In the dynamic world of trading, finding instruments that offer simplicity, clear risk parameters, and potential for profit is invaluable. Event contracts provide traders with a straightforward and engaging way to participate in daily options trading across various futures markets. This guide will walk you through the essentials of event contracts, how to trade them, and why they might be an excellent addition to your trading strategy.

Understanding Event Contracts

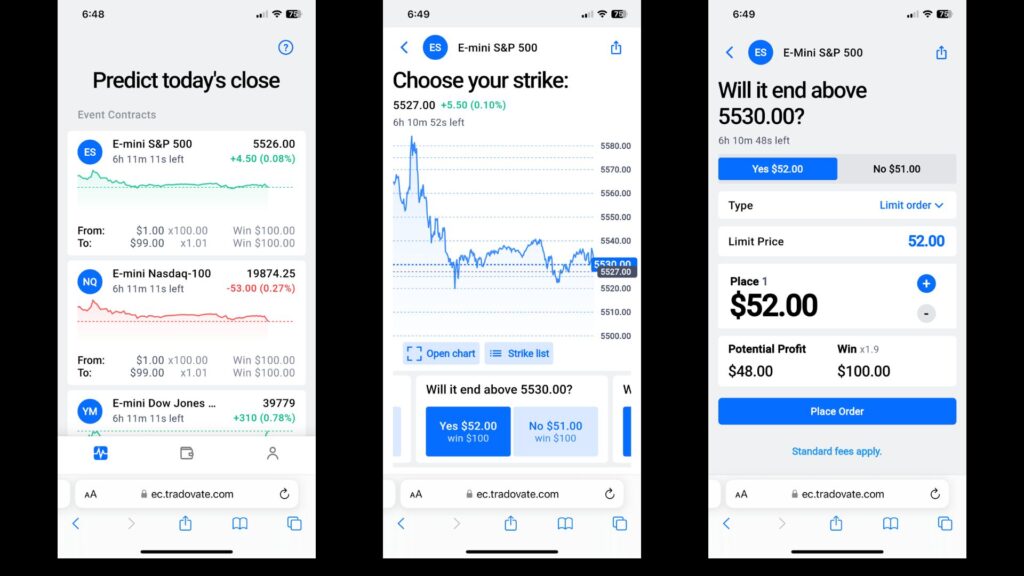

Event contracts are a unique type of trading instrument that allow traders to speculate on daily price movements in 11 different futures markets. These contracts are non-leveraged, meaning you won’t have to worry about margin calls or unexpected losses beyond your initial investment. The simplicity of event contracts lies in their binary nature: you predict whether the market will close above or below a specified price with a simple Yes or No. If you are correct, each contract you own will be worth $100. If you are incorrect, you will lose what you paid for the contract.

Trading Event Contracts: Strategies and Execution

Trading event contracts offers multiple strategies to suit different trading styles and risk appetites. Here are some popular methods:

- Hedging: Protect your existing positions from adverse price movements.

- Strangles: Take positions on both sides of the market to benefit from high volatility.

- Opening Range Breakout (ORB): Trade based on the initial high and low prices within a specified time period.

- Key Support/Resistance Levels: Purchase contracts at critical price levels to capitalize on expected market reactions.

- Trading Events: Reduce your exposure on event days and buy your risk up front

You can trade these contracts intraday, just like daily options, or hold them until the market closes. If you hold a contract until close and it is “in the money” at settlement, you receive a $100 payout. If it is “out of the money,” the contract expires worthless.

Selecting Your Strike Level

Choosing the right strike level for your event contract is crucial and depends on your risk-reward tolerance and strategy. Contracts closer to the current trading price are more expensive but have a higher probability of closing “in the money.” On the other hand, contracts further from the current price are more affordable but riskier.

The price of a contract reflects its probability of being in the money at expiration. For instance, a $50 contract suggests about a 50% chance of ending in the money.

Risk-Reward Dynamics

Event contracts are straightforward in their risk-reward structure. Each contract is priced between $1.00 and $99.00, with the maximum loss being the price paid for the contract and the maximum payout being $100.

Example of a Winning Scenario:

You purchase an E-Mini S&P 5530 Yes contract for $52. The market settles at 5532. Your contract is in the money, and your contract you paid $52 for is now worth $100, yielding a $48 profit.

Example of a Losing Scenario:

You purchase an E-Mini S&P 5530 No contract for $51. If the market settles at 5532, your contract expires worthless, resulting in a total loss of your $51 investment.

The Benefits of Trading Event Contracts

Event contracts offer several advantages that make them an attractive option for traders:

-

- Exposure to Diverse Markets: Trade in equity indices, metals, energy, and foreign currencies.

-

- Fixed Risk/Reward: No surprises, as the maximum risk is the contract price.

-

- Manageable Risk: Allows for trading without significant exposure.

-

- Hedging Opportunities: An affordable way to hedge larger positions.

-

- Introduction to Options: Ideal for traders new to options and Futures markets.

Distinguishing Event Contracts from Traditional Options

Event contracts differ from traditional options in that they are non-leveraged and cash-settled. You either receive $100 per winning contract or nothing at all, unlike traditional options that confer the right to buy or sell an underlying asset.

Getting Started with Event Contracts

You can purchase as many contracts as you want. The Futures markets available for trading event contracts include:

-

- Equity Indices: E-Mini S&P 500, E-Mini Nasdaq 100, E-Mini Dow, E-Mini Russell 2000

-

- Metals: Gold, Silver, Copper

-

- Energy: Crude Oil, Natural Gas

-

- Currencies: Euro

- Crypto: Bitcoin Futures

Trading Platform and Settlement

To trade event contracts, you can use the Tradovate app. Click here to get started.

Event contracts are settled daily based on the market’s settlement price. If the price settles at or below the predicted level, the No contract gets the payout. If the price settles above the strike price, the Yes contract gets the payout.

Event contracts offer a compelling way to engage in daily market movements with defined risks and rewards. Whether you’re looking to hedge, explore new markets, or simply add a versatile tool to your trading arsenal, event contracts provide a straightforward and effective solution.