June 26th, 2024

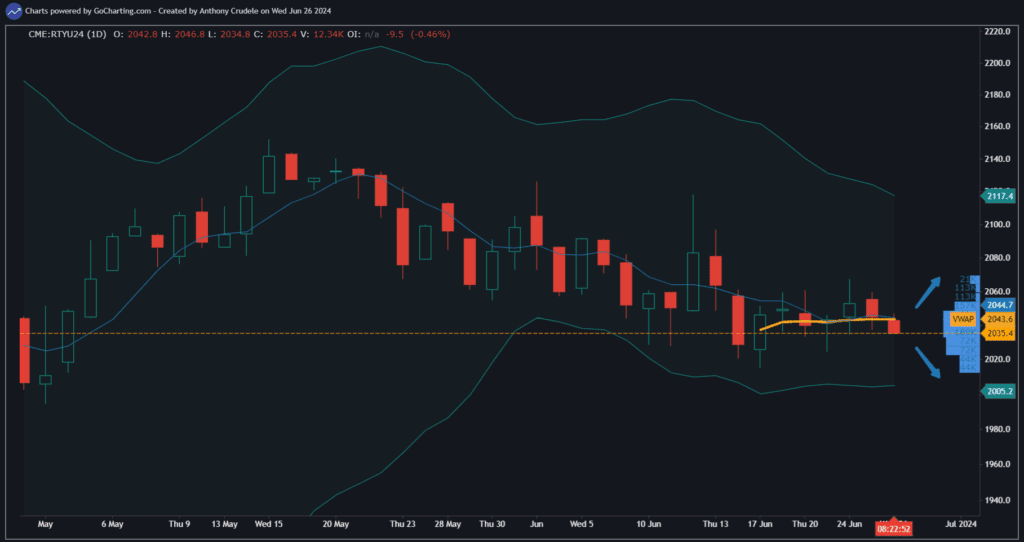

The indexes remain in bull mode, but time is ticking against them for a mean reversion move. Momentum is stalled, as we see rotations/divergences in the indexes every day now.

What does this mean for day traders and how do we trade it?

Buy the strong, or short the weak.

I prefer only to buy the strong, as shorting the weak in this tape is the path to the poorhouse.

What I mean by buying the strong is, on the days that we have divergence in the indexes, use your short-term strategy to look for longs in the strongest index. The same would go for looking for shorts in the weakest index.

I know many of you just trade one index, and that’s fine. Then recognize the day that your index is the weak, strong or the one in the middle. This will help you with your execution.

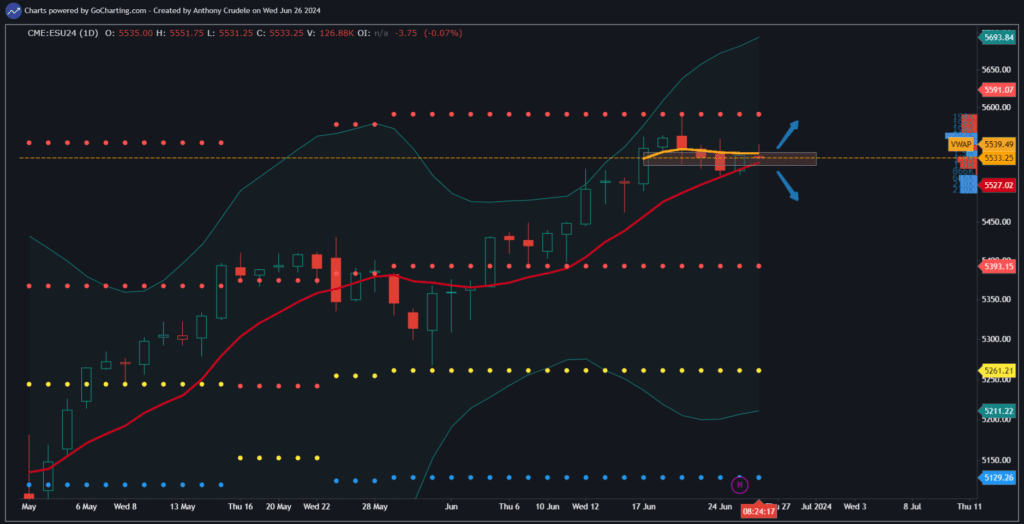

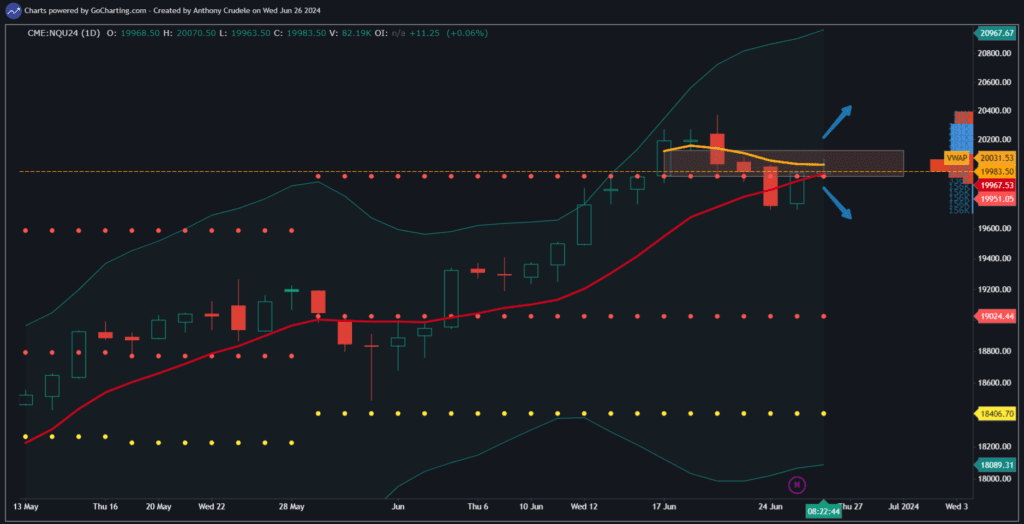

Some technicals to keep an eye on right now; ES 5539-5525 is a pivotal range. That’s the 5-day SMA and VWAP from when Sep became the front month. NQ 2031-1950 is a pivotal zone using the same metrics. RTY 2043 is a pivot I’m watching for daily closes above or below for them to gain any sort of momentum in one direction.

It’s all about being small right now in this tape and not fighting it. If you keep it simple and just understand the overall environment is bullish, but momentum is stalled, and we’re going to have a mean reversion, then focus on your execution based on the type of day we’re having. Don’t be in a rush in a tape that doesn’t have momentum.