May 23rd, 2024

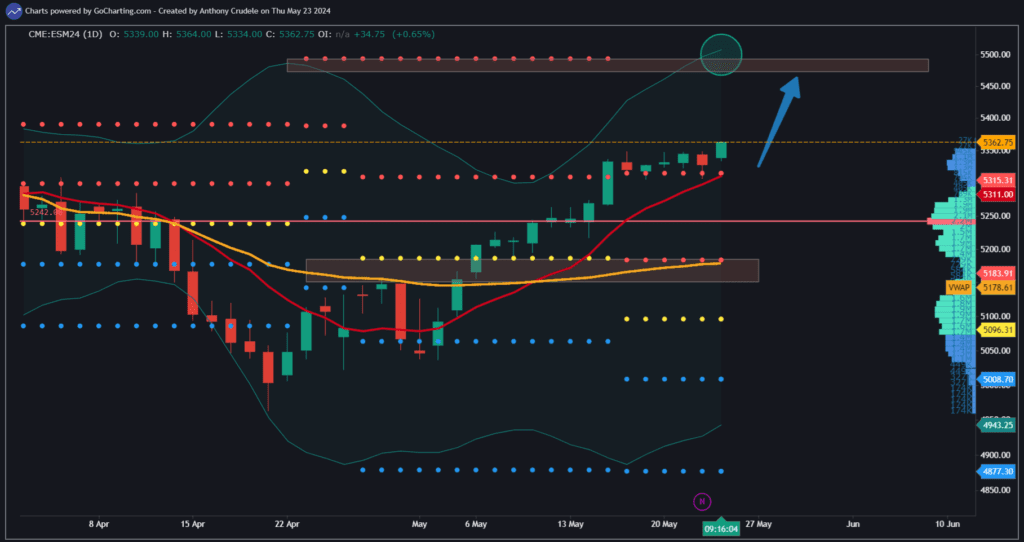

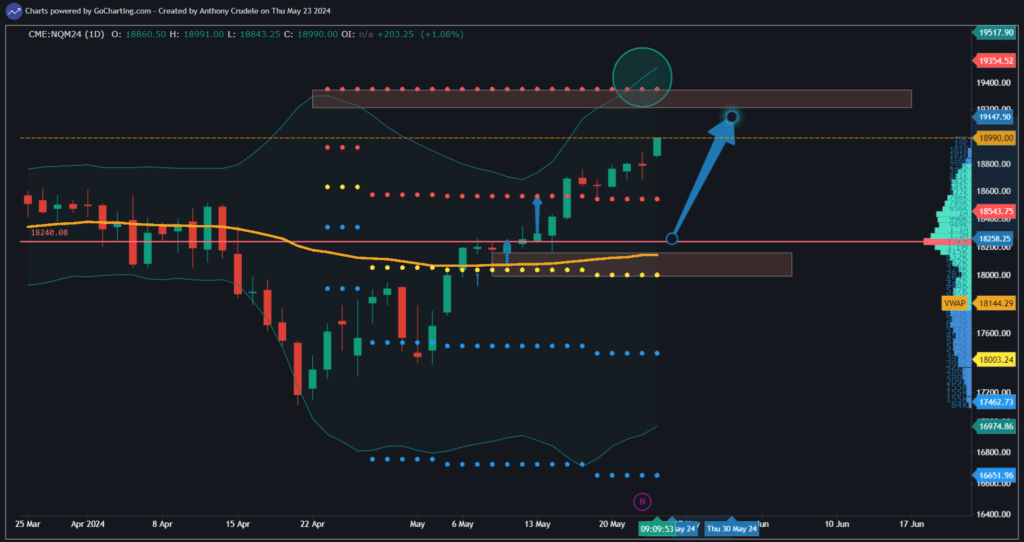

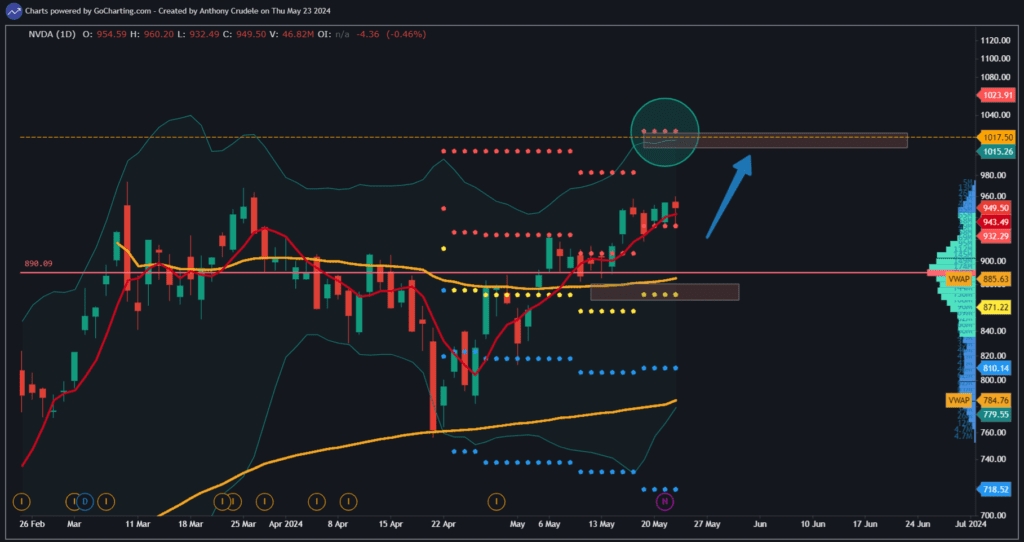

NVDA refuels the momentum for the bulls. Yesterday, I discussed how the market was at a critical moment where technically the market remained bullish, but the momentum had stalled. We were in a holding pattern for $NVDA earnings to determine the potential fate of the market. Both NVDA and the market have been very bullish and in range expansion. Now we’re in a moment where the ES, NQ, and NVDA may run higher from here.

