June 25th, 2024

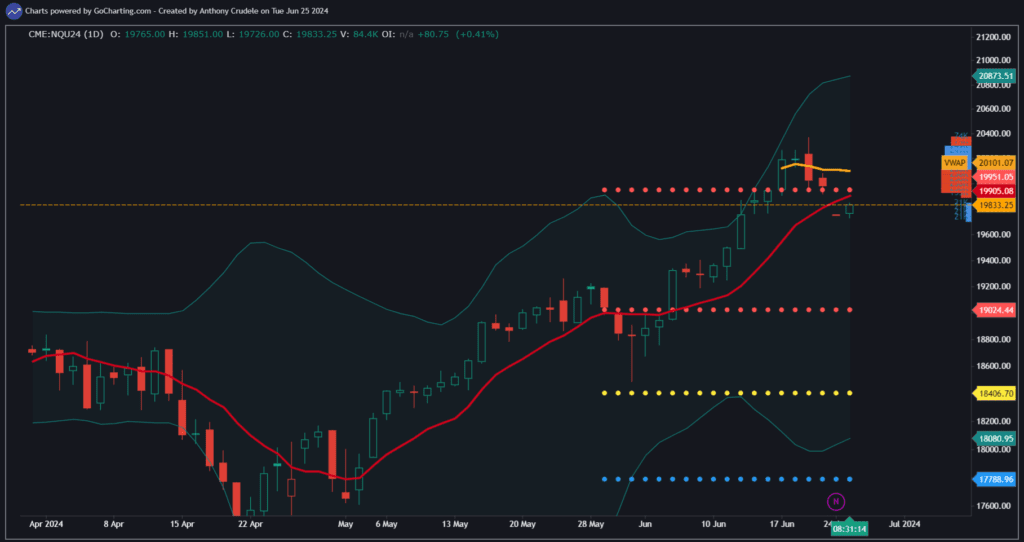

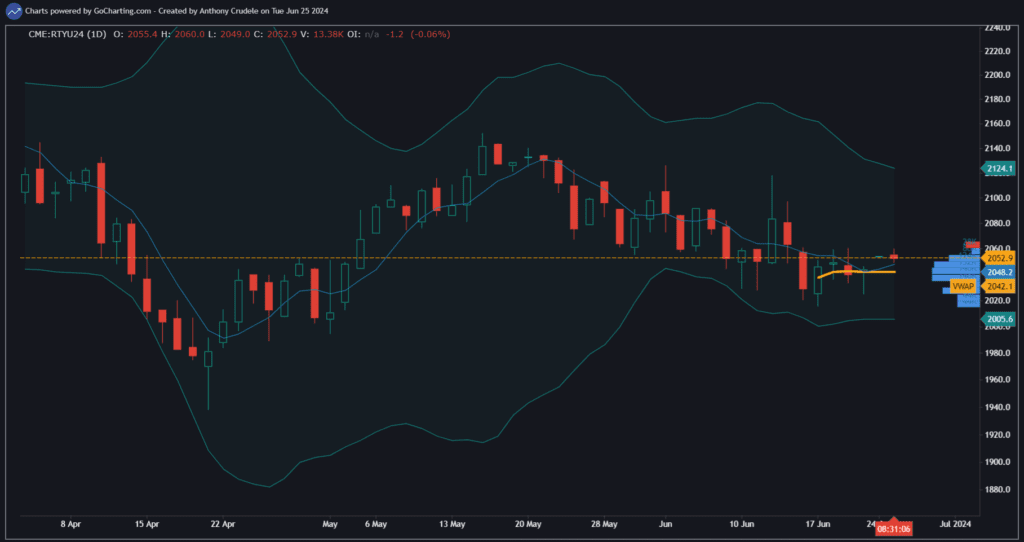

RTY vs NQ: The rotation, divergence, or whatever you want to call it remains the focus in the indexes right now. Since the roll has been completed, this market environment is trying to find clear leadership as NVDA dropped off a bit. Now small caps, energy, and other sectors start to get some life here – we have a divergent, rotating tape.

This is not bearish action, this is what we’d expect in a strong market. Sell some winners, buy some of the areas that haven’t been performing well. Money flows into areas where there is the most potential, with the least amount of risk. For now, NVDA is not that place, whereas other sectors are. This tells me that this market is likely to be a choppy tape in the indexes, and likely to see more rotation lower before finding clear leadership again. The rallies probably have short ceilings, and the market needs to see lower prices to find value and build momentum to go back up.

How do we approach this as day traders? For now, I like buying the RTY on dips during the day. You have to be really patient and not care if you miss it. I will not buy into rallies in RTY because they are not in a range expansion environment – they are in a two-way tape environment that, for now, favors the buyers.

For NQ, I see that market searching for highs intraday, and I like to sell into exhausted rallies and look for shorts. Squeeze highs that see volume come in and then can’t go higher – that is a short for me in NQ.

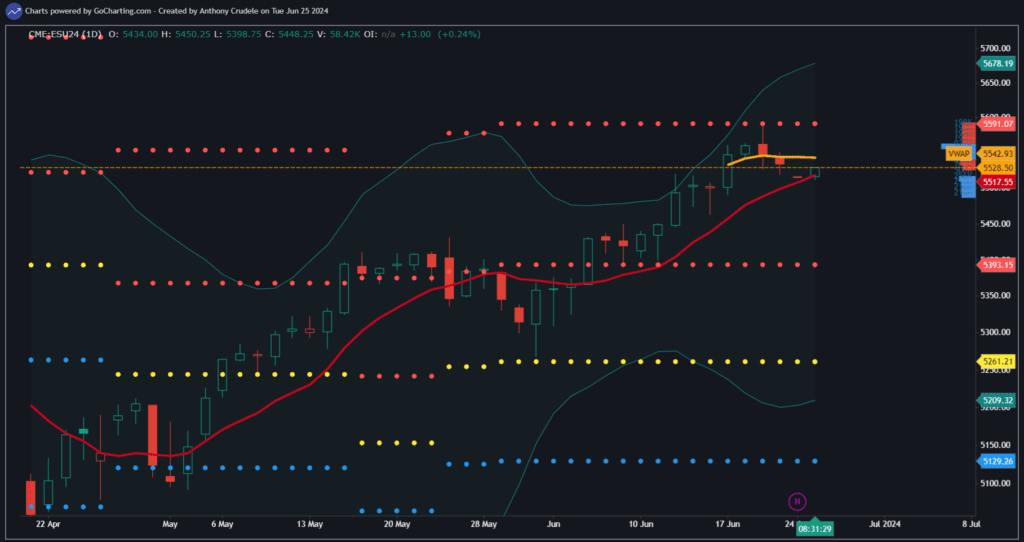

ES is expected to be a bit choppy. I can see it trading in both directions for now but is likely to follow leadership from NQ.

We are in summer, and I expect volumes to remain low. It will be a market where, if you have an early winner, you take it and run. If you have an early loser, keep it really small and don’t risk too much. If you get nothing, go to the beach or go golfing.

Just keep it small and smart.

Cheers, DELI