June 13th, 2024

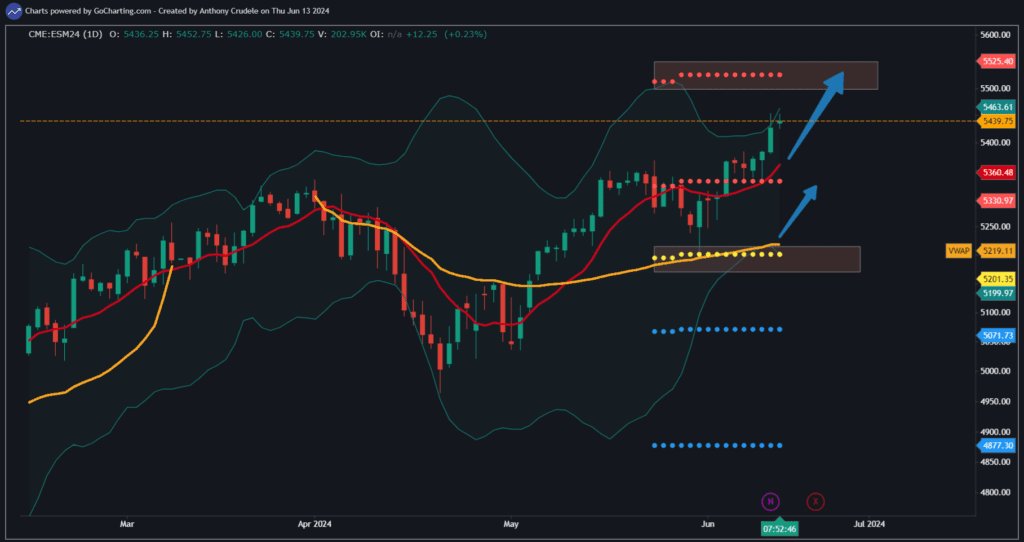

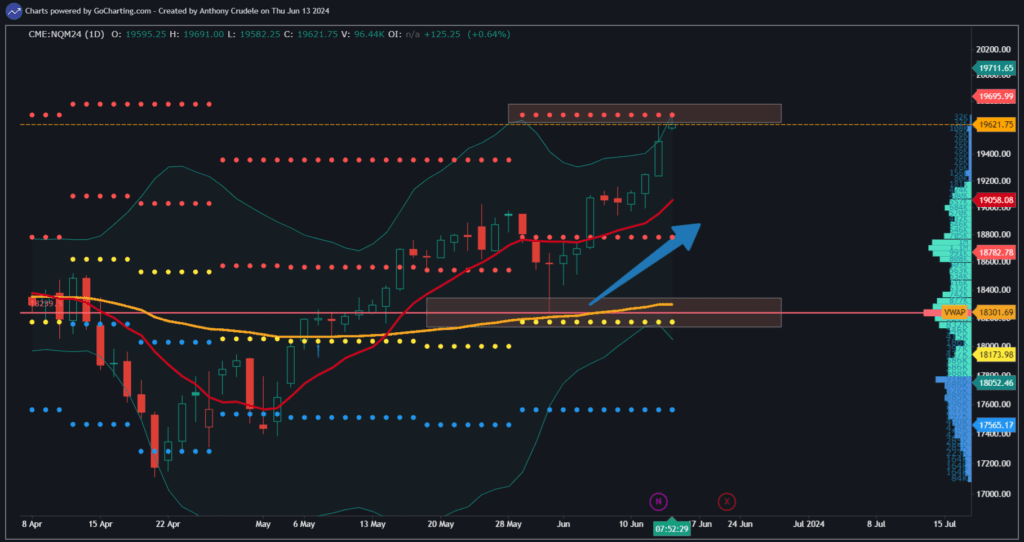

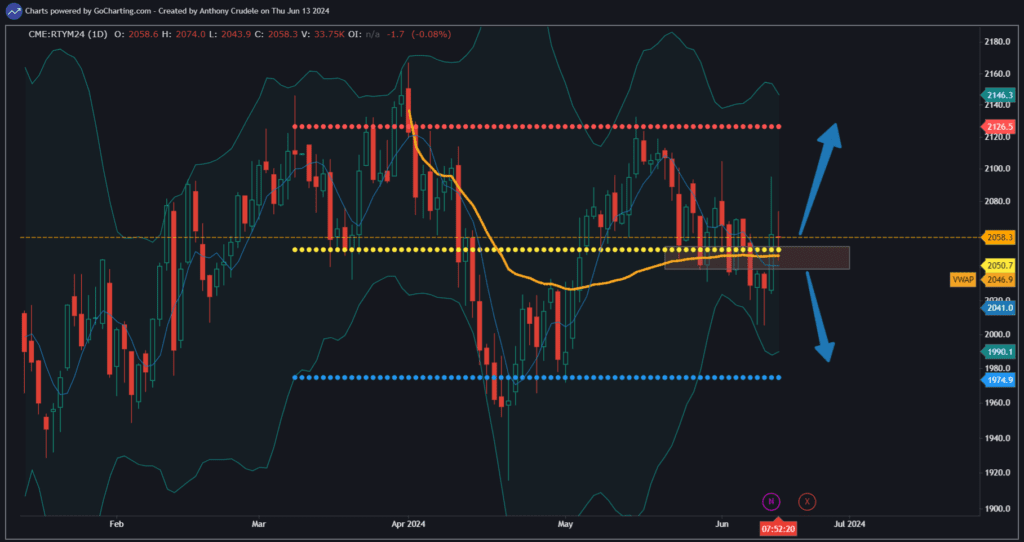

ES and NQ didn’t seem bothered by the semi-hawkish FOMC yesterday, yet RTY was affected, creating a divergent market. But that’s been the norm, so the bulls remain unfazed and rally in ES and NQ continues.

At some point, the weaker trading of small caps will significantly impact the market, but we haven’t reached that moment yet. Markets don’t pay attention to issues until they choose to. Our job is to notice when they start caring.

Something notable about today is that NQ has reached my daily target of 19,695, while ES is yet to hit its target of 5525. In the short term, I foresee the NQ stalling or even pulling