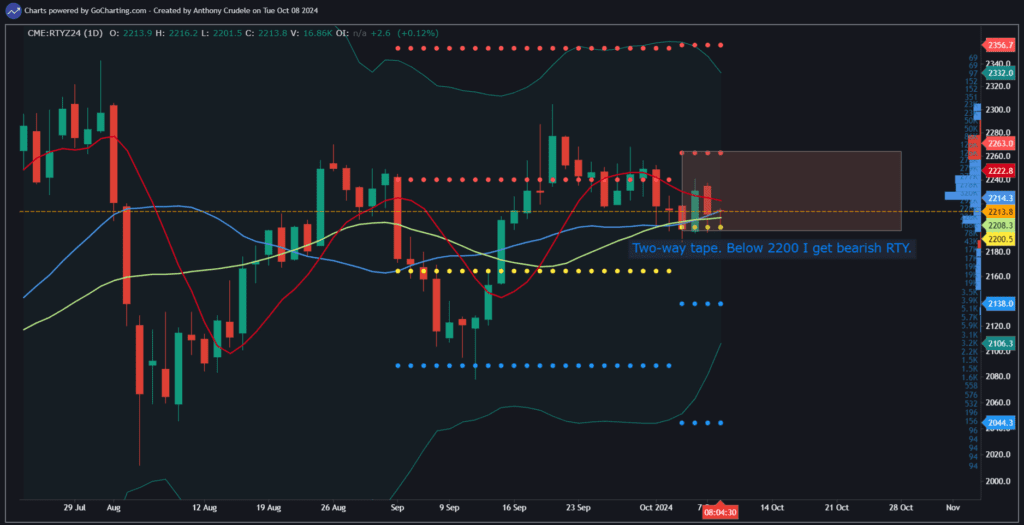

NQ and RTY are just two-way tapes and seem to be traded on both sides for the foreseeable future. Not my favorite looks for indexes.

I remain in the path of Hurricane Milton, so I’ll be focused on that throughout the day. My thoughts and prayers are with everyone in its path. Stay safe, fellow Floridians.

Cheers, DELI

Daily Gap Stats

Historical probabilities of each market closing above today’s open.

- metals

- energy

- indexes

Market Closes In:

| MARKET | SYMBOL | Opening Price |

Probability of Closing Above Open | profit factor |

|---|---|---|---|---|

| Copper | HG | 0.00 | 0.00 | |

| Gold | GC | 55 | 0.00 | |

| Silver | SI | 11 | 0.00 |

Market is closed

Check back in:

| MARKET | SYMBOL | Opening Price |

Probability of Closing Above Open | profit factor |

|---|---|---|---|---|

| Crude Oil | CL | 0.00 | 0.00 | |

| Natural Gas | NG | 23 | 0.00 |

Market is closed

Check back in:

| MARKET | SYMBOL | Opening Price |

Probability of Closing Above Open | profit factor |

|---|---|---|---|---|

| E-Mini S&P 500 |

ES | 0.00 | 0.00 | |

| E-Mini Nasdaq 100 |

NQ | 0.00 | 0.00 | |

| E-Mini Russel 2000 |

RTY | 0.00 | 0.00 | |

| E-Mini Dow |

YM | 0.00 | 0.00 |

Market is closed

Check back in:

