August 1st, 2024

Bulls have the momentum, but the path higher isn’t clear yet. It’s hard to imagine we still have more macro data and earnings to come out in the next 24 hours, along with the first day of the month flows. The market is always looking for ways to go higher, and now is no different, but the technicals aren’t completely aligned with the macro momentum we’ve been seeing this week.

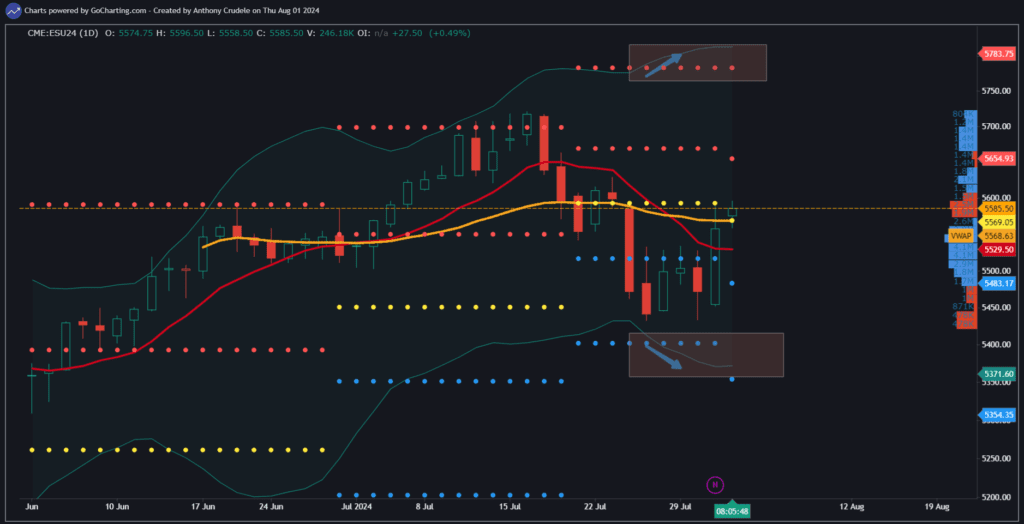

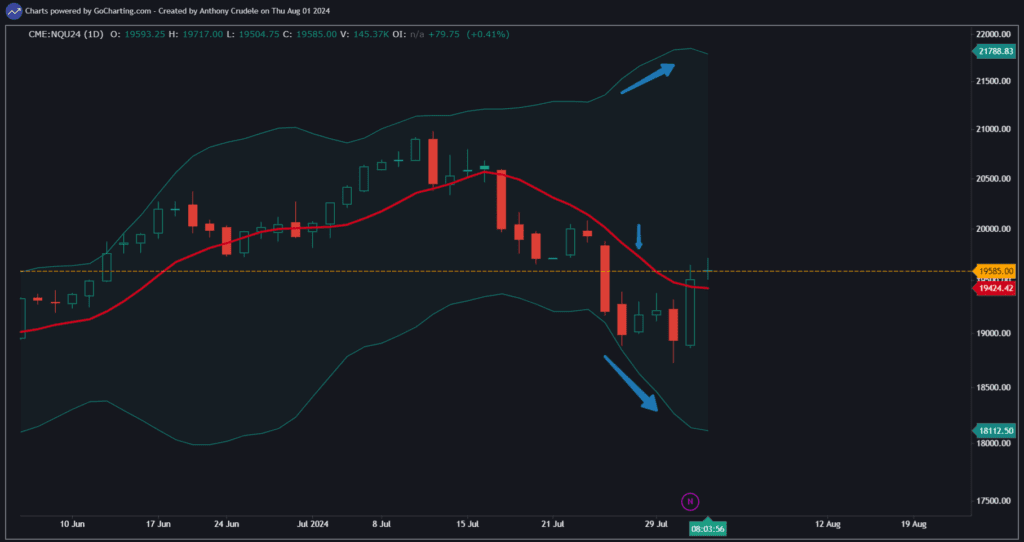

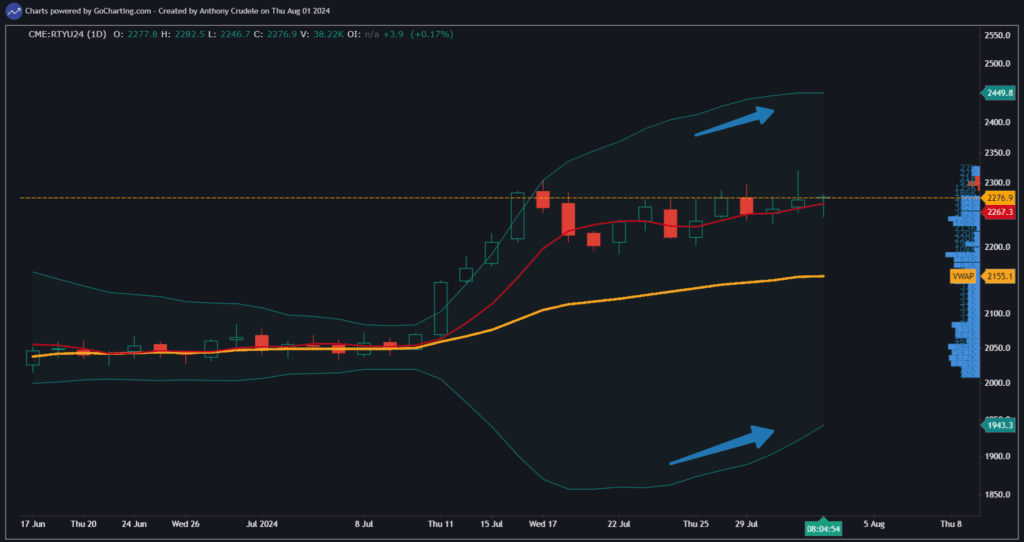

As you know, I am an environment guy and use Bollinger Bands, VWAP, and moving averages to help guide me. Right now, all I see is a two-way tape. There is no clear way to manage risk to the upside at these current levels in the indexes. We can still swing with large ranges intraday, and it really doesn’t change anything on the charts.

We’re in range expansion in all of the indexes with flat Bollinger Bands, VWAPs, and moving averages.

How do we, as day traders, approach this tape?

Keep it small, folks. In this volatility, you can have a lot of success by trading small. You have to keep stops wide enough for a trade to work and prevent overtrading in this tape.

I remain in watch mode because I prefer a directional tape and choose to pick one side to trade. This tape is for scalpers, and if you’re scalping, this is the kind of tape where you need to buckle down, take your signals small, and keep yourself in the game all day because opportunities will arise.

I will be live on Develop Your Edge at 10:30 ET discussing the current market environment in Equities and taking a peek at Gold today. Here is the link to join the livestream: https://www.youtube.com/live/BLDworqA3Gk?si=nT1TDio5Fmm822r9

Cheers, DELI