back in this area, while the ES rally continues higher. However, I wouldn’t short the NQ at these levels – the bulls hold too much momentum and we’re starting to transition into rollover.

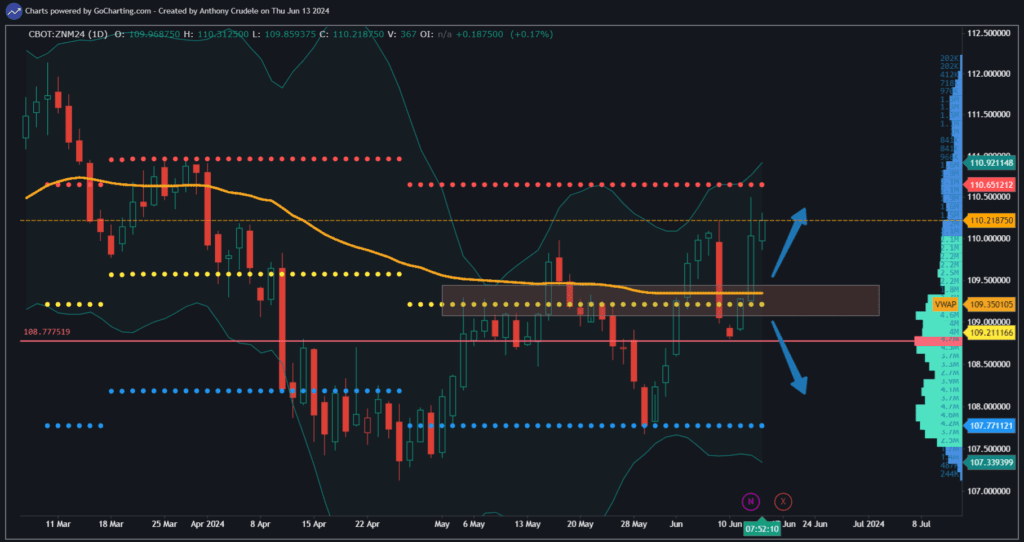

With the futures markets shifting its focus from data to rollover as we move towards the new contract (SEP U) as the front month next week, we can probably expect to remain in trend and perhaps experience some choppiness around the opens and closes as positions move from June to September.

Bear in mind, a lot is happening currently – from data digestion to rollover – but that doesn’t detract from the fact that the bull is fully rallying. Keep your approach light and tight, and stay focused on your preferred setups.

Cheers, DELI