IN THE OVERNIGHT 29 DECEMBER

Mostly GREEN-Quiet Night

- Hong Kong: Hang Seng closed UP +0.02%

- China CSI 300 +0.49%

- Taiwan KOSPI +1.60%

- India Nifty 50 -0.24%

- Australia ASX +0.71%

- Japan Nikkei +0.71%

- European bourses in POSITIVE territory so far this morning

- USD +0.04%

TOP STORIES OVERNIGHT

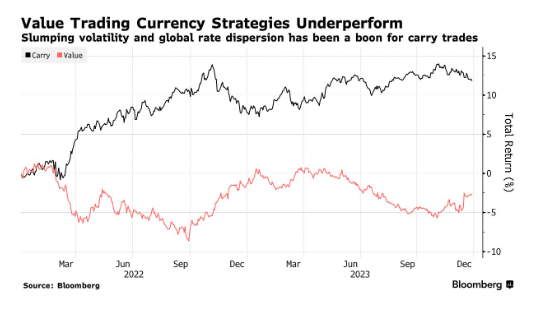

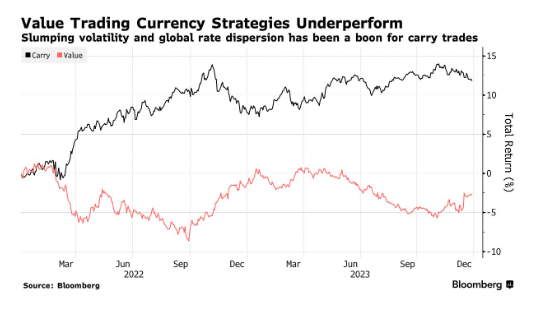

Currency Funds Are Turning to Value After Carry Trade’s Epic Run-BBG

A growing number of currency funds are looking to battered currencies that could benefit from lower interest rates as they attempt to replicate 2023’s blockbuster returns from the carry trade.

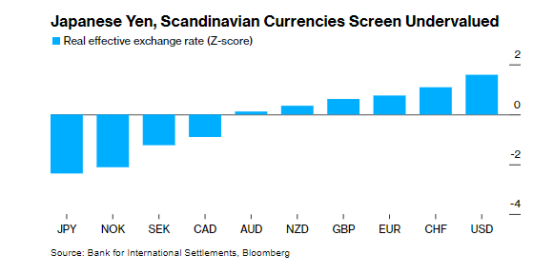

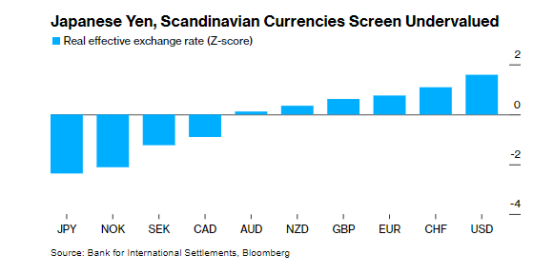

Betting on a so-called value strategy — by buying into the cheapest currencies and positioning for them to rise against more expensive ones — is now being adopted by an increasing number of investors, according to Bank of New York Mellon Corp., which has a bird’s-eye view on more than $45 trillion of asset flows. CIBC Asset Management, Allspring Global Investments and Neuberger Berman, which together control more than $1 trillion, are among those anticipating these value trades will outperform next year.

It’s a brave stance for currency funds, 80% of which have exited the market since the 2008 financial crisis amid a slump in volatility and the rise of algorithmic trading. Carry — which exploits the gaps between interest rates in different countries — has handed them a much needed banner year, with borrowing in yen to buy a basket of three emerging-market currencies netting a hefty 42%, for example. That’s nearly double the gains in the S&P 500 stock index. Value, by contrast, lost money.

COMMENTS: lots of funds now piling into YEN, NOK, and SEK as a value currency trade

For Bank of America Corp. strategists, betting on the krone against the euro is a high conviction value trade. At Citigroup Inc., going short the Swiss franc against the yen is seen paying off

