September 16th, 2024

Rollover and FOMC. Two things that will create scenarios likely to make us scratch our heads. Even if we know what the Fed will do and say, it’s no guarantee we know how the market will react. As far as Rollover goes, today is the day we move to the Dec Contract (Z24) in the major indexes and expect some volatility at the open and just before the open as we make the roll. All we can do is be patient, take our size down, and execute the strategy we have in front of us. If you don’t have a clear setup, don’t trade it.

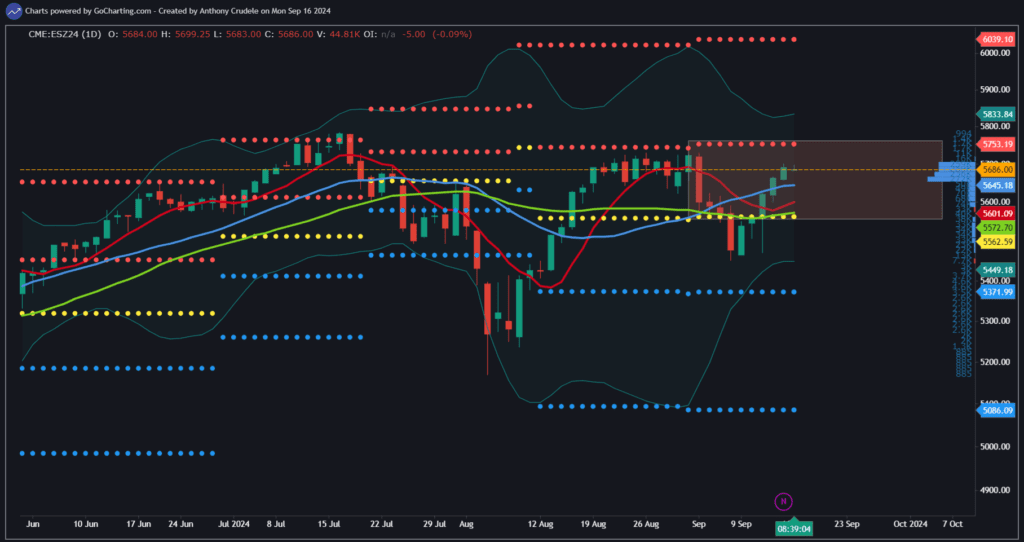

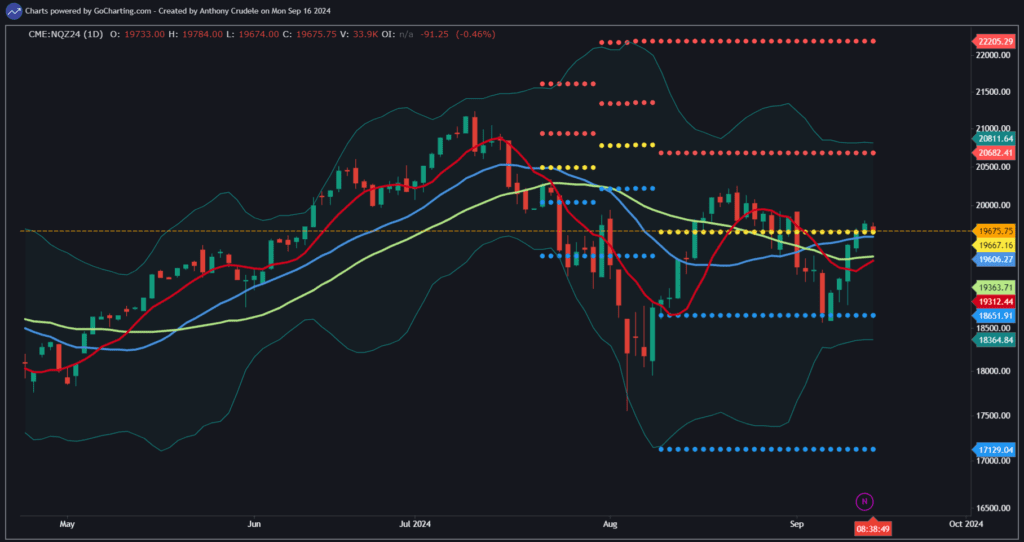

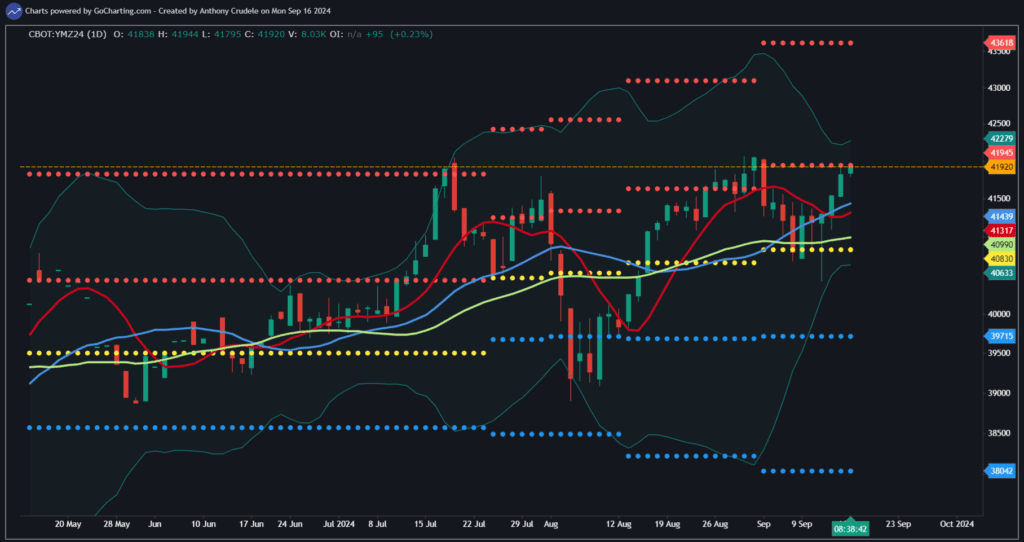

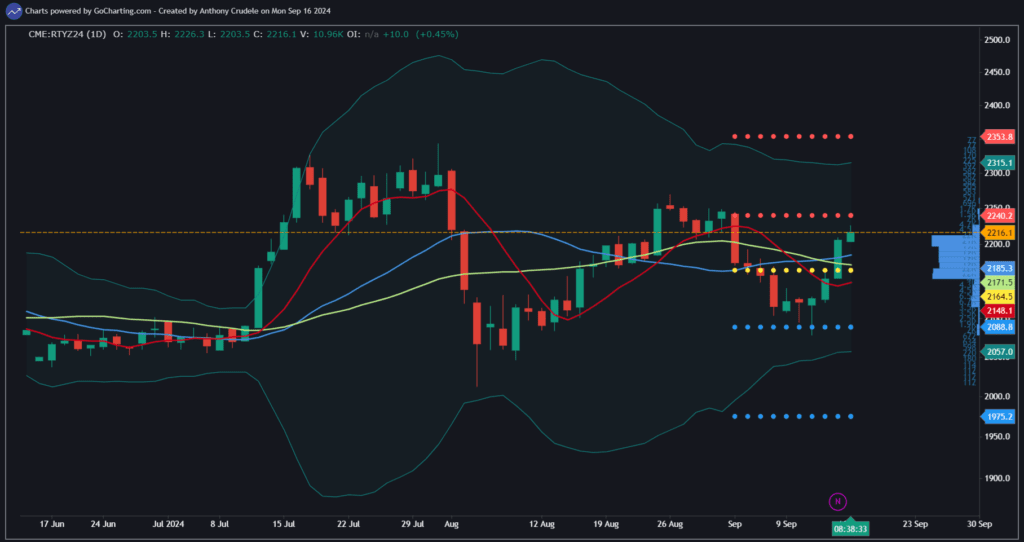

As far as where we stand on a technical basis, the tape had a chance to continue downward momentum early in September and failed to do so. The bulls took the momentum from the bears, but they, too, are struggling to gain any significant momentum. Momentum is important because we’re stuck in a tape that still shows divergence between the major indexes. For a significant move in any direction, the market needs momentum to carry us through. I hate to say it, but it probably comes down to what the market does on Fed day this week. I hate relying on a data point to determine the technical bias, but it’s the tape we have right now. Unfortunately, if the FOMC doesn’t give us momentum across the indexes, we’ll be in a wait-and-see mode once again.

What does that mean for day traders?

It means you can trade both sides of this tape. This tape can swing in either direction and not make a big difference on the daily charts.

The August highs and lows are the likely range for the short to mid-term, and until we see those levels taken out, we will drift in that range.

The bullish setups should have the advantage in this chop because they control the primary trend. The key is to buy the strong tape when we have divergence, not the weak one. Today, that would lean towards buy signals in YM and RTY. NQ is the weak one, and ES is lost in the shuffle.

Keep it light and tight. Watch and learn something on a rollover Monday; there’s no pressure to do anything.

Cheers, DELI