February 15th, 2024

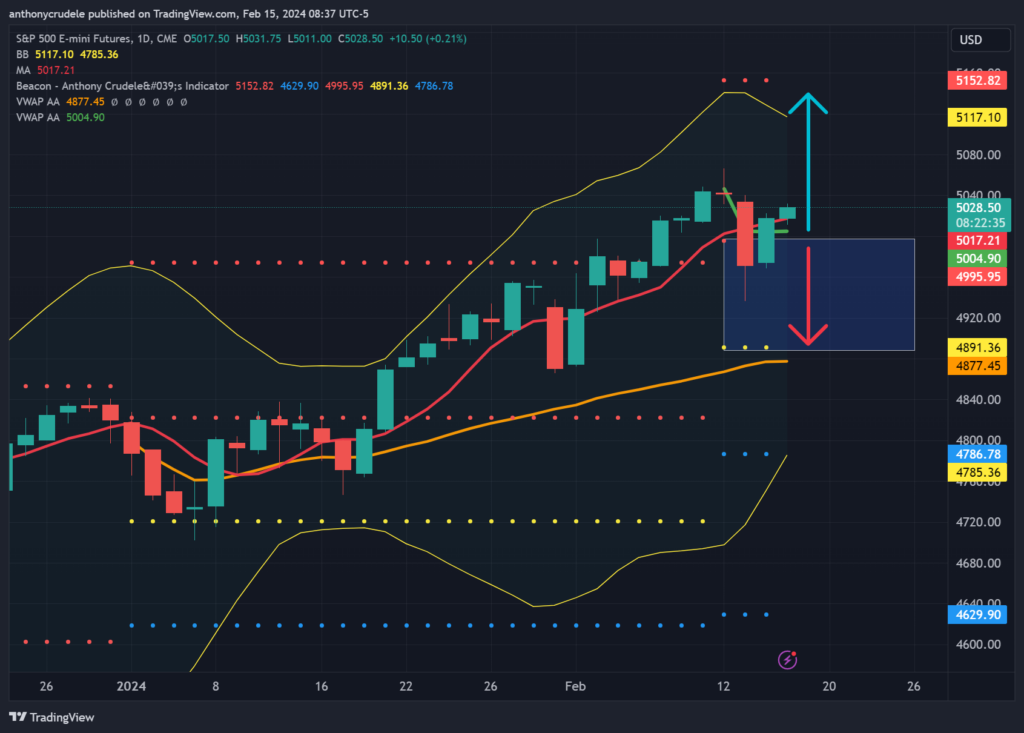

We’re in an environment where rotations to the downside are super short-lived, and the bulls come roaring back after minimal pullbacks. I’ve noticed cracks of weakness, but no follow-through, which tells me that the highs are just not in yet. It doesn’t mean we’re running straight back up; it means we’ll probably frustrate both sides and wake up one day to new highs again.

How do we trade it? Keep it small and buy the market that’s stronger on up days.

The key areas I’ll be watching for the tape to switch bearish are 4995 in ES and 17,680 in NQ. Unless I see daily closes below these levels, I lean towards the long side. I think this back-and-forth intra-day trading will continue. Those active during regular trading hours (RTH) can trade both sides of the tape, but I’m leaning more on the long side.

For swing traders like myself, I’m more inclined to do nothing right now than to look for long positions because the risk is tough here. The daily Bollinger Bands remain pointing inward in ES and NQ, which raises concerns for me about any sustainable rallies. I think this volatile trading will continue for now, and that’s just not my type of market.

RTY looks like the one I would favor for the long side today, as rates are starting to come back down, and the daily Bollinger Bands are pointing outward. This gives RTY the best chance of follow-through to the upside.

Remember, by keeping your positions small, you can withstand the volatility and stay in the game. Even if you’re wrong, you may end up finding ways to squeak out a winning day.

I’ll be live on youtube this morning at 10:30 ET, discussing my thoughts on the current market environment and how day traders can use Micro Treasury Futures to trade interest rates. Hope you can join me on YouTube. Here is the link: https://www.youtube.com/live/L3GO1qj3KQ4?feature=shared

Cheers, DELI