July 16th, 2024

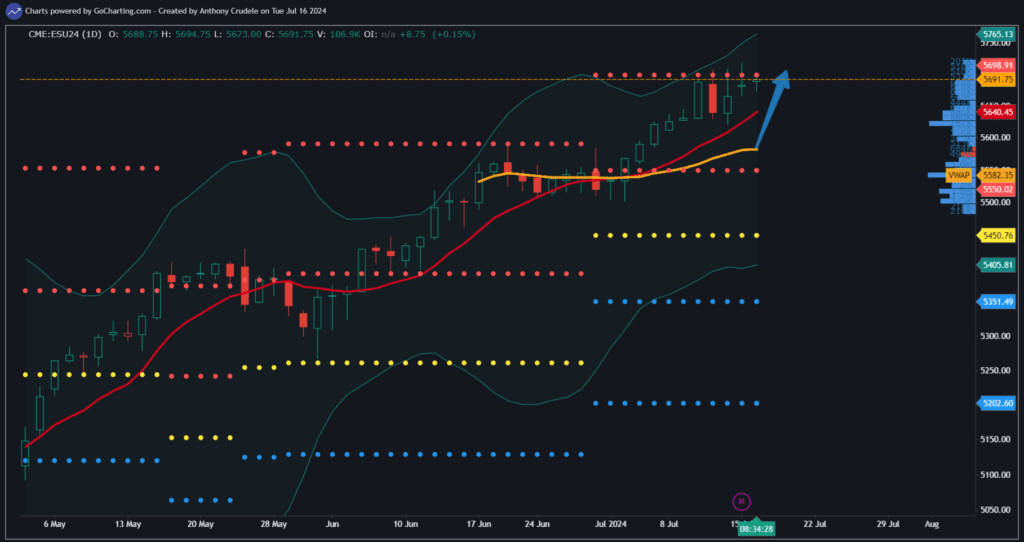

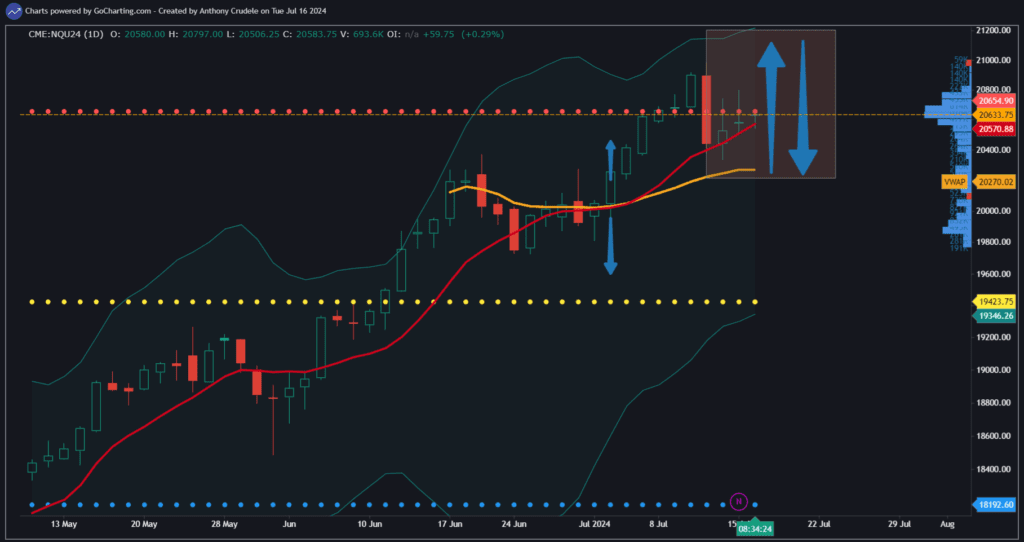

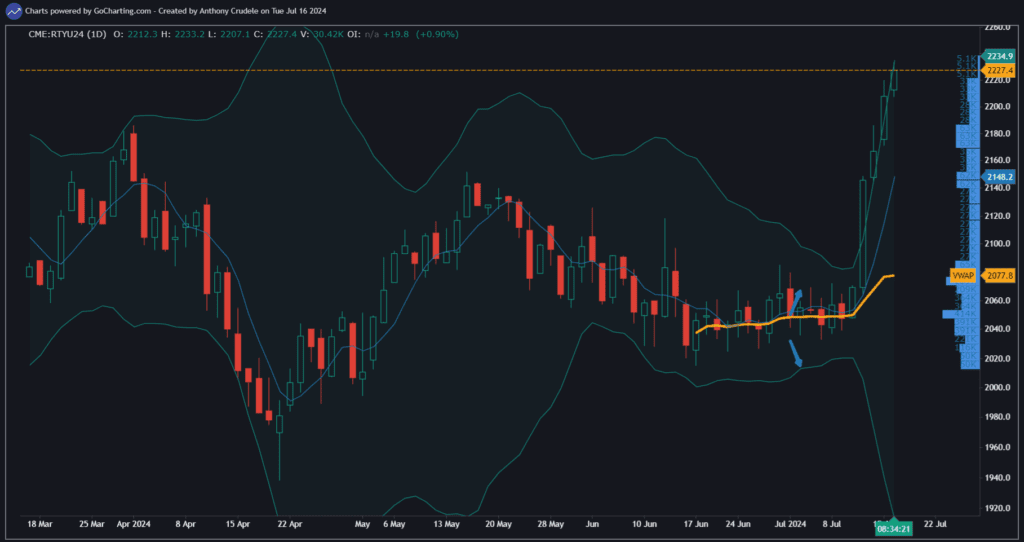

Range expansion across the board as we enter another leg of this bull market rally. Range expansion is when I see the daily Bollinger Bands (20,3) expanding outward, and we have short-term daily moving averages pointing upward. We have that across the board right now, and it’s likely we see this rally continue to higher highs.

As day traders, how do we trade this?

Just look for longs. I know many of you want to find the tops for rotations, but those trades are full risk for minimal rewards. The Bulls are in control of this market, and the follow-through is coming from the long side, not the short side.

Keep it small. The key when we have a runaway market is to focus on the longs in your strategy, and just keep it small. You don’t need to be a hero on your first trade. Let the market come to you, and ease your way in.

My focus remains on ES and RTY for longs, as their charts have a cleaner bullish look on the daily. The NQ is still bullish, but I expect it to be bumpier.

RTY is playing catch-up as the recent headlines supporting a lower rate environment are finally giving fuel to those bulls. RTY is helping the overall bull case as we see all sectors participating now. The biggest rallies come when all sectors are working together, and who knows, maybe the biggest part of this rally is happening now. The key is we don’t know, and no one knows, but I do know not to fade it right now.

Cheers, DELI