Asia RED …Europe GREEN

- Hong Kong: Hang Seng closed down -0.78%

- China CSI 300 market closed for holiday

- Taiwan KOSPI -2.41%

- India Nifty 50 -0.41%

- Australia ASX -1.31%

- Japan Nikkei -0.79%

- European bourses in positive territory so far this morning

- USD -0.24%

TOP STORIES OVERNIGHT

Bond Selloff Upends Markets as Long-Term Borrowing Costs Surge-BBG

A selloff in global bond markets gathered pace, driving long-term borrowing costs in the US and Europe to the highest level in more than a decade, quashing appetite for riskier assets and dimming the outlook for growth.

Traders are bracing for an extended period of tight monetary policy, and demanding ever higher compensation to hold long-dated government debt. The repricing — which sent the yield on 30-year US Treasuries past 5% for the first time since 2007 — is spilling over into equity and corporate bond markets.

“US yields at highs for the year are starting to look disruptive for other regions and sectors,” Steven Major, global head of fixed-income research at HSBC Holdings Plc., wrote in a note to clients.

The jump in US yields, which now tower over peers, has powered a rally in the dollar over recent days, sending the euro to the weakest level in almost a year and driving the yen to 150 per dollar on Tuesday.

The volatility has also spilled over to stocks and corporate notes. The S&P 500 index dropped to a four-month low on Tuesday while a key gauge of credit risk for Europe’s sub-investment grade companies surged to the highest since May.

COMMENTS: This is weighing on all asset classes, and most definitely on emerging markets long duration debt. Could this cause a credit event??????

Russia Reiterates Plan to Curb Oil Exports Through December-BBG

Russia will maintain its 300,000 barrel-a-day cut in crude exports this month and reaffirmed plans to keep them curbed through the end of the year.

The “voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets,” Deputy Prime Minister Alexander Novak said in a statement on Wednesday.

Russia and Saudi Arabia have for several months been making additional voluntary supply cuts over and above those required by the OPEC+ deal. Riyadh has curbed its production by an extra 1 million barrels a day since July, helping to drive a 20% increase in crude prices to above $90 a barrel in London.

COMMENTS: JMMC meeting is also today for OPEC+, expectation is no change to policy

Japan Keeps Yen Traders Guessing Over Whether It Intervened-BBG

Japanese officials are sticking with their strategic silence on currency intervention as speculation swirls over whether the government acted to prop up the yen.

The finance minister, the top currency official and the government’s chief spokesman all said Wednesday they wouldn’t comment on whether Japan intervened.

Among other possible explanations for the sharp market moves on Tuesday: a combination of jittery markets and trading algorithms responding to the yen’s slide through the key 150 per dollar threshold. Either way, the seed of doubt serves Japanese interests by keeping traders on edge.

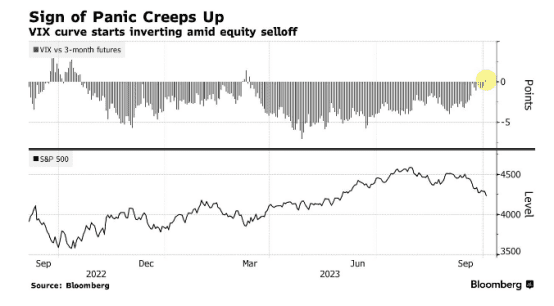

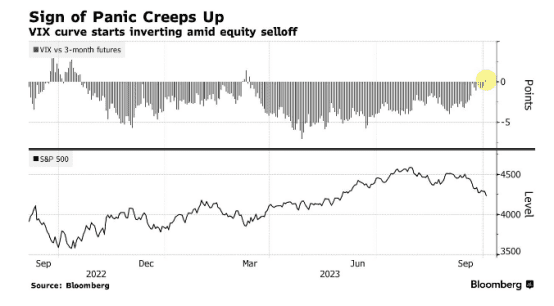

Panic Creeps Up as VIX Curves Invert for First Time Since March-BBG

The US stock selloff is spreading panic among volatility traders at a scale unseen since the regional bank crisis in March. In perverse Wall Street logic, that’s raising hopes that the equity rout is on its last legs.

As stock losses gathered pace Tuesday on still-surging Treasury yields, derivatives pros priced in more turbulence in the here and now than in the future.

The Cboe Volatility Index, a gauge of implied price swings in the S&P 500 known as the VIX, surged 2.2 points to 19.80, pushing the spot price above that its three-month futures for the first time since the turmoil in US lenders earlier this year.

The setup, known as inverted VIX curve, has occurred twice in the past year and both instances heralded market bottoms.

“The Treasury yield is really all that matters but a VIX term structure inverting is a sign the stress is being fully priced in,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group. “I would want to see a VIX term inversion before I am confident this bout of selling is over.”

“Downside momentum is escalating, and technical levels are being taken out. No one knows if the higher yields are going to break something,” said Michael Purves, the founder of Tallbacken Capital Advisors. “But it feels like the chances of something breaking are only going up with this rates move.”

