May 13th, 2024

Rotations. Markets don’t move in a linear fashion; there are ebbs and flows, and markets rotate between leaders as we move higher. Friday was a day of rotation as we saw flows coming out of RTY as rates went higher, and large caps held on to small gains. This morning, we see RTY fighting back as rates are steady, and the ES and NQ are also moving back into Friday’s ranges.

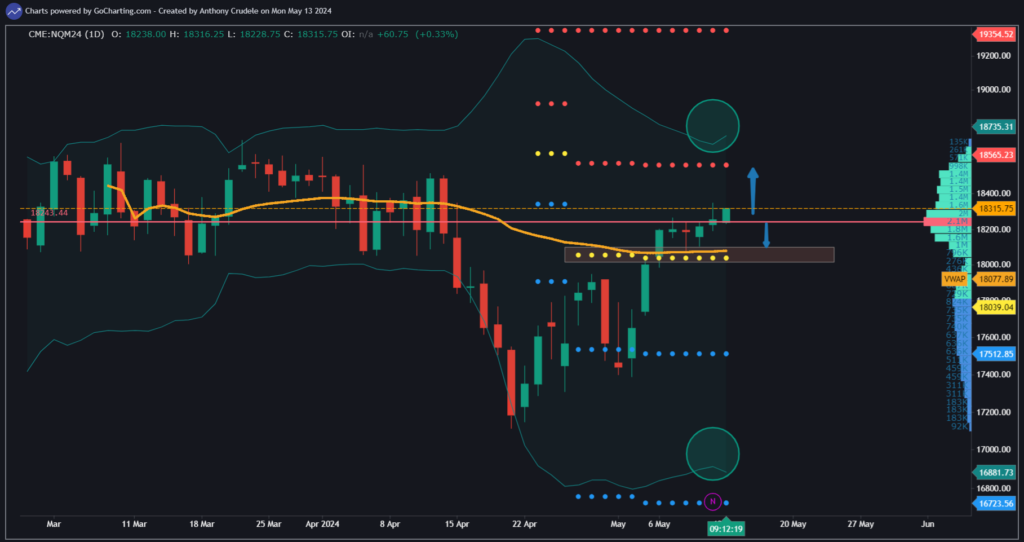

The rally to all-time highs from here probably won’t be clean and won’t be pretty, but I do think the bulls are in control of this market, and they are shooting for all-time highs in NQ and ES in the coming months.

Remember, it’s not about the destination; it’s about executing the journey, and there will be rotations.

For today, it looks like the buyers are back out, and I think they can make a decent move higher today. All of the indexes protected key support on Friday, and now the daily Bollinger Bands are starting to open up on the top and bottom bands. This indicates range expansion, and the rallies could have legs across the board.

As long as we hold Friday’s lows across the indexes, I will be a buyer of dips this morning, looking for rotations back to Friday’s highs and possibly higher highs. It’s not a tape I would be fading today. The only way I step off longs is if ZN starts to fall quickly, and we take out Friday’s lows in the indexes. Then the tape would turn bearish to me.

Cheers, DELI