July 1st, 2024

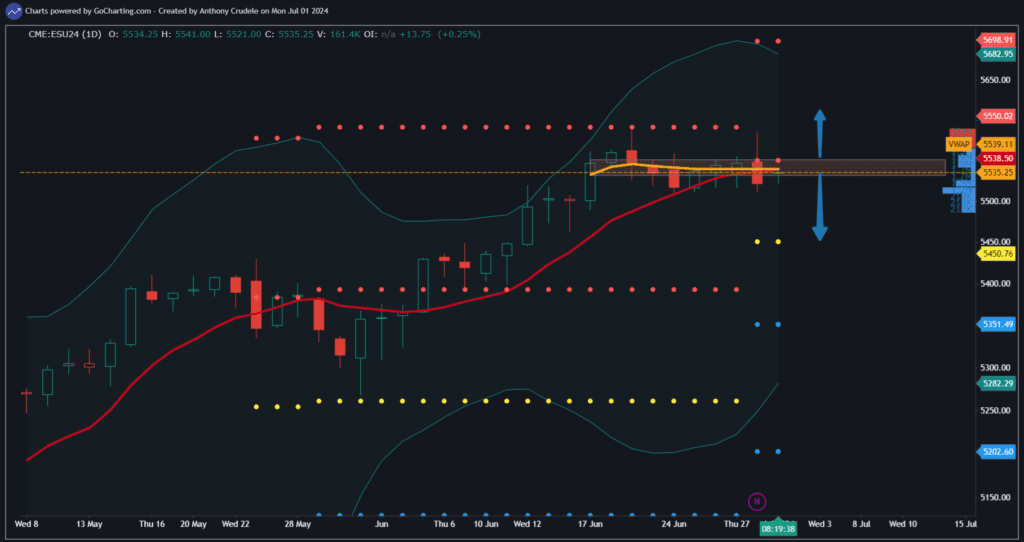

The market is set to be in mean reversion for the near future. This doesn’t mean I’ve turned completely bearish and the rally is over, but in the short term, it means that I am short and will continue to trade the short side in ES until I see a daily close above 5550 or intraday we take out Friday’s high. My target is 5450 which I see getting hit by next week.

I will do a quick video on the close today to detail the reasons why this is a mean reversion trade I really like, but in a nutshell, we have the daily Bollinger Bands moving inward, we had a daily close below the VWAP from the day of rollover and below the 5-Day SMA. That’s enough info to tell me to be short and start managing risk to the short side.

As I’ve mentioned before, when I get a mean reversion setup I always trade it smaller and put on less dollar amount risk vs. a setup that is with primary trend. I prefer to use micros and options for this swing short and ES for day trading.

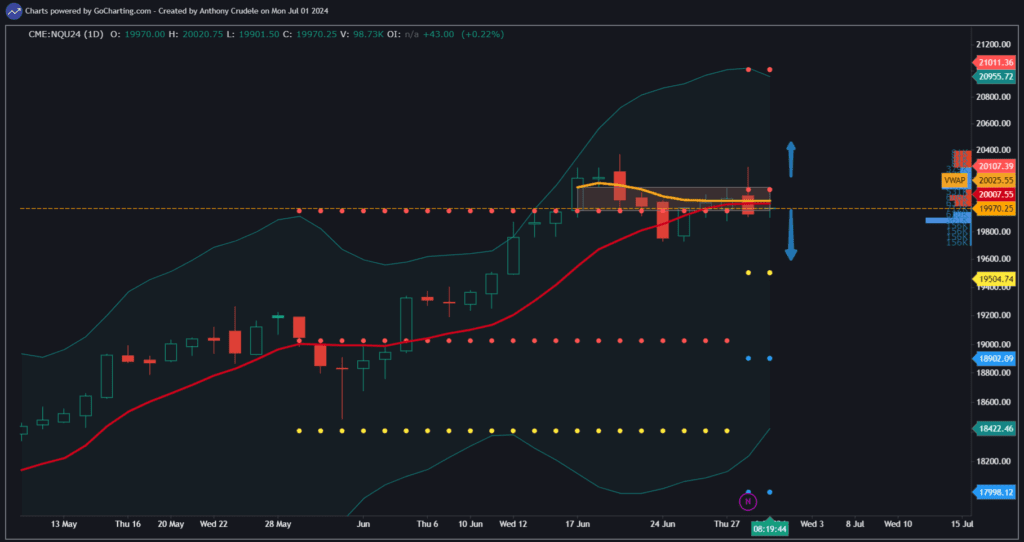

NQ is also indicating a mean reversion trade. I was short it last week and got stopped out, so I am focusing on ES for now. If NQ rallies up to 21,000, I will consider shorting again as that is their resistance level I will be trading off of. The target to the downside is 19,500.

RTY remains a two-way tape and a no trade for me right now.

Today’s close is key for my strategy. If we do close below 5550 today, I see this move to the downside happening sooner than later. First-day-of-the-month flows could be to the buy side so patience if selling rallies. Let the market come to you when fading trends, don’t chase anything lower.

Cheers, DELI