September 4th, 2024

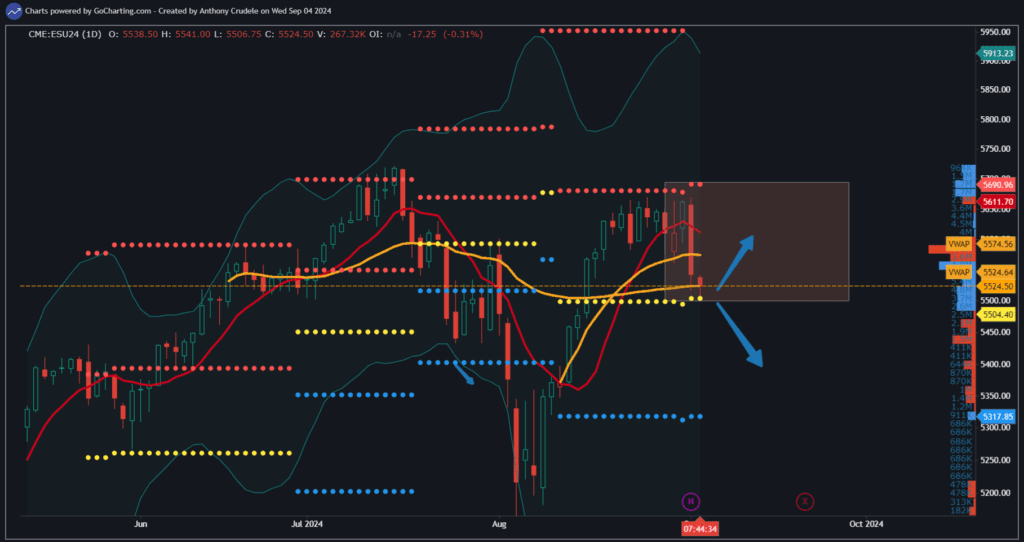

Trade for a bounce, but an extended rally is unlikely. Yesterday was the first day of the month, and something I’m noticing that’s causing me concern about this bull market: Since July, the first day of the month has seen sellers, and the last day of the month has seen buyers. This behavior is typically seen in bear markets, not bull markets. My charts aren’t bearish in ES just yet, but I wouldn’t count on any big rallies in the short term.

How do we, as day traders, trade this market environment?

