July 22nd, 2024

Focus on trading from price level to price level. The world is full of new headlines every day that can impact the market, alongside people who think they can predict what the markets will do based on those headlines. Having been day trading since the late ’90s, I can tell you with certainty that no one knows exactly what the market will do following headlines.

All we can do is trade with the information right in front of us and execute level to level. Yes, we need to understand that things are fluid and headlines will move the market, but the machines will move the market well before you can react to any headline. So, I just stay in my lane by focusing on executing my strategy.

The bears have short-term momentum and the bulls have long-term momentum. This makes for a two-way tape in all the indexes right now. As a directional trader, I don’t have a direction I favor at this moment.

How do we, as day traders, approach this type of market environment?

Pick a direction that your strategy favors in this environment and trade small. Accept that you may not get a trade off today. This market does not favor the impatient but the extremely patient.

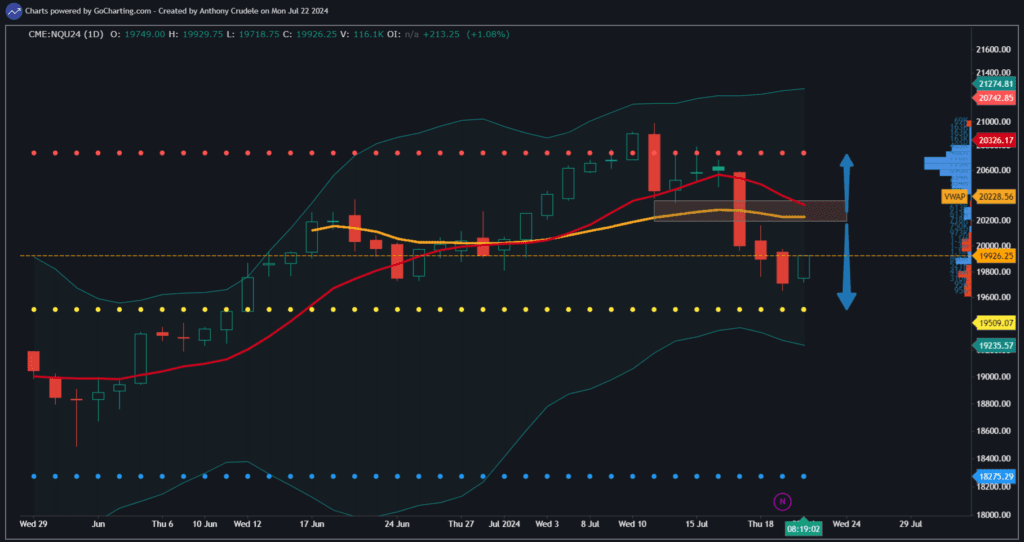

NQ 20,328-228 is a pivotal area to keep an eye on. It’s the 5-day SMA and the AVWAP since we rolled to the Sep contract.

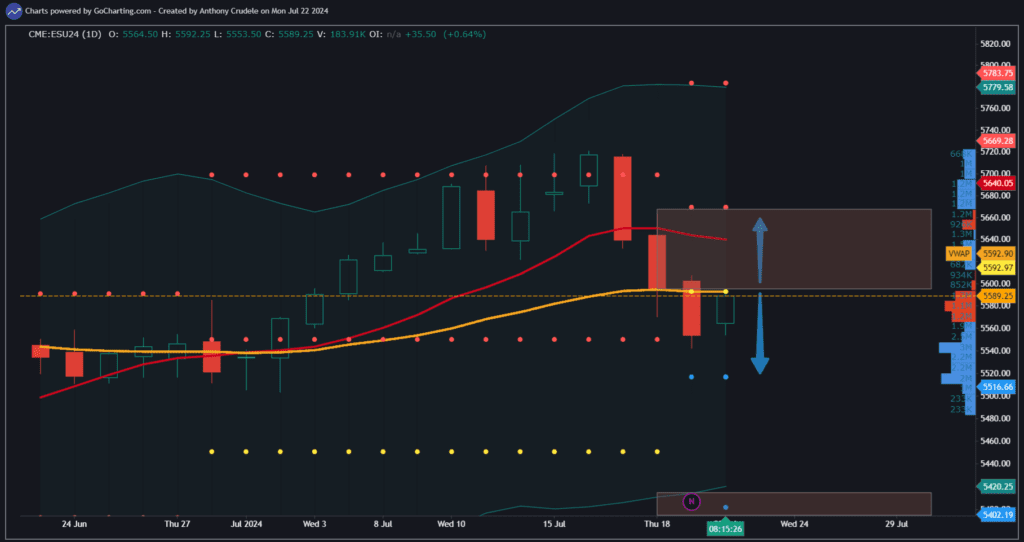

ES 5593 is a pivotal area to watch as that is the AVWAP since the beginning of the Sep contract. This AVWAP matters to me because it shows if buyers or sellers are in control since we rolled into the Q3 contract. This will be an area I watch all quarter.

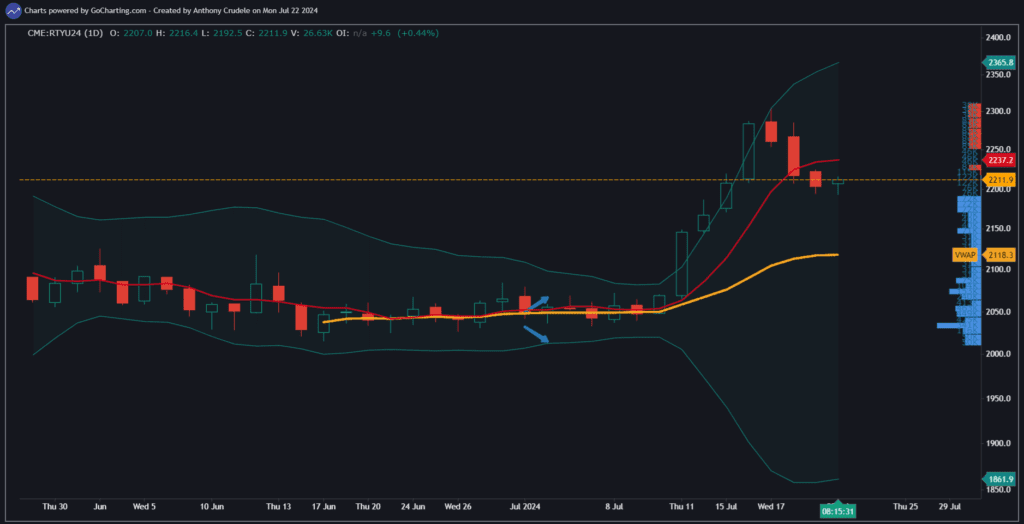

RTY has a capitulation look to it on its highs, and only time will tell if this was a blip higher or just a pullback and the rally is set to begin again. Expect a lot of volatility in RTY right now.

Cheers, DELI

ES Chart https://gocharting.com/sh/83e1c9b8-9c55-4b54-8ae6-6bb025d8f07c

NQ Chart https://gocharting.com/sh/ec531e29-288a-4b09-bd88-966d84a48cda

RTY Chart https://gocharting.com/sh/4f90f631-96ce-4747-8bba-37a891838183