July 30th, 2024

There will be an abundance of reasons why the market is moving this week, but the ‘why’ doesn’t matter to me. Our job as day traders is to execute from one price point to the next and focus less on the ‘why’ and more on the ‘how.’

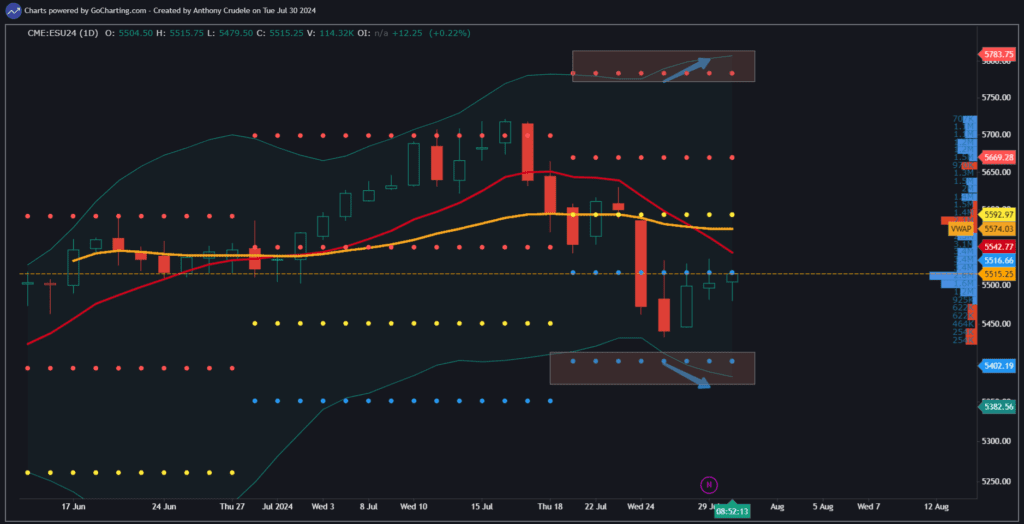

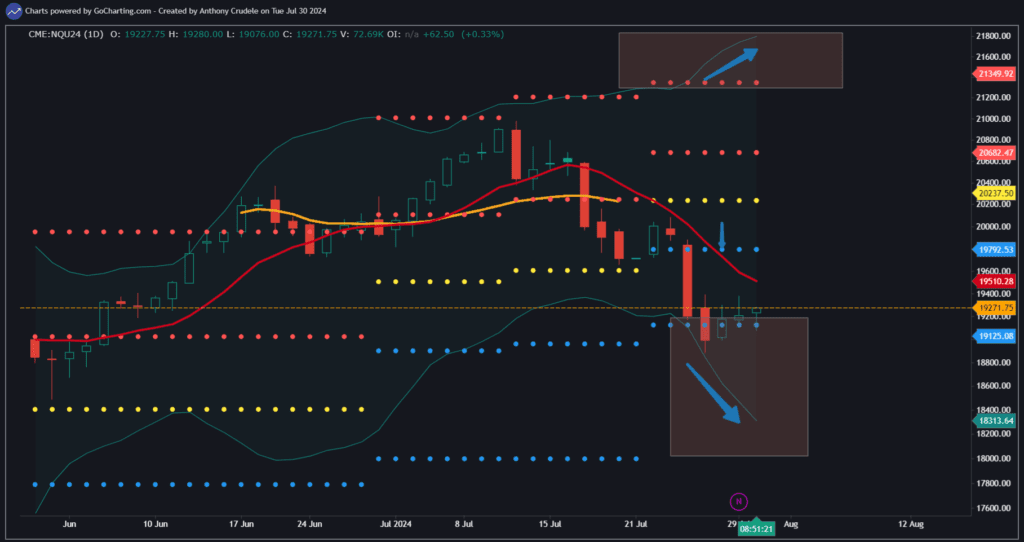

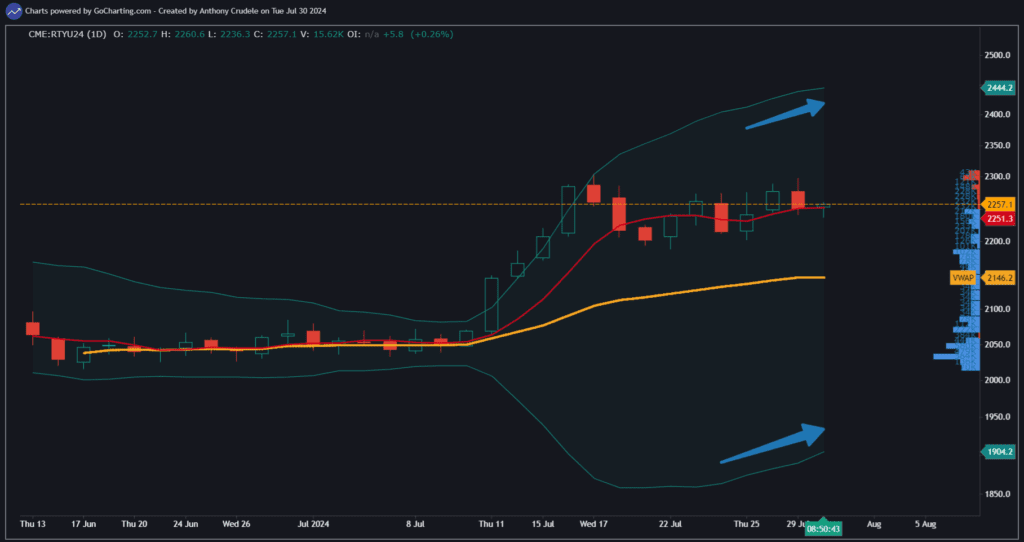

Macro will lead the way with directional moves this week as there is plenty of data and announcements front and center stage. As far as the technicals go right now, this environment is tough to read. I still see a two-way tape with the possibility of further downside. The market is trying to build a base here, but it’s not ready yet or it’s just not building a base :).

The key technicals I look at for the market environment are daily Bollinger Bands, AVWAPs, and a small set of moving averages. When the Bollinger Bands are not clean and moving inward or outward, and instead bumpy and not making a clear move outward or inward, that is a sign that no direction has the upper hand. When we’re not respecting AVWAPs from key areas (up or down) and moving averages are flat and we’re trading around them, we have no clear direction from the daily charts.

For day traders, this tells us we can trade both sides and strictly focus on the short-term charts.

How do we, as day traders, approach an environment like this? The most important part of a top-down approach to trading is when the daily charts do not give us a clear direction, trade smaller or not at all on the lower time frames. It’s simply about taking your position sizing down. Just focus on your short-term signals and don’t put full risk on a trade or day in this environment.

My mindset is to look for reasons not to be in the market right now, not for reasons to be in the market. If I stick to that mindset, the market will force me to be in at the areas I should be in.

Keep it light and tight.

Cheers, DELI