July 19th, 2024

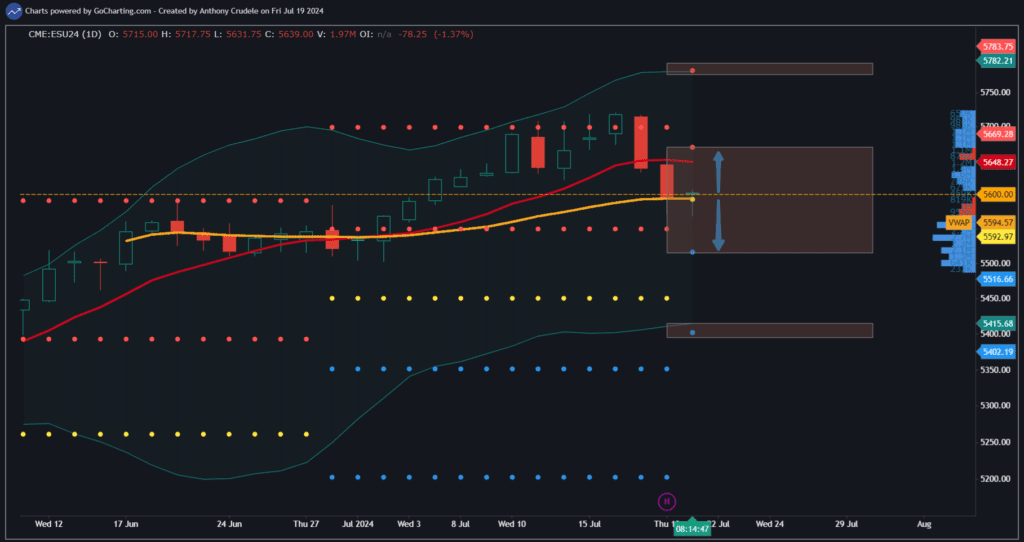

Rotation: Now prepare for consolidation. The ES has had a decent slide the past few sessions, and now it looks like we’re headed into a consolidation phase. I see a consolidation phase because the daily Bollinger Bands are pointing inward, and ES is sitting at my neutral area of 5592, along with the AVWAP from the beginning of September being the front month at 5594.

I am currently long from this area and will lean on it throughout the day as a key pivotal area for today’s trade. I am not looking short below it because this tape is still bullish on the big picture, and I foresee some consolidation in today’s session and buyers defending that area. I won’t fight this area, as I will keep stops really tight.

As far as NQ goes, it’s still the weak link, and I can see that market being very whippy today. I lean bearish for now, but the rallies can be fierce. Not in my interest to trade NQ at these levels.

RTY needs to find some footing soon, or we will look at this high as a capitulation, and we could see a pretty decent move lower. Like the NQ, this market is not on my radar for trades today.

The ES is the play for me today to lean on the 5594-92 area, and if it holds, I can see a decent bounce, but if it doesn’t, I won’t fight it, and I will be flat. Link to chart: https://gocharting.com/sh/ad6160ef-c52b-4535-bc1d-fa523c351343

The key for me is, as I have been saying lately: pick a market, pick a side, and execute. Live with the result. Do not overtrade this market.

As my brother Pax says, it’s Capital Preservation Friday. Don’t ruin your weekend by overtrading and risking more than you wanted to.

Cheers, DELI