We’re in a mode where the market is searching for a high, maybe even the yearly high. With Bollinger Band expansion (see my daily charts where I’ve been circling in my notes every day), short-term moving averages sloping higher, RSI’s close to getting overbought (which is short-term bullish, not bearish), the markets may run forest, run.

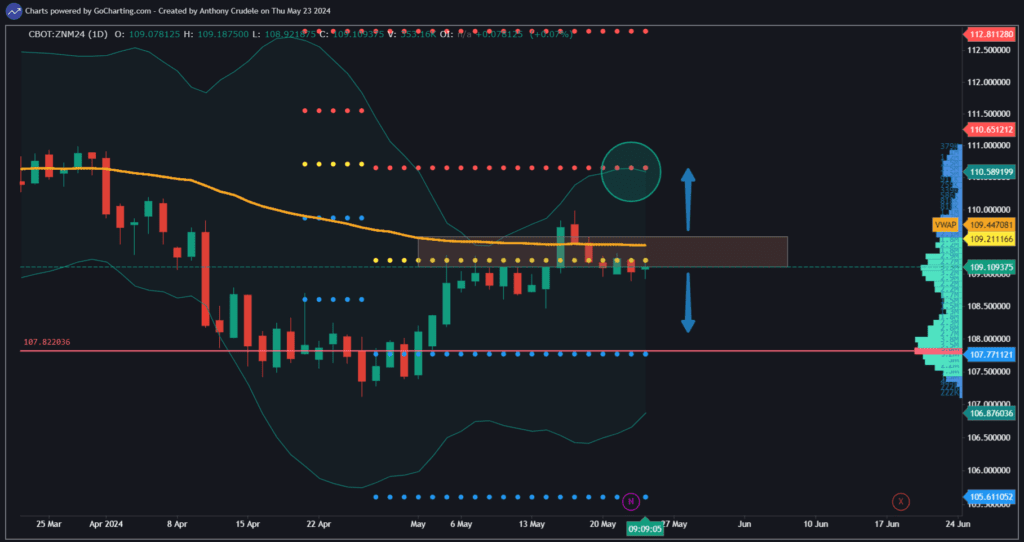

Technicals get us in trades, but Macro aligned with Technicals, we get the biggest moves. NVDA is the Macro driver right now as the AI story remains strong, and the technicals in the Indexes are robust. I remain a long-only day trader in ES and NQ for now. This is not a market I look to fade.

Key targets I can see ES and NQ hitting in the coming weeks: ES 5450-5490, NQ 19,250-19,350.

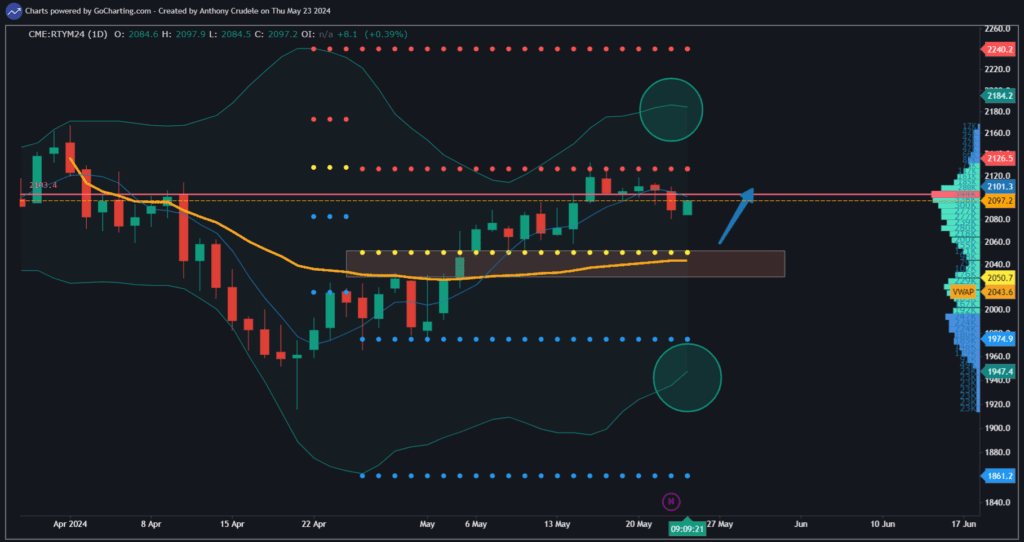

Notice how I have not included RTY in today’s note; it’s because rates remain steady. Without signs that rates are coming down, the small caps will struggle. This rally is fueled by Tech, and they can run higher with rates and inflation remaining elevated.

Put your levels in, set your risk, and trade accordingly.

I am signing off for the long weekend. There will not be a note tomorrow morning. I want to wish all of you a wonderful long weekend and a special thank you to all of our veterans who have served this great country and given the ultimate sacrifice. We are so grateful and thankful to have men and women serve and protect our freedoms.

Happy Memorial Day. Cheers, DELI