July 17th, 2024

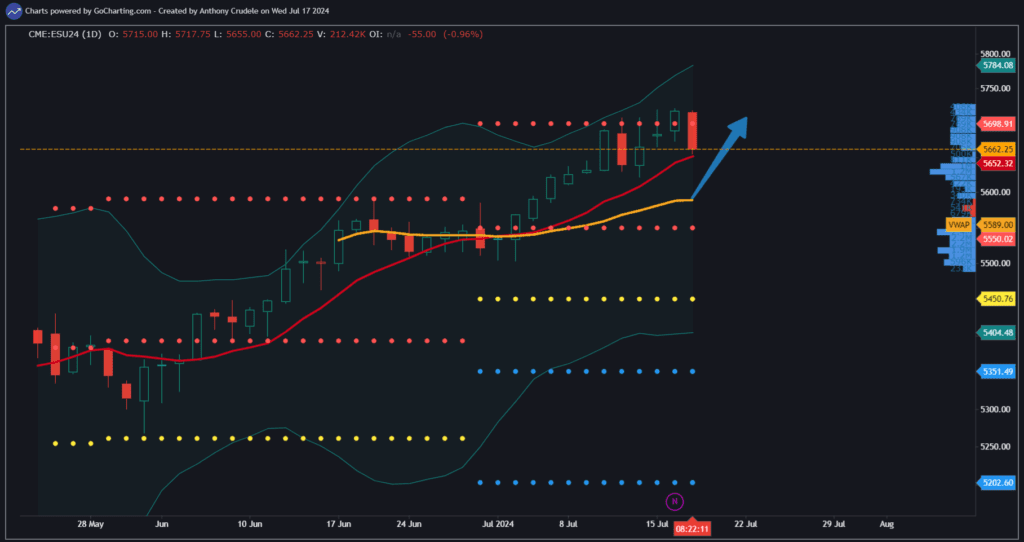

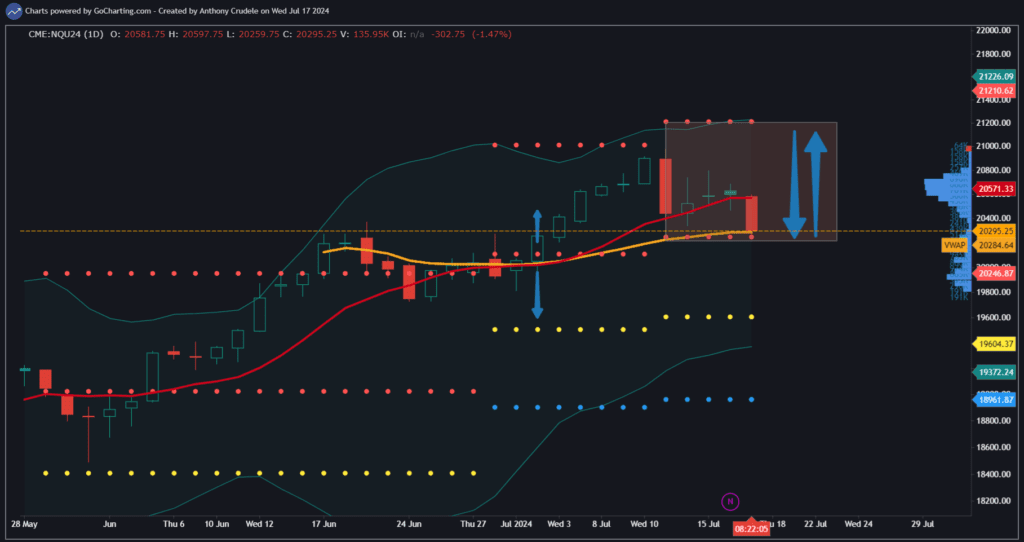

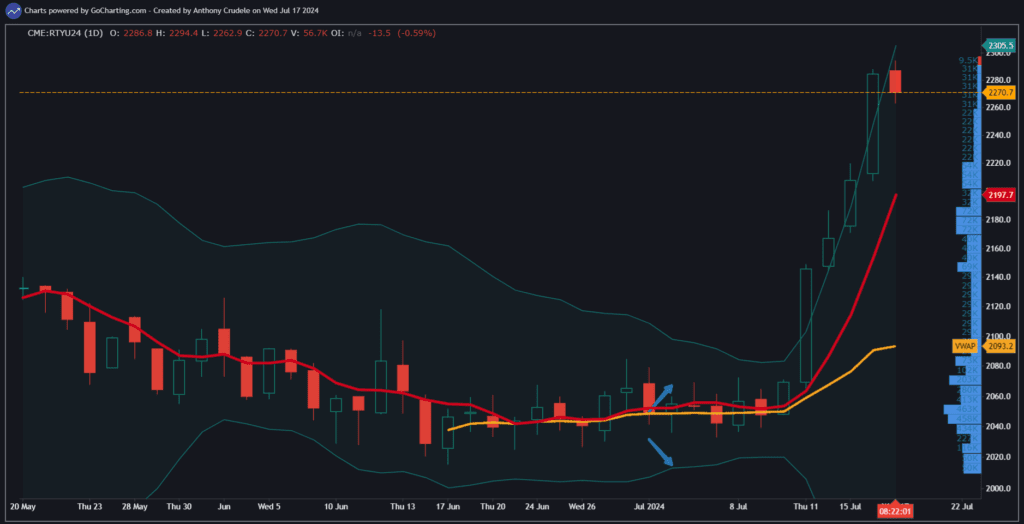

Rotation, not correction. The ES rotated back down to its 10-day SMA in overnight trading. The NQ rotated back to an AVWAP from the beginning of rollover, and the RTY has come off a bit but is still well above any technicals I watch. These markets remain extremely bullish, but as day traders, there are opportunities to trade both sides of the market in this environment.

How do we approach a day like today?

Sell the weak or buy the strong.

The mistakes most day traders make are buying the weak, selling the strong, or overtrading a market like this and trying to trade both sides instead of focusing on one side and a solid setup.

Pick a path for today. If you want to be long, find the index that is the strongest based on your strategy and take a long setup. If you want to be short, find the index that is the weakest based on your strategy and take a short setup.

Trying to pick bottoms or tops or trading the middle while chasing a direction is the path to the poorhouse.

Have a plan. Execute your plan.

Cheers, DELI