October 4th 2023

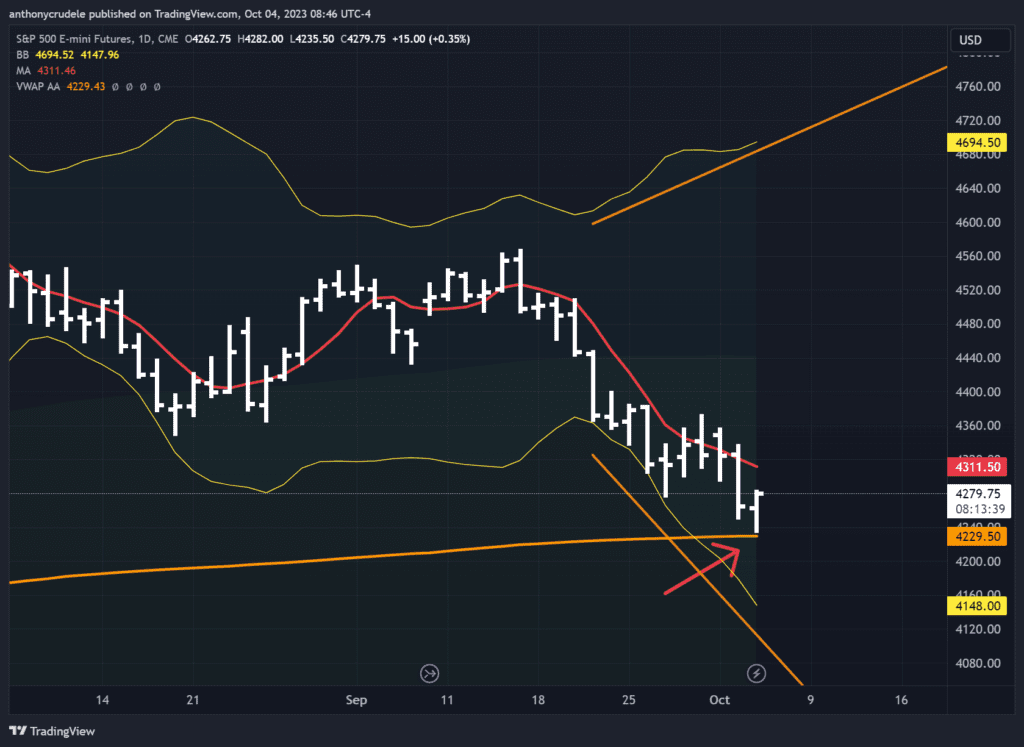

I’ve previously discussed the likelihood of the YTD VWAP being tested at 4230. Overnight, the market dipped to this point and has since experienced a substantial rally. Though this low is currently holding, we’re not entirely in the clear. Even though we’ve hit my target, the daily Bollinger bands continue to indicate possible range expansion.

Today, I anticipate a two-way day leaning towards the long side, as bulls now have a low to play from. I’ll be closely observing the 3-minute opening range, utilizing the VWAP strategy I touched on in my recent video. If the trend is upwards, get ready for a rally – I’ll use every method at my disposal for long positions: futures options, event contracts, and futures. However, if we end up with a range day or a downward trend, I won’t be trading. Once I’m comfortable with a low (or high), I stick with it until it’s taken out or I have several reasons to anticipate it being taken out.

Additionally, take a look at rates today…they have finally paused going higher. That helps the bull case for today.