October 7th, 2024

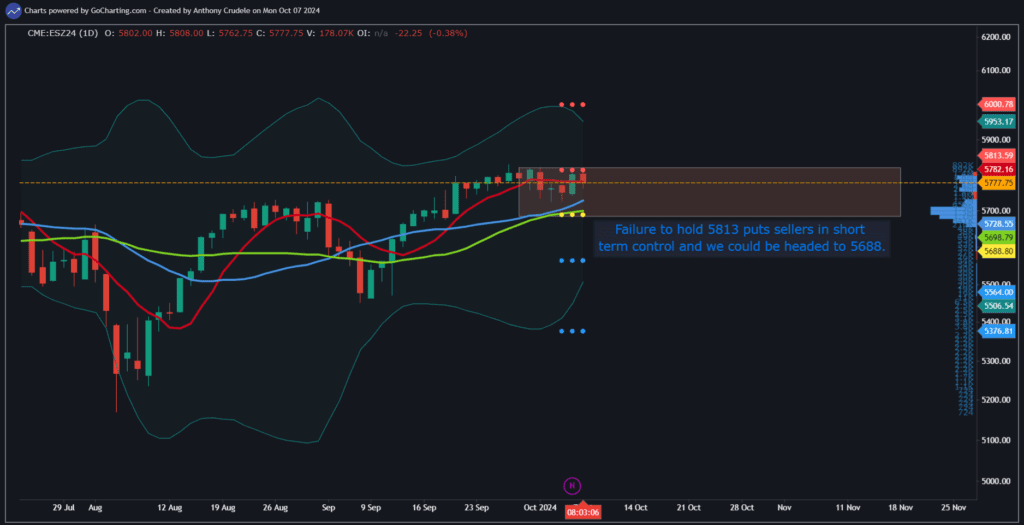

Stalled, but not stopped. The ES has hit a resistance area that has stalled the bulls’ momentum. As long as we remain below 5813 on a closing basis, I think we’re headed to 5688. My reasoning is that the momentum from the daily Bollinger Bands has shifted from range expansion to contraction. The buyers are just out of gas and likely need a sell-off to refuel the momentum. This isn’t a market environment that screams sell for now; it just means that rallies are likely to stall, and we may temporarily grind lower.

How do day traders navigate this environment?

For ES traders, I see a sell the rally market for now with my short-term strategy. But it’s about selling the rally, not the dip. Wait for rallies to stall and use your short-term strategies for signals to get in small. The bulls still have the big-picture momentum, but this is a mean-reversion market for now.

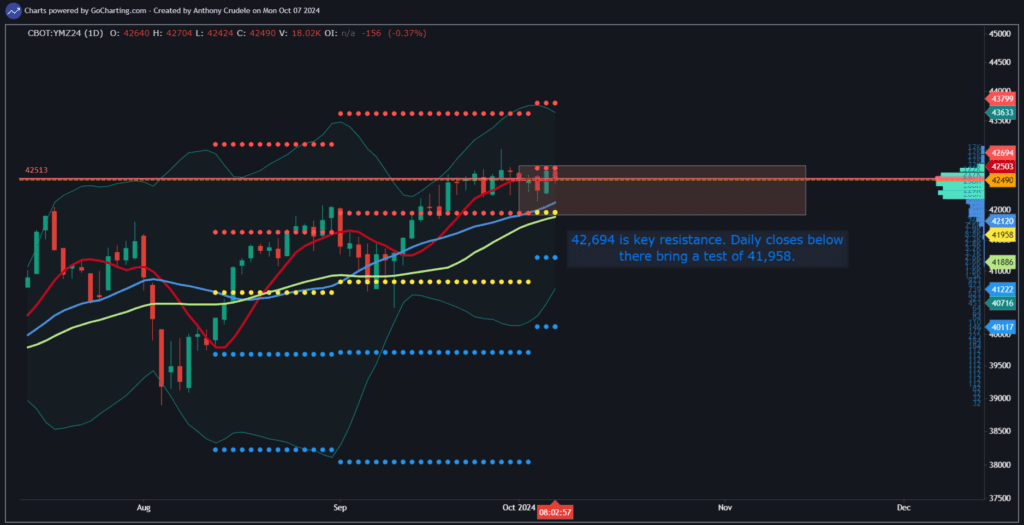

YM has the same look as ES right now; I think they’re temporarily in sell the rally mode. 42,694 is key resistance, and I’m looking for 41,958 to test in the coming sessions.

NQ and RTY are just two-way tapes and look to be traded on both sides for the foreseeable future. Not my favorite looks for indexes.

Keep it small and trade smart. Unfortunately, Hurricane Milton is headed right towards me, so I’ll be focusing on securing my home as I prepare for it to hit us. Thoughts and prayers for everyone in its path. Stay safe, fellow Floridians.

Cheers, DELI