July 23rd, 2024

Let the consolidation trade begin. The long-term bullish momentum is playing tug-of-war with the short-term bearish momentum, bringing us to a consolidation phase. As a directional trader, I do not see any edge in direction right now; the Indexes need time in this area. It seems like we’ve rarely had consolidations this year as the bulls have been running away with this market, but the charts right now support a consolidation even with all of the crosswind headlines.

How do we, as day traders, trade this type of market environment?

Small and smart. Pick a side and commit to good execution in that direction. I’ve been saying lately that this tape can spin you around during the day and get you to overtrade it, so don’t let it. Assess the morning through your preparation and focus on trading the side of the market that your short-term strategy favors.

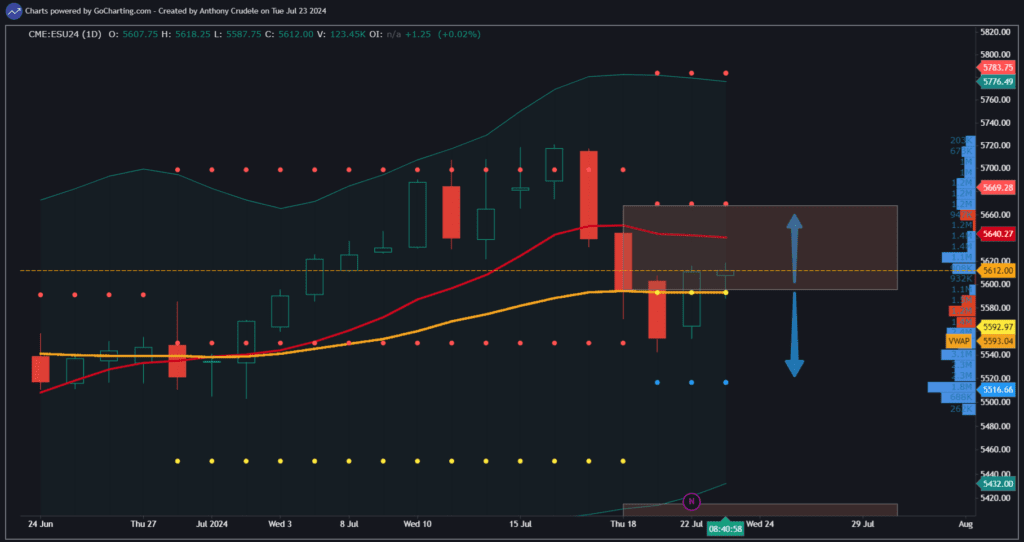

ES is the market that mostly favors the two-way tape as their daily Bollinger Bands are flat, along with flat AVWAPs and short-term SMAs. The 5593 area remains a major pivot for me. 5669 is big picture resistance. Daily closes below 5593 start to shift the balance to the shorts, and 5516 could then be in play.

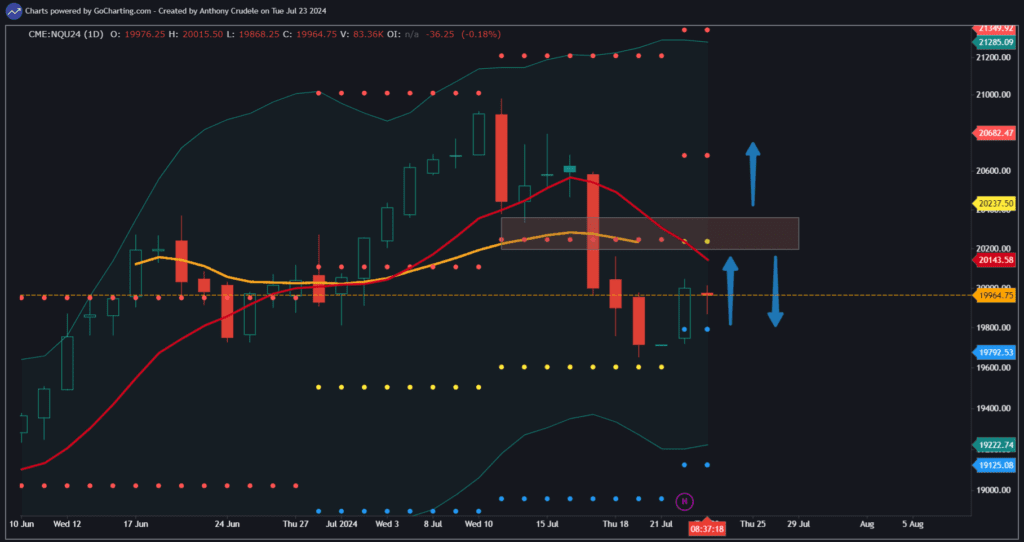

For NQ, I lean towards a test of 20,236 in the coming sessions. Daily closes below 19,792 give the bears momentum again.

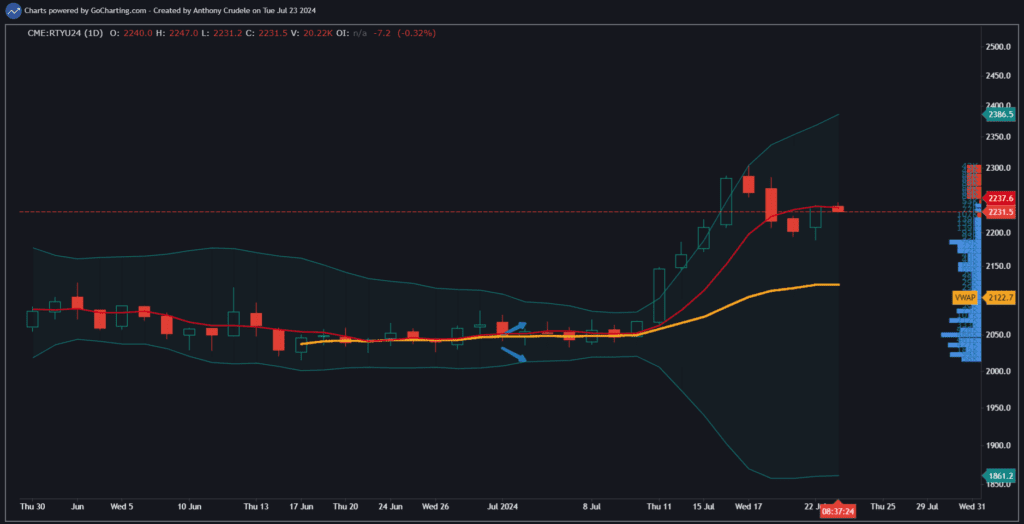

RTY is in a major chop zone. I’m just not sure what to make of it yet. The chart needs time.

Keep it small and smart. Do not overtrade this tape. Patience.

Cheers, DELI

ES Chart https://gocharting.com/sh/470e7b98-42ef-4db7-a03c-2ffdb11fc2f7

NQ Chart https://gocharting.com/sh/0d6dfa40-1414-44a5-bc1d-823d47e2a55f

RTY Chart https://gocharting.com/sh/e2a3f215-98ca-443f-9363-78a461c645c0