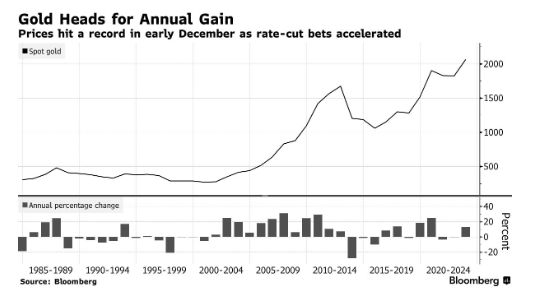

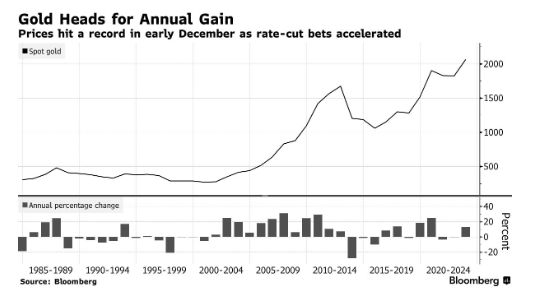

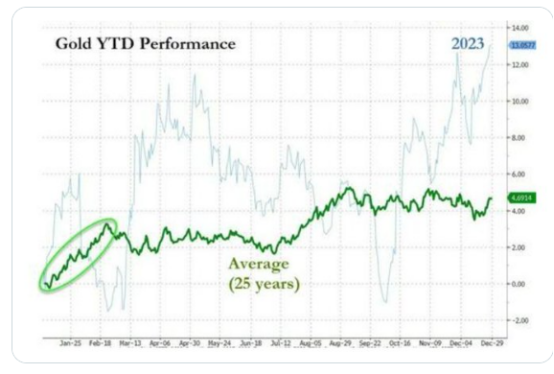

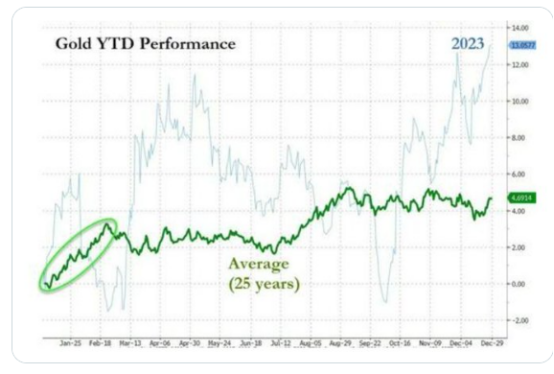

Gold Heads for Yearly Gain as Market Eyes Rate Cuts in 2024-BBG

Gold headed for its first annual gain in three years as investors doubled down on bets that the Federal Reserve will start to unwind its restrictive monetary policy stance in 2024.

Bullion was steady on the final trading day, putting it on track to end the year about 13% higher. On Thursday the metal edged lower as Treasury yields rose from multi-month lows following a US debt auction that drew lackluster demand from investors.

Still, yields have declined sharply since late October — benefiting non-interest bearing gold — as traders ramped up wagers on rate cuts next year. Swaps markets are pricing in about an 80% chance of a decrease by March.

Bullion is also getting support from a weaker dollar, boosting the appeal of commodities priced in the currency, with the greenback poised for its worst year since the onset of the pandemic

COMMENTS: According to the World Gold Council, Since 1971, gold has had an average return of 1.79% in January. That’s nearly three times the long-term monthly average. The World Gold Council points to three factors that may boost gold’s January performance. Beginning of the year portfolio rebalancing. Seasonal weakness in real yields. Gold restocking in East Asia ahead of the Lunar New Year

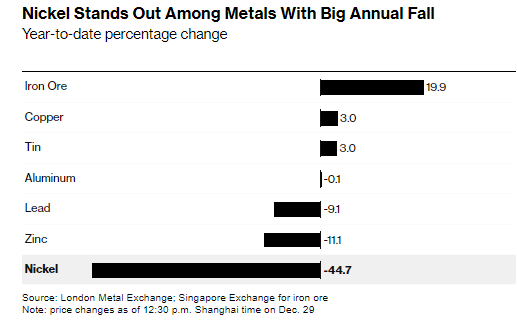

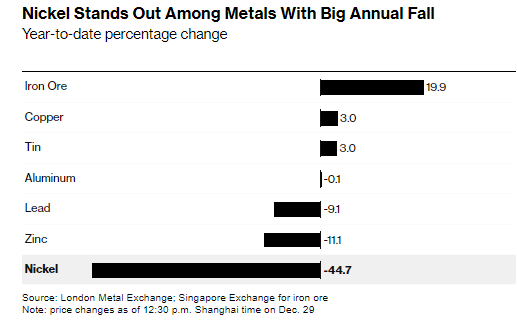

Nickel Is Year’s Biggest Metals Loser, Copper Manages Small Gain-BBG

In a mostly lackluster year for metals trading, nickel emerged as the worst performer and might not see a reprieve anytime soon.

