September 3rd, 2024

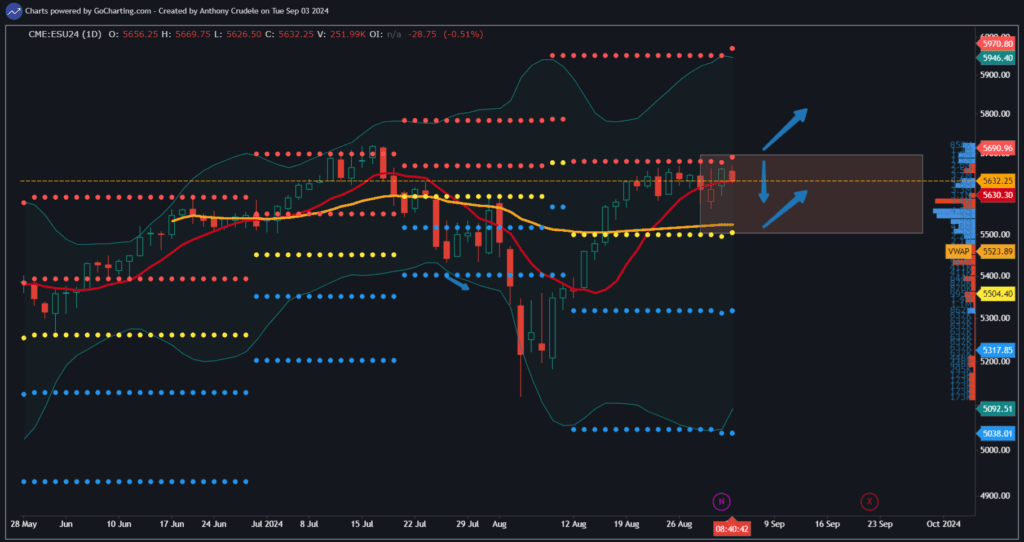

The bulls’ momentum has stalled, but charts aren’t bearish. Now that August has come and gone, we’re off and running in September. Just like the first day of August, September is starting off with momentum stalled, looking like a selloff is in store for the first day of the month. That being said, on pullbacks in September, I think they will initially be bought as traders look at the August low as a ‘good low’. In August, we had news that drove us lower, the charts were already showing cracks of weakness, and there wasn’t really a recent ‘good low’ made.

As day traders, how do we approach today in this market environment?

Understand the primary trend is intact (bullish), but short-term momentum has slowed. So don’t chase a rally, and if we sell off, don’t be in a hurry to be short. Trade the edges, not the middle on days like today.

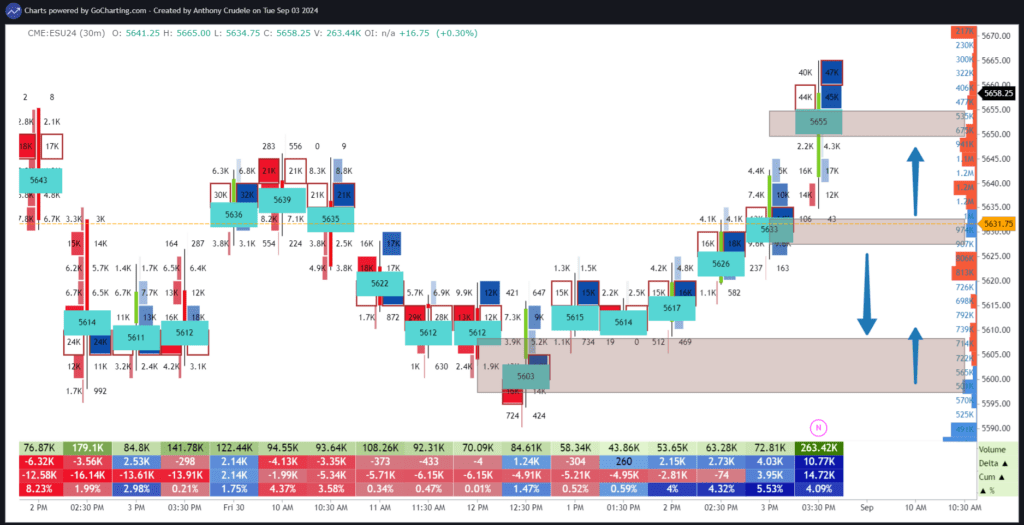

For ES today, I am looking at 5633 as the morning pivot; above it, we go back to 5655 and below it, we look to test 5612-03. On the bigger picture, I am looking for swing longs at 5522-5501. I will be a buyer there, and my stop will be around 5470.

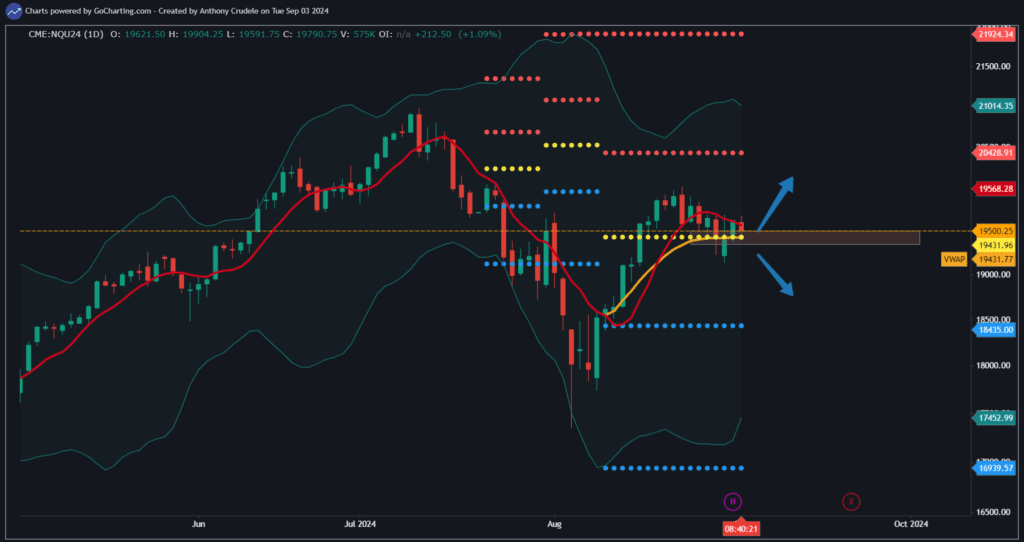

NQ, on the other hand, is sitting right at my key pivot of 19,431. I hate using the term ‘line in the sand,’ but for today, that is the pivot I will be watching. The key is to never fall into the trap of overtrading a pivot. Wait to see how it trades around that area and be small once you pick a side. Watching the first 30 minutes and opening range is key for today in NQ. I am focused on ES this morning; NQ may be a bit tricky in this area.

On a side note, it’s great to be back at my screens this week after taking time off in August. I will be hopping on audio this week in my Discord to chat about the current market environment and to do a live Q&A. Stay tuned for when that will be as I look forward to chatting with all of you.

Small and smart.

Cheers, DELI