February 13th, 2024

NQ and ES are in mean reversion. The CPI data has been released. Instead of dwelling on the numbers, we as traders focus on the market reactions. The NQ market stands out as it’s currently in mean reversion mode. As I mentioned in my note and in chat yesterday, NQ is on my radar for shorts as I took home some Puts last night. The daily bollinger bands started converging on Friday, and after yesterday’s close it bears a resemblance to the first week of the year.

As long as we see daily closes below 17,655, I predict we are headed down to 17,270 (YTD VWAP) and my neutral yellow area of 17,170. For today, my attention is on 17,720 as key resistance. This is the 1 standard deviation band above the YTD VWAP. I plan on short selling futures in that area and will consider adding to my puts if the area holds this morning.

Should we surpass 17,720, we could see a return to 18,028 which is a high volume bar I’ve been tracking on my charts. If we do cross 17,720, I won’t short futures, but will keep my puts that expire at the end of the month. Currently, I hold one strike, the 17,750 put that expires in 11 days.

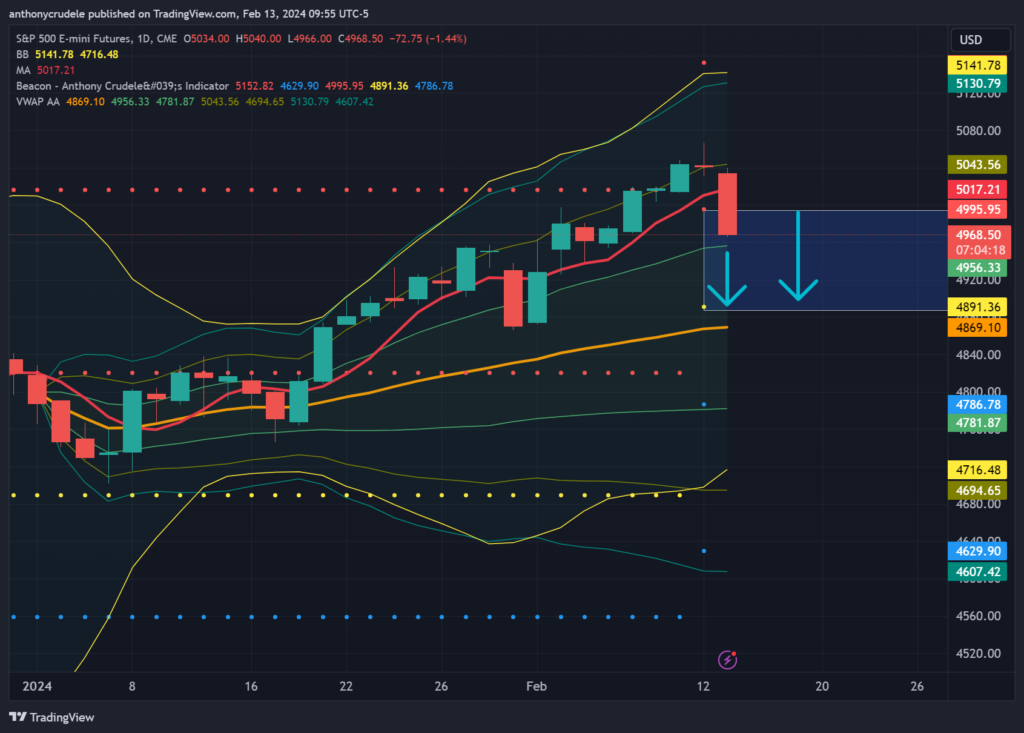

ES is also exhibiting mean reversion. As long as we see daily closes below 4995, I forecast a descent to 4891. The first level I’m keeping an eye on today for potential support is 4956 – 1 standard deviation above the YTD VWAP. If that fails, expect a sharp drop. I still favor NQ shorts over ES as NQ appears weaker on the charts and I prefer to short the weakest market.

RTY is remaining consistent with its behavior the entire year. It gets close to range expansion and then fails to follow through. I’ve been saying for a week or two straight, at some point rates will matter again in RTY and ES, and today’s CPI is causing rates to become important again for these markets. 10 YR Yields are at their yearly high and in range expansion. I’m unsure how this would be appealing to any bull at this time.

I think today is a good day for CME Groups Event Contracts. These daily options are good to manage risk on days like today where I think the market will continue lower, but we will have a lot of volatility in between now and the close. I like the NO Strikes in NQ at 17,700. If we get up there, I will be a buyer of those NO’s, which are essentially 0DTE Options. I also think buying some out of the money NO’s in ES below 4660 are interesting too.

It’s crucial to stay small and be able to weather the volatility. It’s important to trade the market that’s presented to us, not the one we would prefer.

Cheers, DELI