January 9th, 2024

A Tale of Two Tapes. On one hand, bears dominated the market in the first week of the year, while on the other hand, bulls made one of the strongest rallies in the last few months. It’s not easy to interpret when the market sways dramatically in one direction, but that’s the situation we find ourselves in currently. Yesterday, I mentioned we have three types of market environments: range expansion, mean reversion, and consolidation. After yesterday’s rally, we may have moved from mean reversion into the possibility of new range expansion to higher highs, or we might be in a consolidation phase from last year’s highs to this year’s lows. It’s uncertain at this point.

As I delve deeper into the charts, here are some observations:

ES: It came up just shy of my neutral target (the yellow line on my daily chart from my beacon indicator) and, for now, has regained the 5-day SMA and YTD VWAP, hinting at a slightly bullish tone. However, we did not get back above the resistance at 4820 (red line on the daily chart), and the daily Bollinger Bands remain pointed inward. So, for now, bulls have a slight advantage, but it remains to be seen if they can build on it in the upcoming sessions.

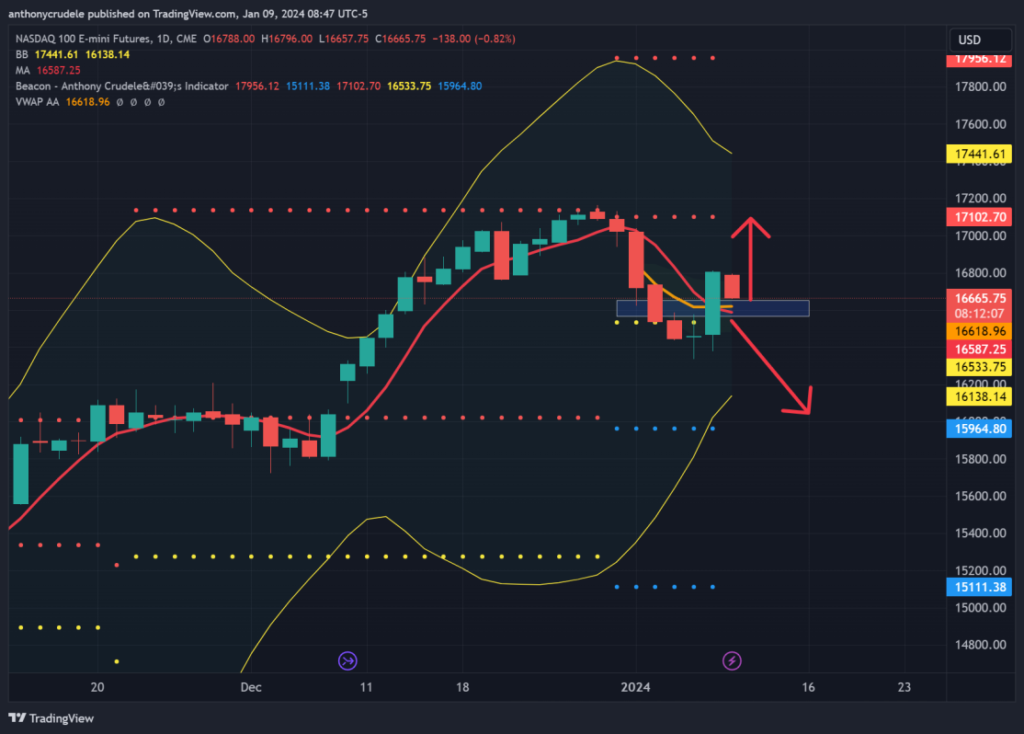

NQ: It hit my first downward target and got back above the YTD AVWAP and 5-day SMA. But, like ES, it isn’t above resistance yet. For now, bulls have won a battle but haven’t won the war.

RTY: It continues to be the weakest link as it is below the YTD AVWAP and 5 Day SMA, which is similar to what we saw last year. Short-term, this suggests that if I’m going to trade an index, it will be shorting RTY versus NQ or ES. I opt to short weak markets or buy strong ones. For now, the only strategy on the table is to sell rallies in RTY.

ZN: It continues to show weakness, and a target of 110’25 is still in play on my daily chart. I believe this market is key to watch. If it continues to remain weak, it might put additional pressure on RTY, which is most sensitive to higher rates. If ZN continues to sell-off, it might attract bears back to the table in NQ and ES, and take us below the YTD AVWAPs.

With tomorrow’s highly anticipated CPI, today is unlikely to provide many answers, but you never know. Stay focused, trade small, and continue building a solid trading rhythm for the year.

On a side note, it was great to see all of you in the livestream last night. I really enjoyed chatting with all of you.

Cheers, DELI