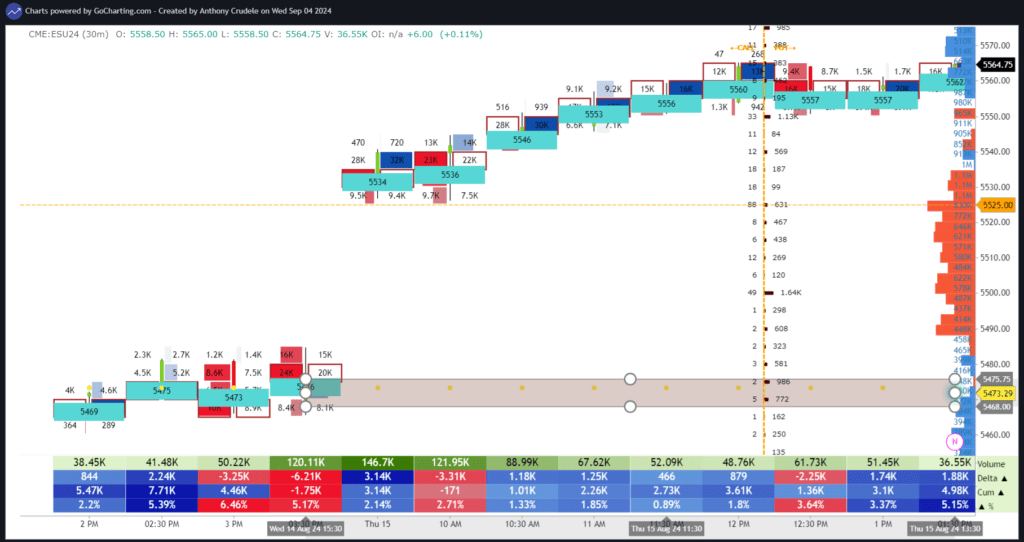

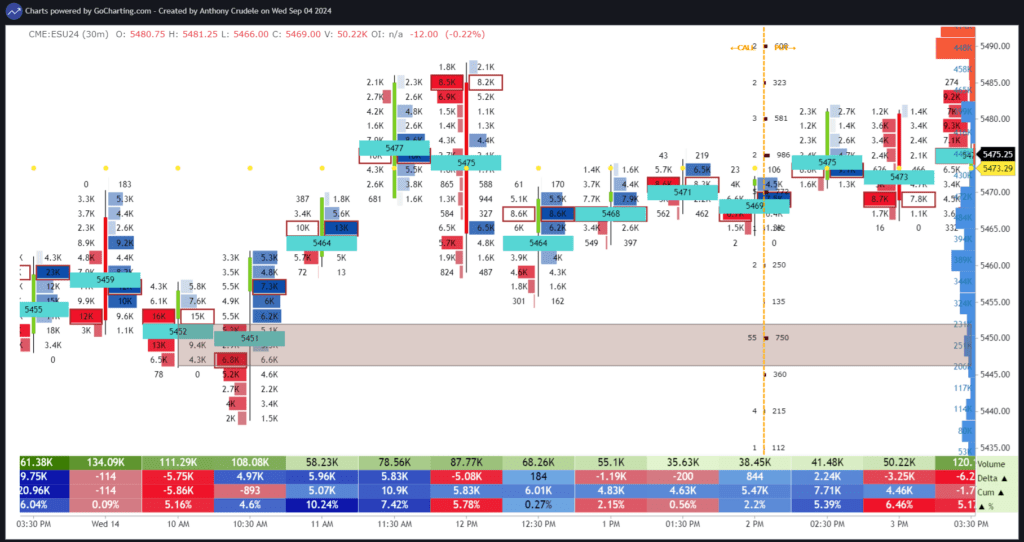

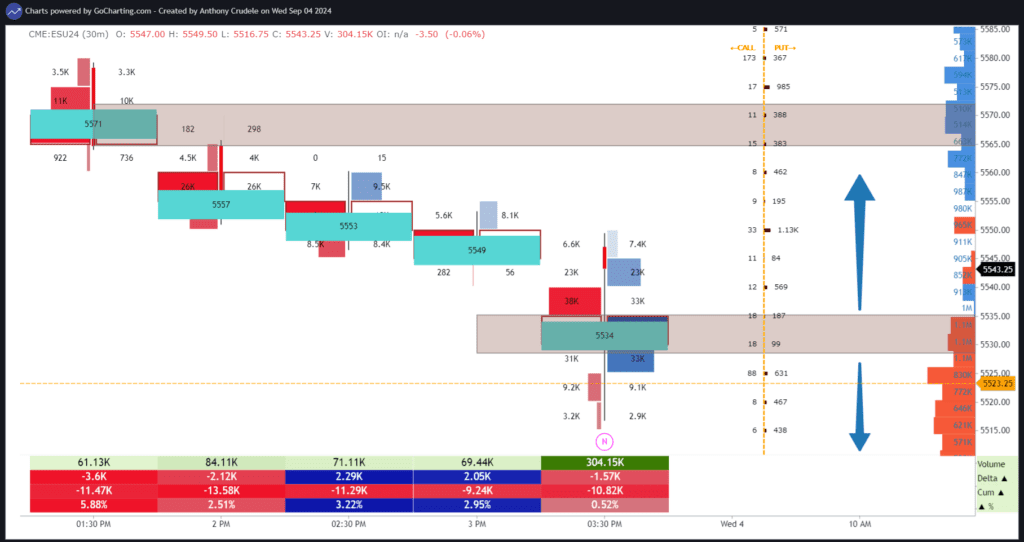

Initially, I was looking for swing longs in ES between 5522-5502, as noted in yesterday’s note. But now, I’m just getting long leaning on this zone, looking for a bounce and trading short-term scalps. If the market fails to hold 5500 this morning, selling may escalate, and we could head towards 5476. Below 5476 opens the door to 5451. On the rallies today, I will target 5534-40 as the first level to take off long trades. If we get above 5540, I will look for a test of 5571.

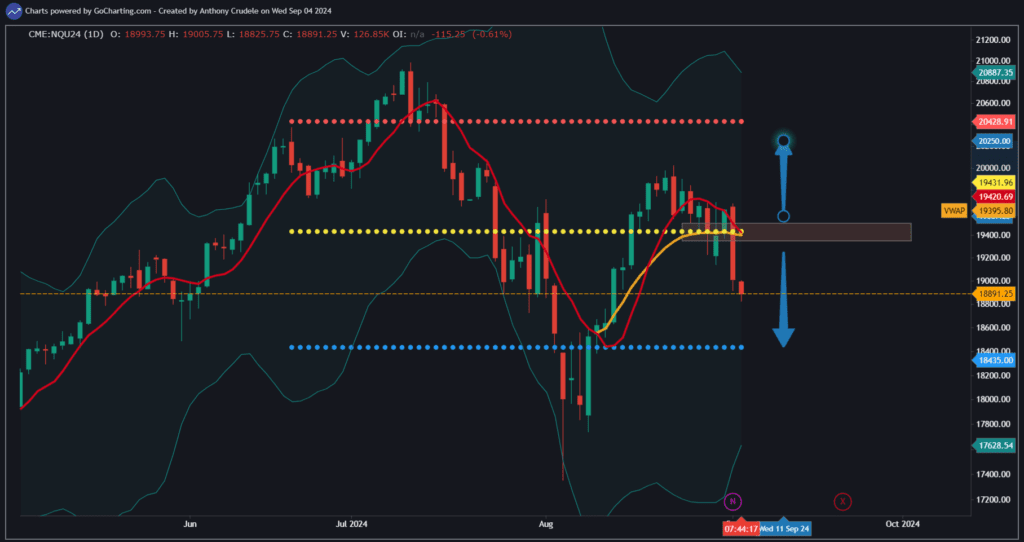

NQ is just straight-up bearish on my charts at the moment. I would only be looking at short signals in that market. Until I see NQ regain 19,431, I am bearish and it looks like we’re headed to 18,435.

Small and smart in this market. There will be opportunities. Don’t take yourself out of the game too early in a busy market. Patience.

Cheers, DELI