June 24th, 2024

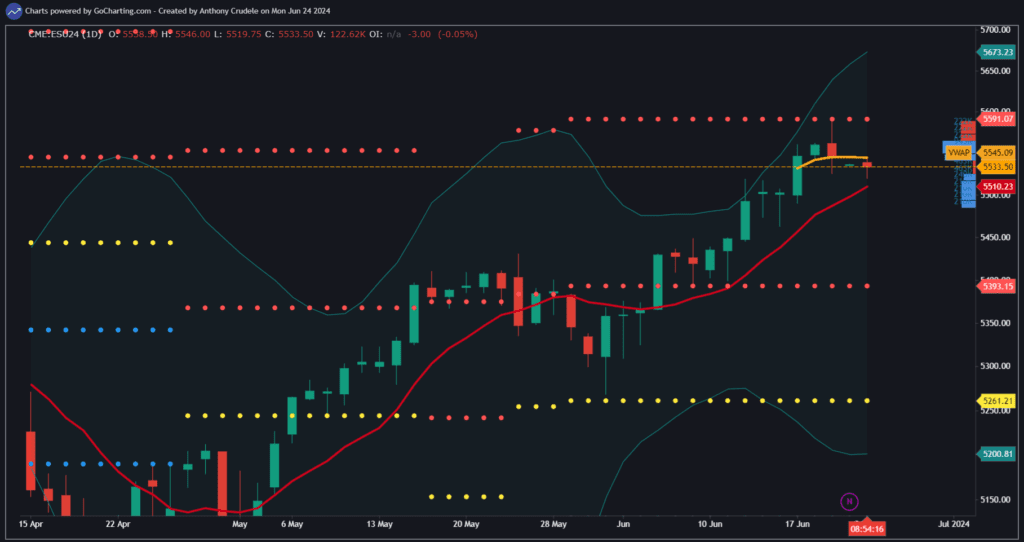

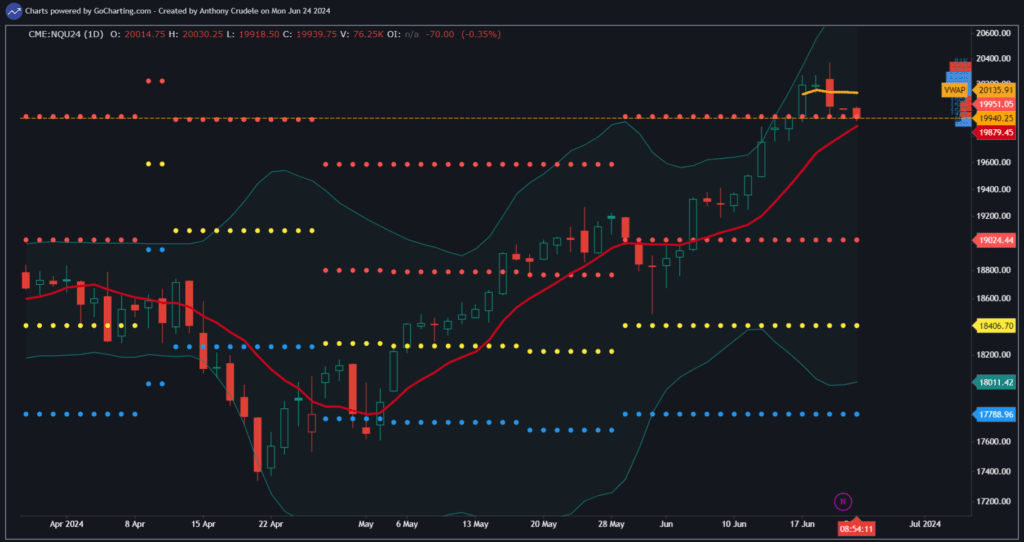

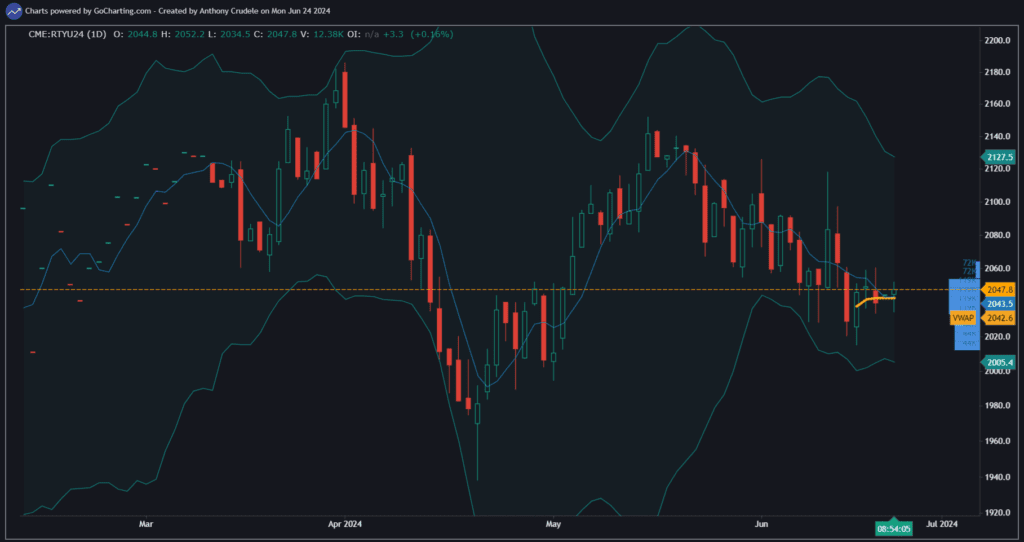

Since the roll was completed, we are seeing a shift in market environments. The Russell 2000 is now showing signs of strength, while the NQ and ES seem to be stalling and may soon be in mean reversion.

How should we, as day traders, approach this?

Until I gain further clarity on ES and NQ, they still appear more bullish than bearish. In our short-term strategies, I lean towards long positions, but acknowledge that the upside potential seems limited. In the upcoming sessions, if the daily Bollinger Bands start to contract (using 20,3 settings on BB’s), I will consider looking for short opportunities in NQ and ES, anticipating mean reversion and a pullback.

RTY seems to be attracting more active buyers at the moment. I determine this by anchoring VWAP on the daily chart in the indexes, starting from June 17th when we rolled to the Sep contract. This method helps me gauge whether buyers or sellers are prevailing in the short term battles. RTY is the only index above its AVWAP, and while I’m currently bullish for day trades, I remain cautious, as the market remains two-way, allowing day traders to capitalize on both directions. I favor buying for now in day trades, but I am wary of being overly bullish on RTY.

As we enter summer markets, anticipate lighter and choppier trading conditions. Keep your trading light and tight.