June 27th, 2024

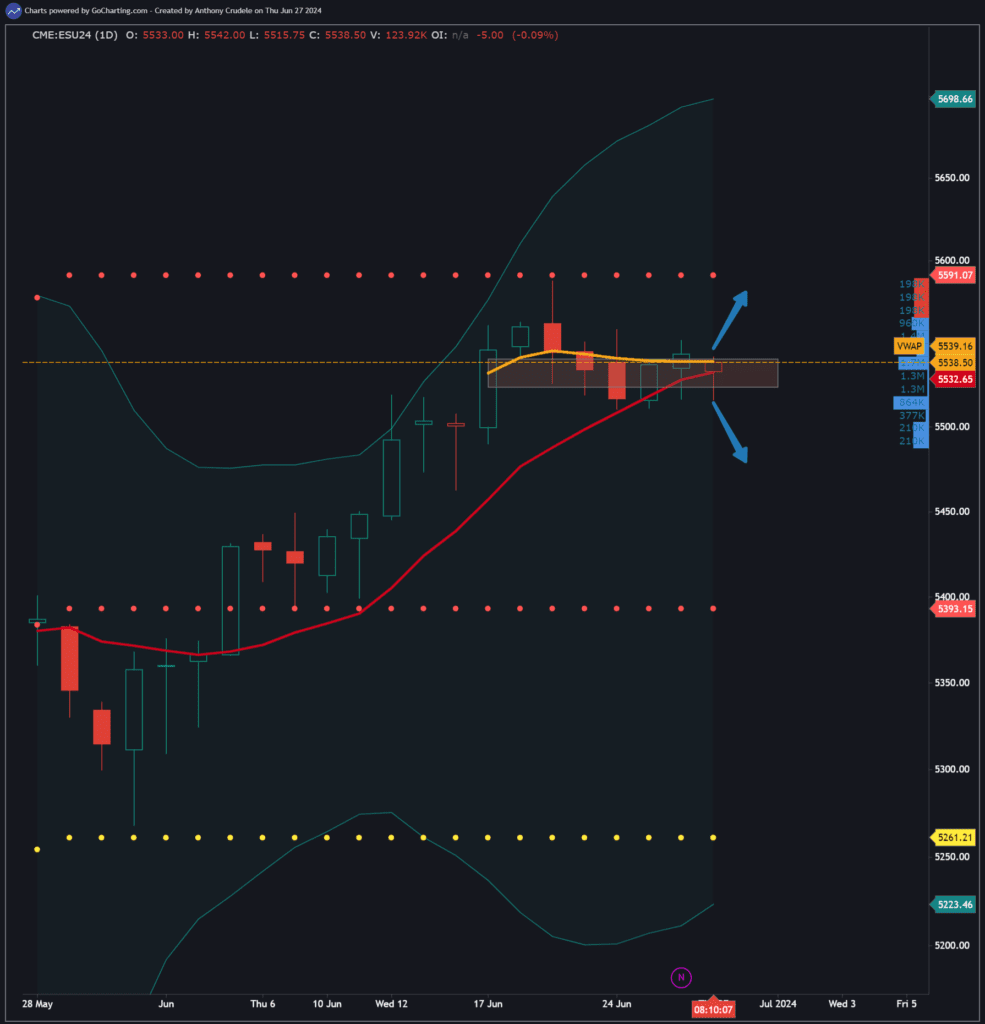

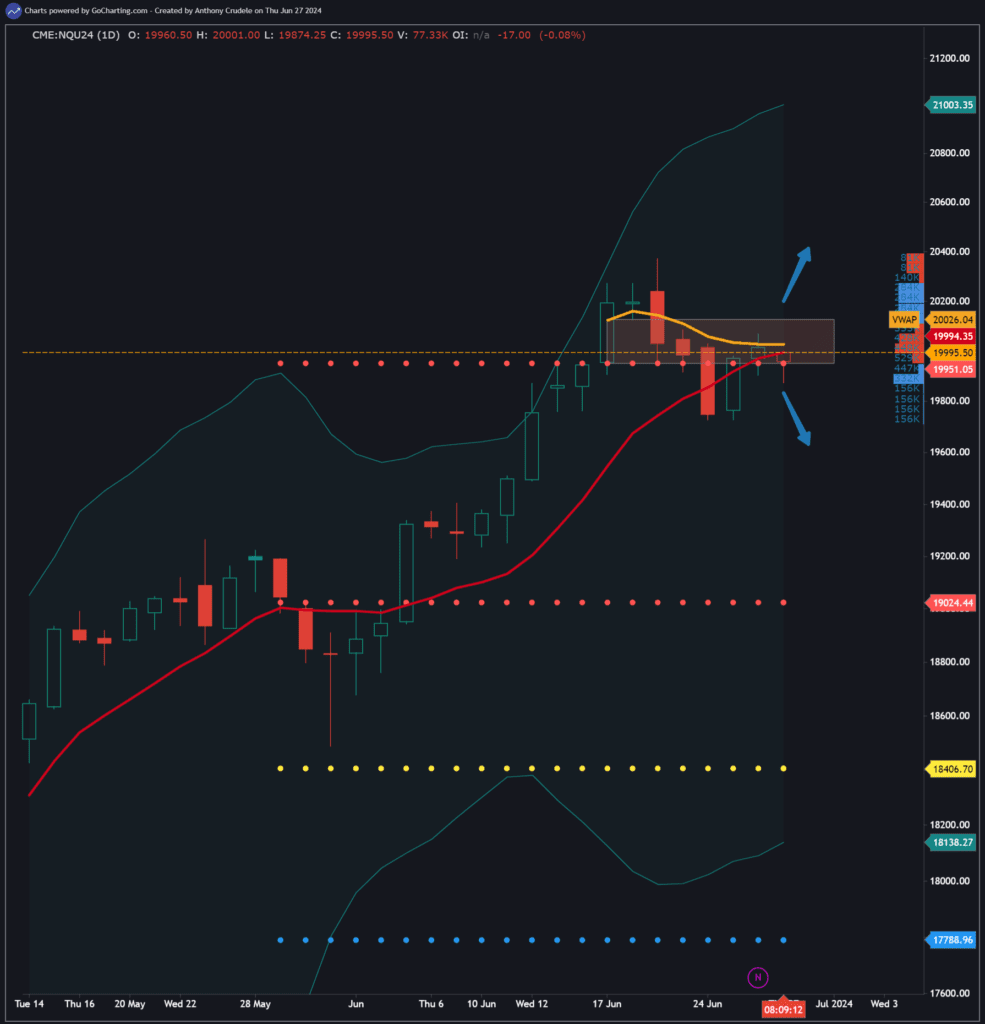

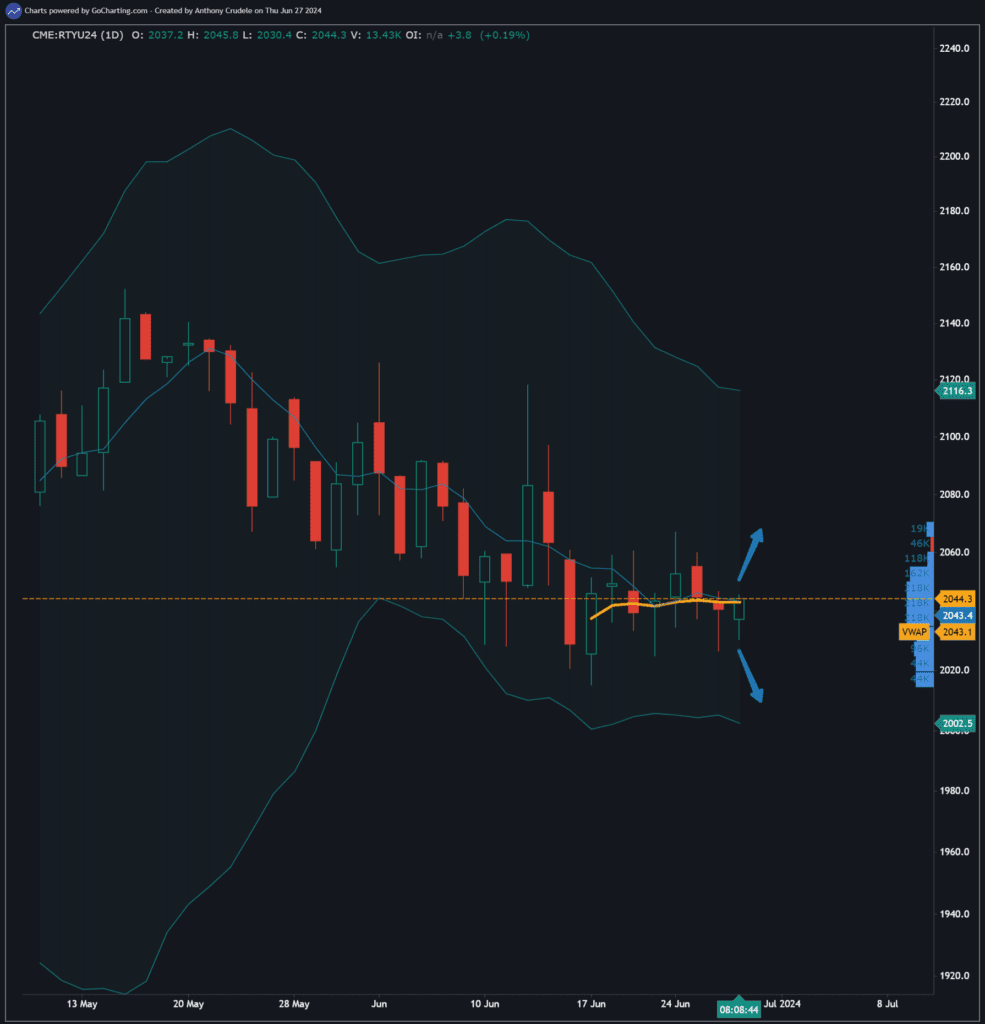

Numbers this morning did not change my sentiment on the market. The reaction was minimal in the indexes, and that’s all that matters to me. Markets are still stalling from my perspective and likely headed for a mean reversion or remain in a consolidation environment for the foreseeable future.

How do we trade this market environment?

Buy the strong, short the weak. Favor the index that is stronger on the day with long setups and favor the index that is weaker on the day using short setups.

As I’ve been noting, I favor long setups on my day trading strategies for now. I do not look to short the weak unless I have multiple confirmations, and I think we’re close to that scenario, but not there yet.

Some technicals to keep an eye on right now; ES 5539-5525 is a pivotal range. That’s the 5-day SMA and VWAP from when September became the front month. NQ 2031-1950 is a pivotal zone using the same metrics. RTY 2043 is a pivot I’m watching for daily closes above or below for them to gain any sort of momentum in one direction.

Yesterday I saw a lot of talk about Bonds moving lower and I haven’t mentioned them because they are just in a range and their moves right now are not moving the needle one way or the other in equities. As discussed with Bob Elliott on my recent #FuturesRadio Podcast, it’s not about the Fed and rates right now, it’s about earnings projections.

Overall, this is a market that is easy to overthink and overtrade. Don’t be the person who thinks they’re seeing edges that aren’t there. Lean on your strongest setups right now and let the impatient pay you for being patient.

Keep it light and tight.

I’ll be live this morning at 10:30 ET on my YouTube channel live trading the NQ and MNQ. Here’s a link if you want to join the livestream: https://www.youtube.com/live/8KDOs6cl7zo?si=VwoJeehYh5pDwxDu

Cheers, DELI