July 18th, 2024

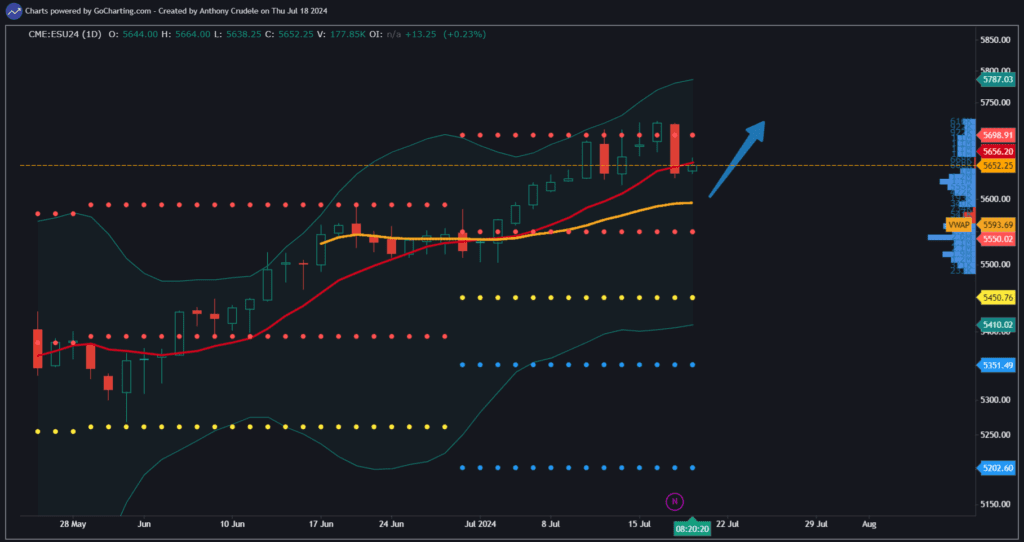

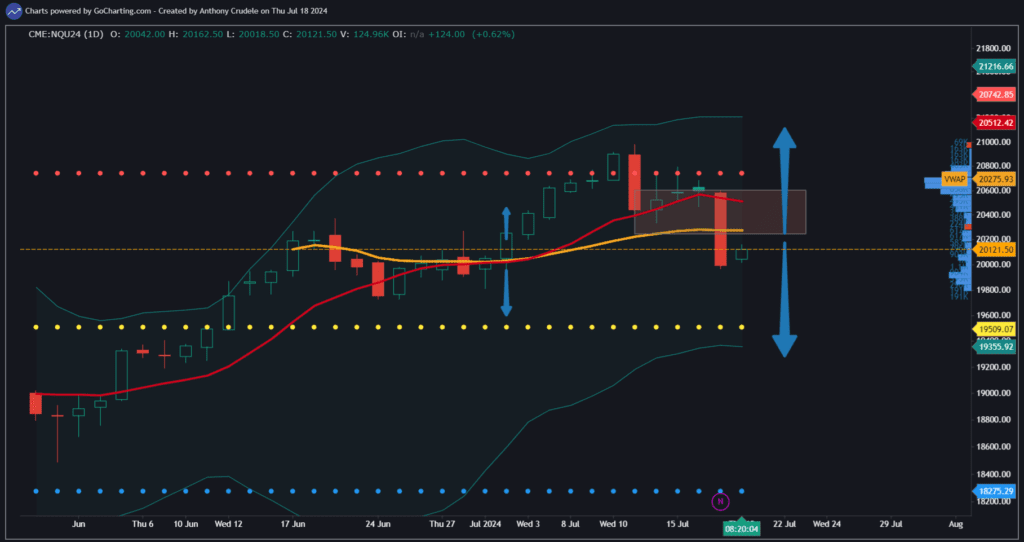

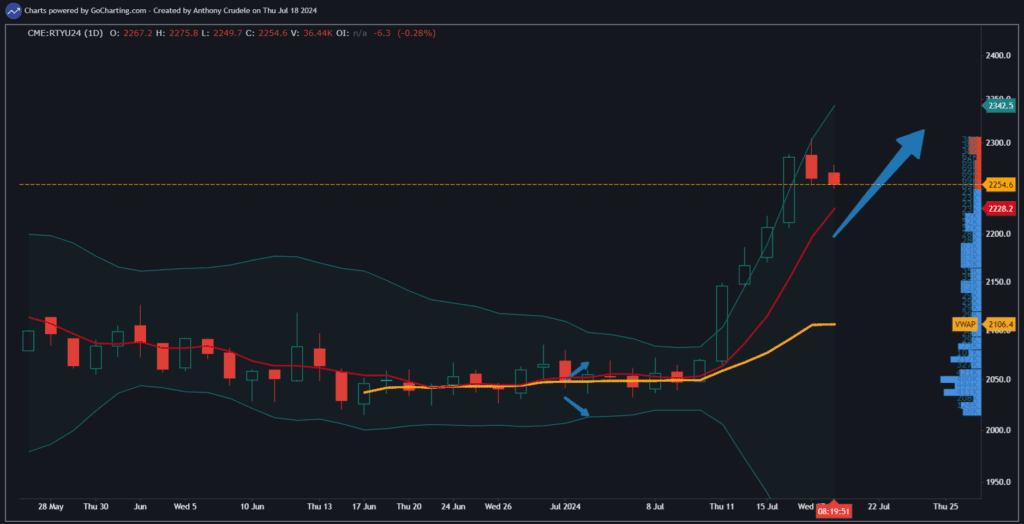

Long the strong, short the weak. Reflecting on my early days as a trader focused solely on the ES index, I often felt pulled in many directions during divergent tapes like this. I learned that to be a successful index trader, I had to leverage these types of markets. Long the strong or short the weak was the simplest way to find some alpha in divergent tapes.

Right now, this market is probably the most divergent I’ve seen in some time, so it’s clear which ones are strong vs. weak. This doesn’t mean we should blindly go long or short; it comes down to your strategy and how the market is reacting to it.

How do we as day traders capitalize in today’s market?

** Find the market that is strong or weak. Pick a market. Pick a side. Stick to your plan and don’t divert.**

It’s really that simple for me. I lose when I overtrade or try to fade tapes. If I pick a side and execute well, I can live with the result. If I try to do it on the fly, I end up frustrated and down money.

Keep it small and let the results be what they are. Focus on the process.

I will be live on Develop Your Edge at 10:30 ET trading the MES. Here is the link to join the livestream: https://www.youtube.com/live/JUylyQaCtwI?feature=shared

Cheers, DELI