September 17th, 2024

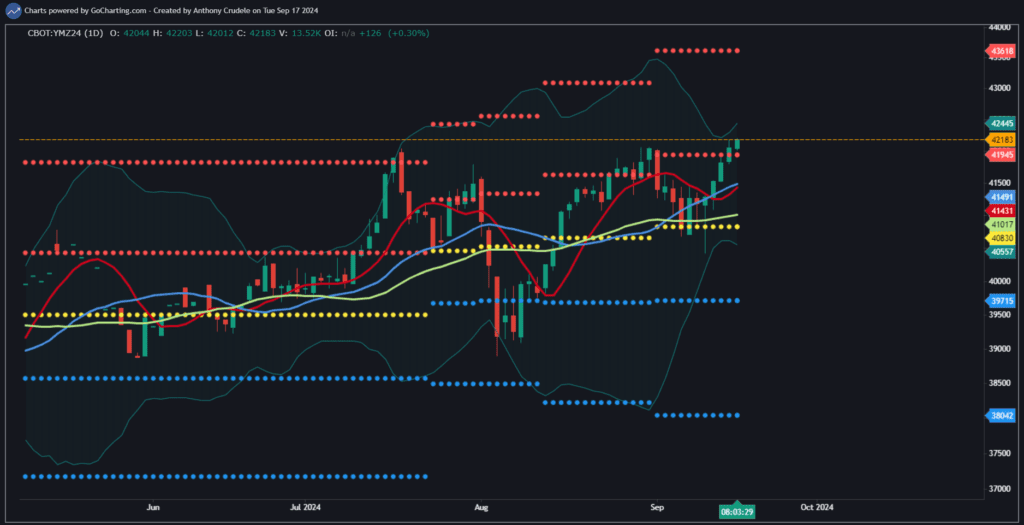

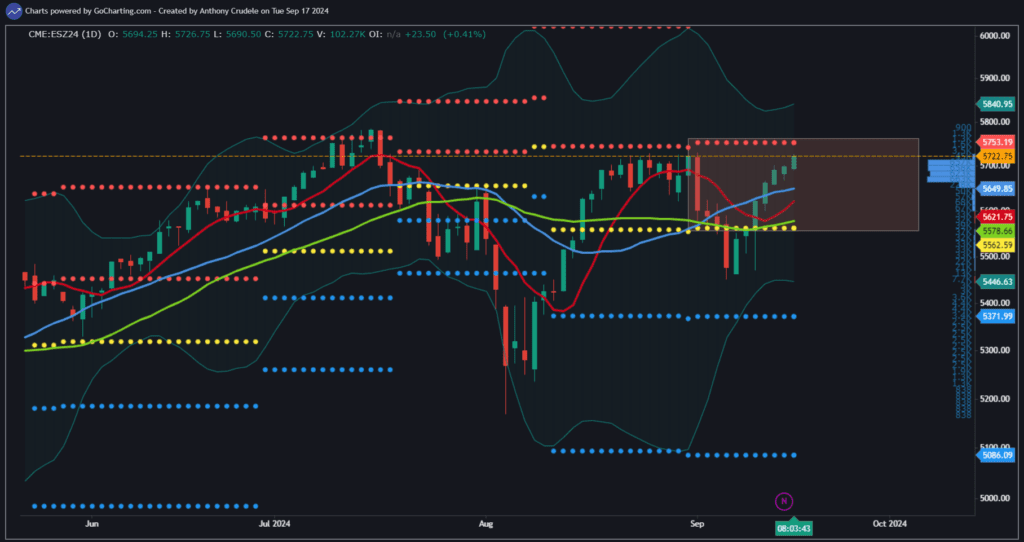

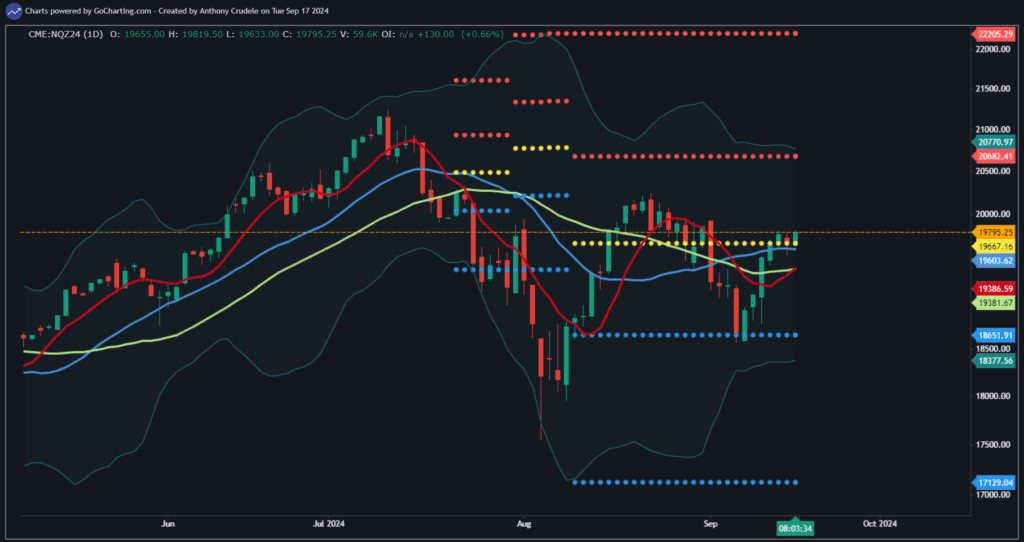

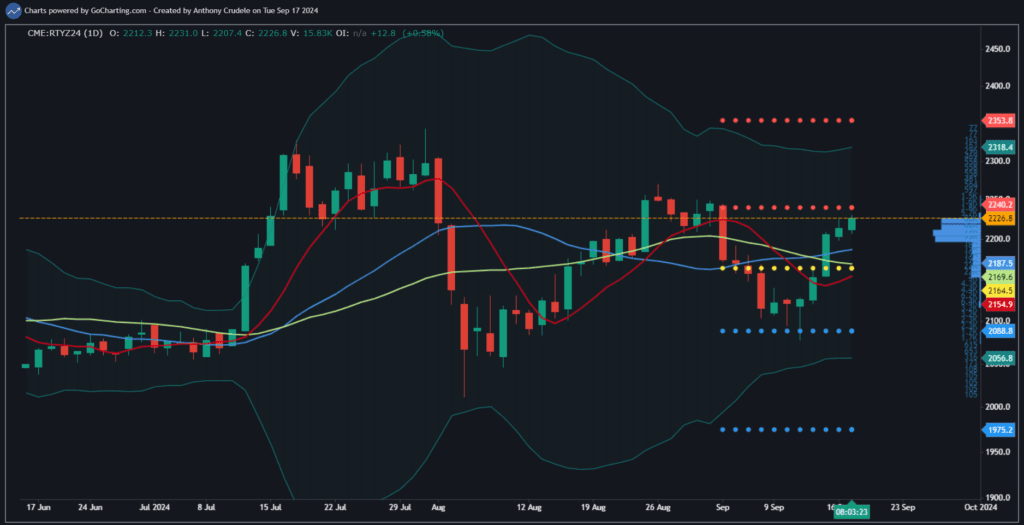

Dow leads the way higher. YM sits at new yearly highs this morning, ES is approaching its August highs, while NQ and RTY remain weaker. This divergence remains the focus until the FOMC decision.

How do we trade a divergent tape?

Buy the strong markets, not the weak ones. Focus on long strategies in YM and then ES. Especially if you’re getting signals in both at the same time, that is good confirmation for a short-term trade.

The tendency for many traders is to trade the weak market and hope it will catch up. Yes, that happens sometimes, but the stronger tape has a higher probability of a short-term buy signal working because the higher timeframe is on its side. The catch-up trade has a lower probability.

With a day to go until we finally get this highly anticipated FOMC behind us, the focus for now is on buy signals in the YM and secondly in the ES.

Keep it simple. Keep it light. Don’t overtrade this tape.

Cheers, DELI