April 23rd, 2024

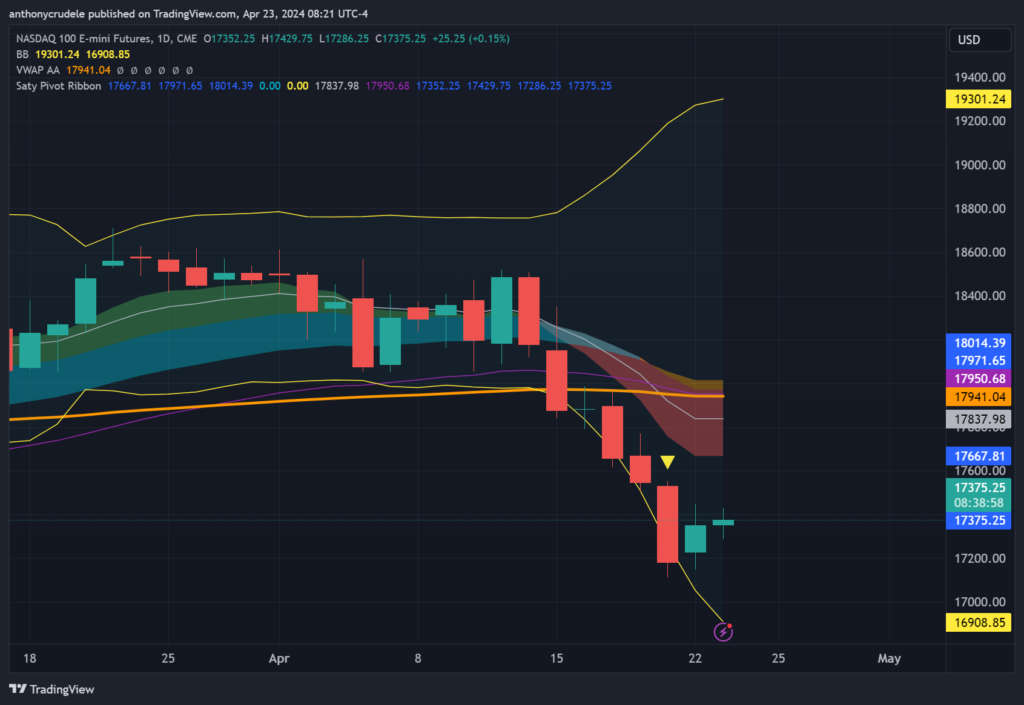

Forming a bottom: Yesterday was a good hold for the bulls as they stopped the bleeding to the downside, and the daily charts are starting to round out, forming what could be a bottom.

When it comes to forming a bottom, I look at a few things: Did the market experience some sort of capitulation at the lows? Was there little time spent at the lows? Did the market attempt to retest the lows but fail to reach them? Are we starting to see separation from the bottom daily Bollinger Bands, with the bands moving sideways or inward? Are we moving back up into an area with clustered moving averages pointing downward and stalling, rather than pulling back?

We are witnessing some of these signs currently, and while the bulls are not completely out of the woods yet, we must remember that this is a bull market, and the recent pullback was just that – a pullback, not the start of a new bear market. We should anticipate the bulls starting to fight back after a selloff.

In today’s charts, I included Saty’s Pivot Ribbon, a free indicator you can find here: https://www.satyland.com/home. I have been monitoring it on my charts for some time, and I believe it offers valuable context alongside Bollinger Bands and my Beacon Indicator to gauge market conditions. With the 8, 21, 34 EMA’s, you can clearly see the trend direction.

We are currently in a volatile environment, likely to witness an intraday tug-of-war with ranges forming on both sides. A straight trend day in one direction is unlikely. The key is to acknowledge that this environment remains challenging, so keep your positions small and ensure you have confirmations from your short-term indicators before trading.

Short-term momentum appears to favor the long side, so if all three indexes (RTY, NQ, ES) move higher together, be cautious about fading the trend. Be wary of a choppy market if you notice divergence, where one index rises while another remains flat or falls. Given that the NQ has been the weakest performer on the charts, we might expect a catch-up rally from them today.

Stay nimble and disciplined while trusting your preparation. This mindset will cultivate your patience and trading discipline.

Cheers, DELI