June 17th, 2024

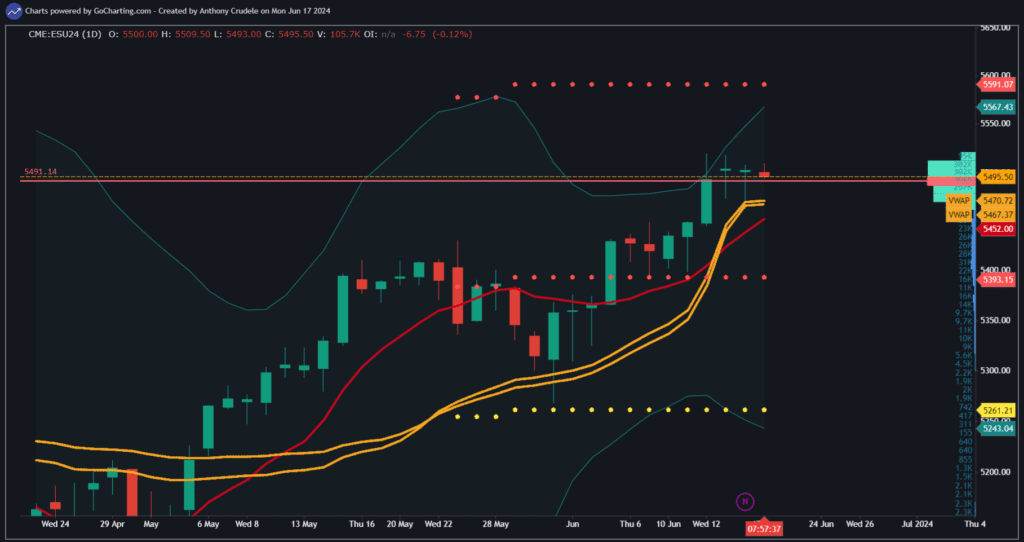

I’ll be avoiding the markets today and tomorrow as Rollover is happening, along with a midweek market holiday. Today, the indexes switch from June to September, but June will still have enough volume for day traders to stick around. Just remember, most traders have likely shifted over to September today.

