September 23rd, 2024

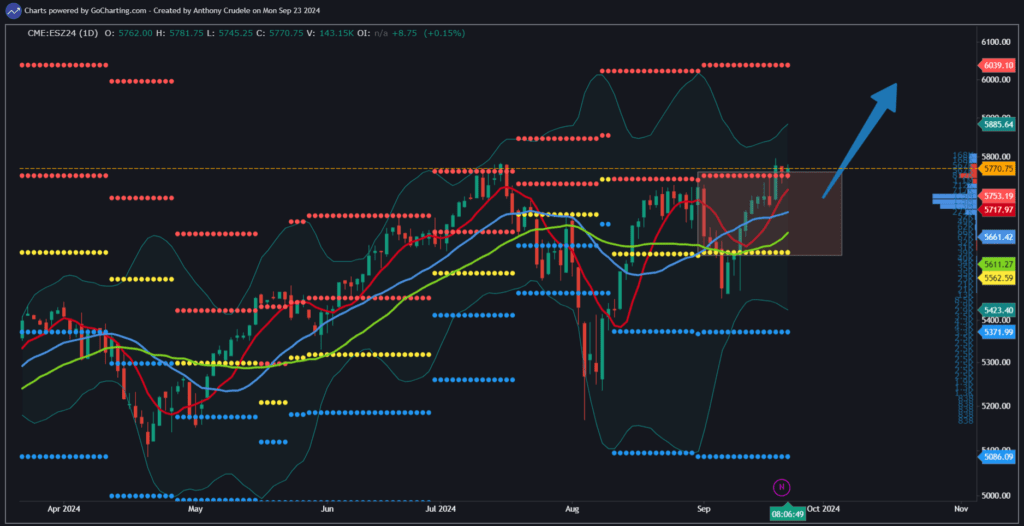

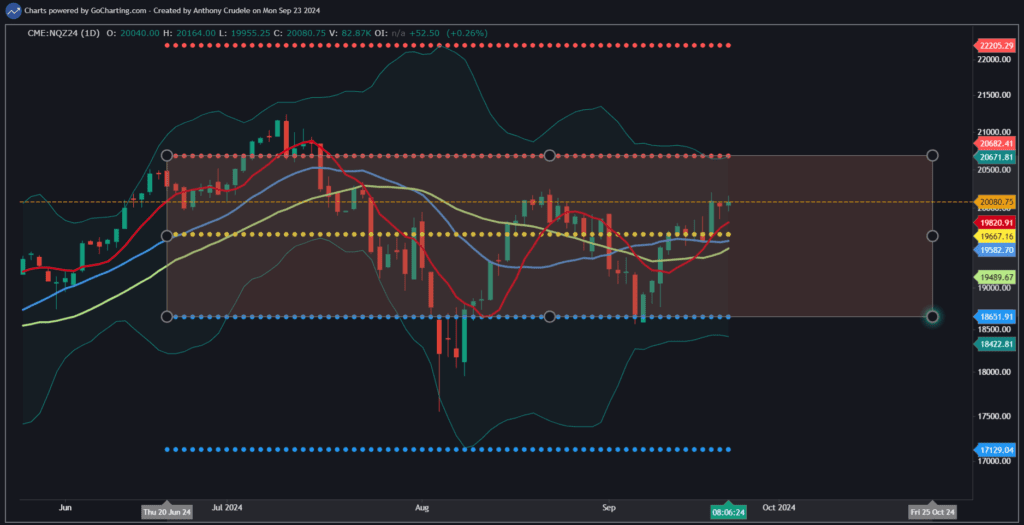

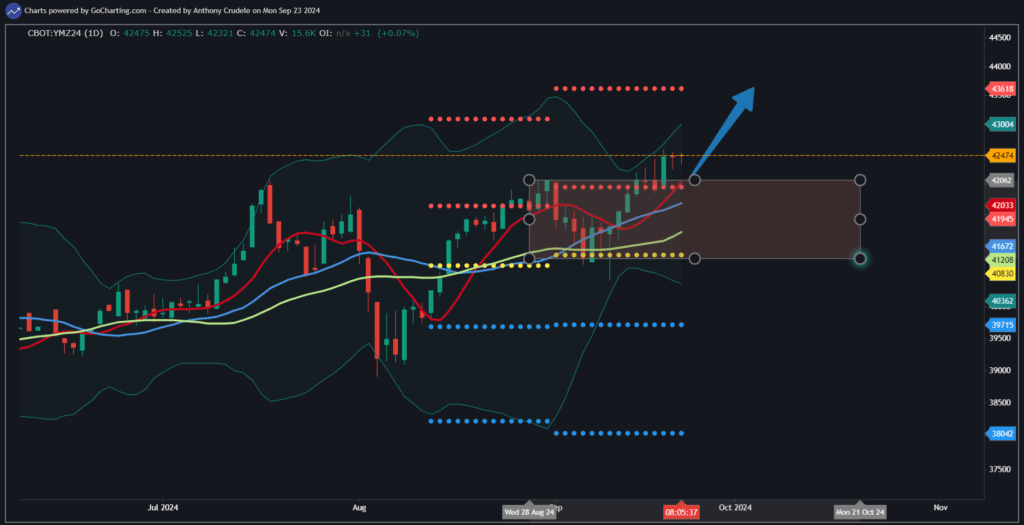

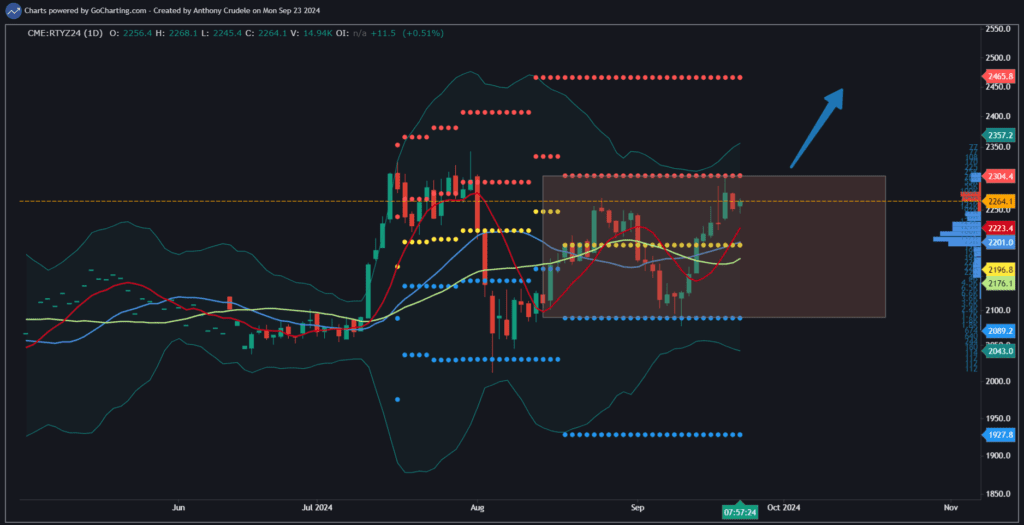

As we are now through OPEX and FOMC, the market tells us it likely wants to go higher. The indexes are still in a divergent pattern, and it will unlikely be a clean trade higher, but the path of least resistance is up.

How do we as day and swing traders trade this tape going forward? Favor buying the strong and staying away from the weaker indexes.

Because the indexes have some divergence in the charts, I will continue to look at the indexes and buy the one that is stronger. The upside leader right now is YM, and following just behind is ES. They are both breaking out on the daily charts with conviction while the NQ and RTY remain a two-way tape.

The RTY remains of interest to me on dips because we are in a rate-cutting environment, and that tells me they likely have an underlying bid in them.

Do not overthink this market. The charts remain bullish; follow the leadership and execute. Keep it small and follow your plan. Have a great week.