The metal used in stainless steel and electric vehicle batteries is poised to post an annual drop of more than 40% on the London Metal Exchange, the biggest decline since 2008. That’s by far the worst outcome among industrial metals, and contrasts with a 3% gain for copper or with iron ore’s advance of about 20% in Singapore.

Metals have been pressured this year by global economic headwinds and uncertainty over China’s growth outlook. The LME’s all-in gauge of six metals is down more than 5% for the year, and set for a second annual decline.

In most cases, concerns over tightening supply or even shortages have proved unfounded or perhaps premature. But those worries were particularly true for nickel, a market that’s been flooded with a wave of new material from top producer Indonesia. Demand growth has also faded.

Copper’s annual gain comes after a fourth-quarter rebound, helped by optimism that the Federal Reserve will start cutting interest rates next year. Prices will hit $10,000 a ton within 12 months, Goldman Sachs Group Inc. said in a Dec. 18 note.

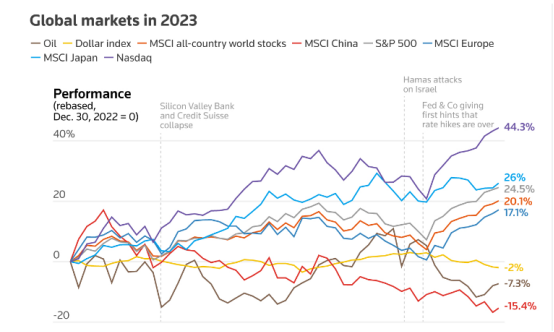

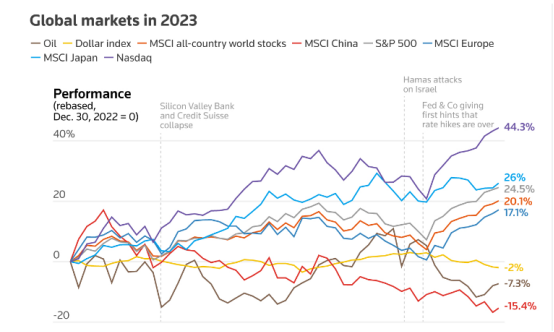

Markets in 2023: Soaring stocks and roaring bonds defy the doubters-Reuters

This year might go down as one of the most unusual ever in financial markets – mainly because everything seems to have come good despite a lot of turbulence and many predictions turning out to be wrong.

Take equity markets. World stocks are more than 20% higher despite the highest interest rates in decades and a mini crisis that wiped out one of Europe’s best known banks – Credit Suisse – along with a few smaller ones in the U.S.

In the bond markets, just a few months ago investors were expecting the Fed & Co to raise rates and leave them there while recessions rolled in. Now bond markets are looking to central banks to embark on a rate-cutting spree with inflation apparently beaten.

Other areas of the markets have experienced wild gyrations that are baffling to explain. Bitcoin is up nearly 160% on the year. Some of the most beaten up emerging market bonds have achieved triple-digit gains while the “magnificent seven” tech giants have seen a 97% surge when lumped together.

“If you’d told me at the start of year that we would have a U.S. regional banking crisis and Credit Suisse would cease to exist, then I’m not sure we would have guessed that we would see the year we’ve had for risk assets,” PIMCO’s CIO for Global Fixed Income, Andrew Balls, said.

The result has been 3.5%-6.5% returns from top government bonds and a $10 trillion rally in world stocks, although that has been ominously top heavy.

Meta and Tesla have soared 197% and 105%. The Nasdaq is on the cusp of its strongest year in two decades, while AI’s demand for semiconductor chips has catapulted Nvidia nearly 240% higher into the $1 trillion dollar club.

But it has been a bumpy ride.

In March, the collapse of Silicon Valley Bank, a mid-sized U.S. lender, and the rescue of 167-year-old Credit Suisse triggered a slide in world shares where they lost all of the 10% gains made in January.

The scramble for safety pushed gold up 7% and U.S. and European government bond yields – the main drivers of global borrowing costs – recorded their biggest monthly drop since the 2008 financial crisis.