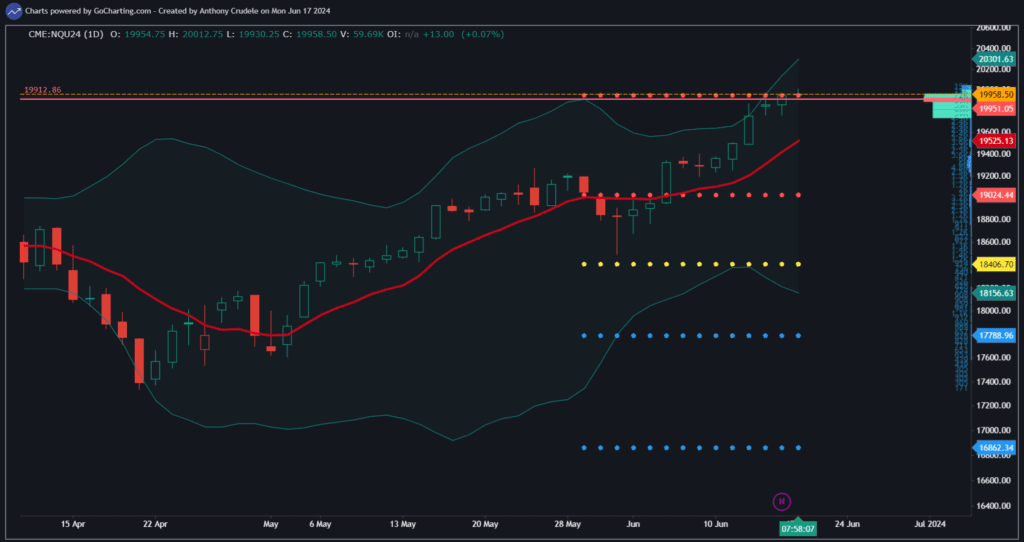

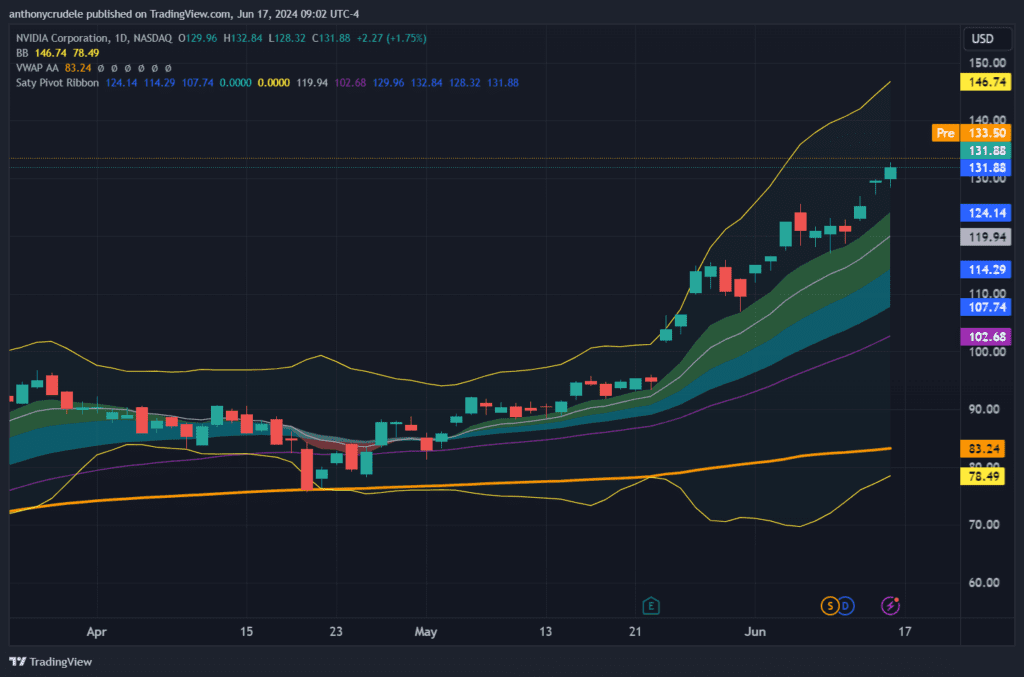

From a technical perspective, I don’t see this rally stopping just yet. The NQ’s Bollinger Bands are still widely open, and so are NVDA’s Bollinger Bands. Both the market and index leaders are in range expansion, but when they start to stall and revert to the mean, the market may begin to dip. I believe we’re heading in that direction.

The momentum seems to be slowing down, but shorts have no opportunities to act, and they keep getting squeezed.

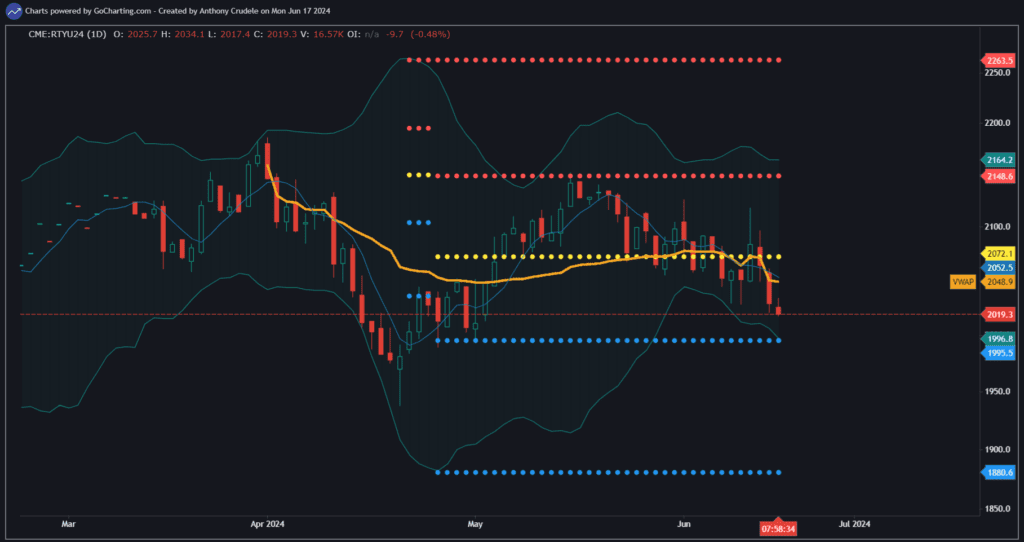

The RTY continues to struggle, raising concerns among bullish investors due to the divergent market within the indexes. Despite this, NVDA and a few other stocks have lifted the market. However, this discrepancy will become significant at some point. The story isn’t over yet, and we may see shifts in the market environment after this rollover.

In the quieter upcoming sessions, consider joining this month’s Place Your Trades challenge. We’re collaborating with Menthor Q, where the top three traders with the highest account value at market close on Friday 6/28 will win a 1-month MenthorQ subscription. I have previously discussed their futures data launch on a podcast and use it regularly. It’s a great opportunity to give it a try for free. Sign up here.

I’ll be back on Thursday, so keep your trading light and focused in the next couple of sessions.

Cheers, DELI