COMMENTS: a case of what wins out it seems. The inverted VIX curve signaling a bottom or treasuries pulling the market down with it

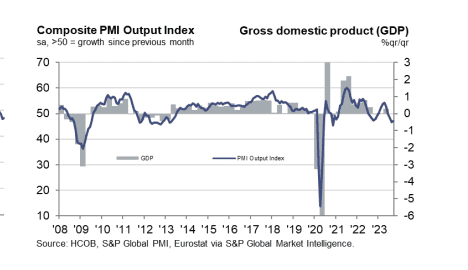

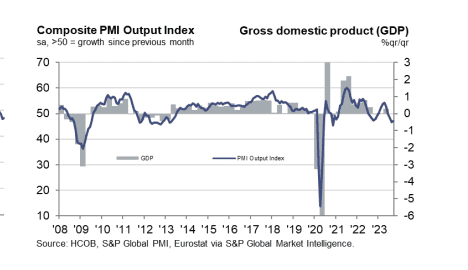

HCOB Eurozone Composite PMI

HCOB Eurozone Composite PMI Output Index at 47.2 (Aug: 46.7). 2-month high.

HCOB Eurozone Services PMI Business Activity Index at 48.7 (Aug: 47.9). 2-month high.

Demand for eurozone goods and services falls at strongest rate since November 2020

The HCOB Eurozone Services PMI Business Activity Index registered below the critical 50.0 level which separates growth from contraction for a second month in a row during September, signalling a sustained reduction in services output across the euro area.

At 48.7, this was up from 47.9 in August and signalled a mild, but slower rate of decline.

Weighing on activity was a further drop in demand for eurozone services. New business fell solidly and at the quickest pace since February 2021. Subdued sales performances were also seen with external clients, as new export business fell to the sharpest degree in over two-and-a-half years.

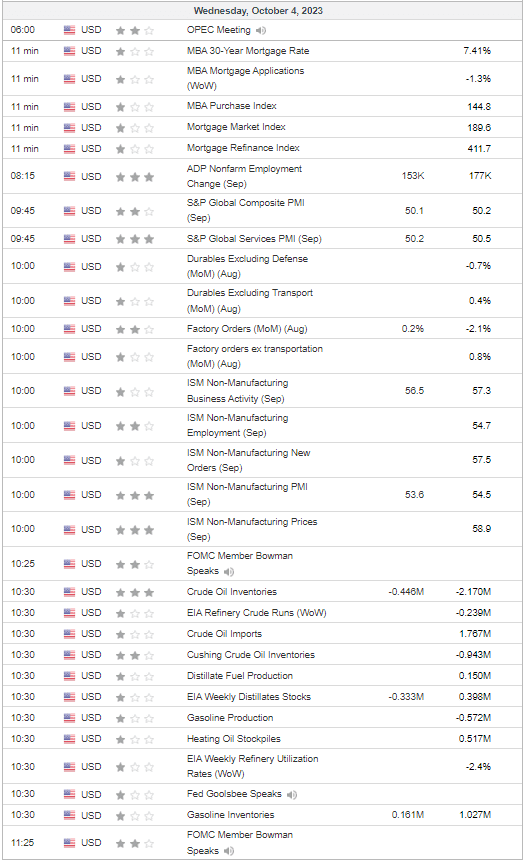

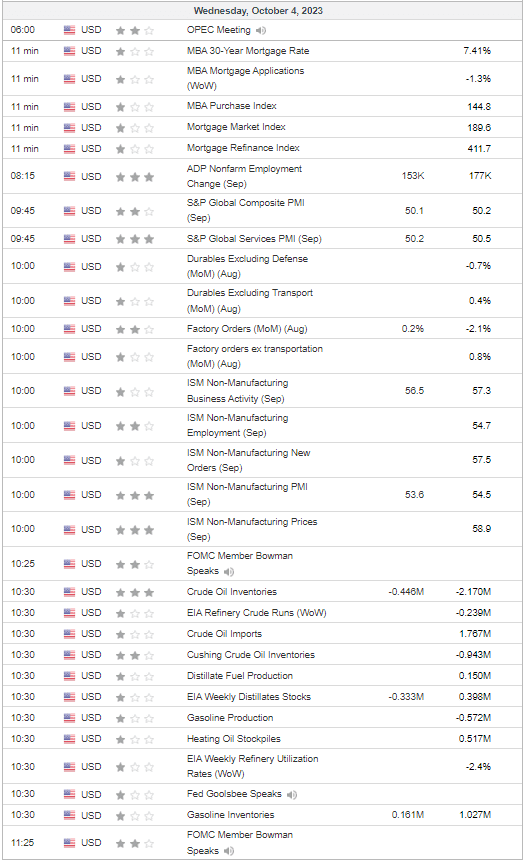

US DATA TODAY