The steady climb in interest rates around the world then kept investors sweating through the summer, and in October Hamas’ attacks in Israel ratcheted up geopolitical tensions.

“Everyone expects a soft landing to happen, everyone expects bond yields to be lower and everyone expects Fed rate cuts,” BofA strategist Elyas Galou said, highlighting the group think the bank’s investor surveys showed.

The big discrepancy though is that the Fed has only cut rates when unemployment is as low as it now five times the last 90 years.

COMMENTS: Last day of the trading year…stay nimble!

Five Things You Need to Know to Start Your Year-BBG

What happened

First a reminder of what happened in 2023. Stocks were supposed to slump and bonds rally as the Federal Reserve drove the US into recession to defeat inflation, according to forecasts made on Wall Street a year ago. They also reckoned buying Chinese stocks would pay off. That’s not how it played out for the most part, as Bloomberg’s Big Take details today. Strategists at Goldman Sachs and Bank of America were among those to get parts of the year wrong. Now, let’s look at predictions for 2024…

Dollar bears

A weaker dollar is the expectation for 2024 of most analysts surveyed by Bloomberg amid forecasts that the Fed will lead the way among rich peers in cutting interest rates and that a soft landing in the US’s economy will encourage investors to seek risk away from its shores. But strategists at JPMorgan Chase and HSBC are among those who reckon the greenback could still strengthen because the rest of the world will end up needing to reduce rates more to aid their economies. Currency-watchers are more confident in predicting the Japanese yen will rise as they anticipate the Bank of Japan will finally raise rates.

Bond bulls

The Fed’s December change in tack towards easier monetary policy in 2024 forced bond strategists to rewrite their forecasts to show US debt doing even better next year. The median forecast for the 10-year Treasury yield is now for it to fall to 3.98% this time next year. But there is still some dissent. TD Securities thinks yields have scope to hit 3% a year from now following 200 basis points of Fed rate cuts beginning in May. Goldman Sachs and Barclays Capital, while capitulating on their views that rate cuts were unlikely before the fourth quarter, forecast yields to end 2024 at 4% and 4.35% respectively. In the hunt for returns, some traders are looking to Austria’s century bonds and the debt of supra-nationals among other non-traditional destinations.

Steady stocks

No fireworks for next year. That’s the consensus view for equity markets as investors have already scooped up stocks on expectations of a soft economic landing and a flurry of interest rate cuts for 2024. Record highs have been broken on a number of benchmarks in the last stretch of the year, confounding bearish forecasts set by the likes of Morgan Stanley and JPMorgan. The biggest focus for 2024 is whether Big Tech can extend its meteoric rise following its best year since the dotcom bubble, if the rally broadens up to include 2023 laggards such as Chinese equities, or if the long-awaited recession finally hits and send stocks plunging. Some who got this year right see more gains ahead.

Coming up…

As is clear from each of the above sections, central banks will be key source of news in 2024. Economists at Bank of America reckon there will be more than 150 rate cuts globally over the next 12 months, which would be the first time since the pandemic year of 2020 in which reductions outpaced hikes. It’s also going to be a big year for elections. Bloomberg Economics estimates voters in economies accounting for 44% of global output will head to the ballot box, including those in the US and India. The wars in Ukraine and Gaza add to the geopolitical risks. On the fun front, Paris will host the Summer Olympics.

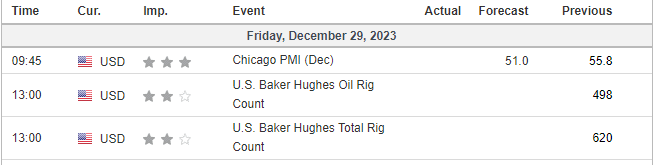

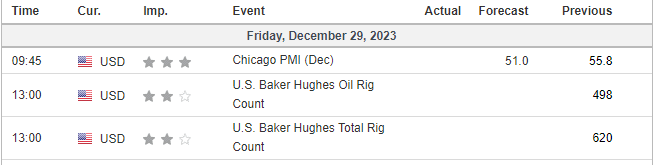

US DATA TODAY

Signing off! HAPPY NEW YEAR!