Mixed Markets

- Hong Kong: Hang Seng closed UP +0.66%

- China CSI 300 -1.10%

- Taiwan KOSPI +1.78%

- India Nifty 50 -1.62%

- Australia ASX +0.87%

- Japan Nikkei +0.41%

- European bourses in MIXED territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

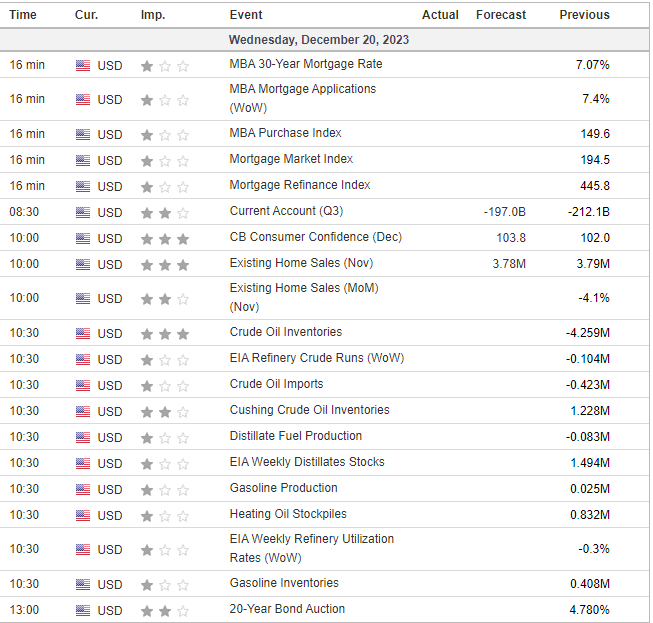

Red Sea Chaos Has Shippers Bracing for Weeks Without Key Trade Route-BBG

The global shipping industry is bracing for the prospect of living without its most important trade route for weeks.

Even as the US works to pull together a task force to stop Houthi militants in Yemen from attacking commercial vessels, shippers are still waiting for details, and worry about implementation. The Houthis are attacking ships to show support for Hamas in its war against Israel, and some in the region worry that too forceful a response will only escalate the violence.

So shippers are sending vessels the long way around Africa, adding $1 million in costs — and seven to 10 days — to each voyage. Oil prices are creeping higher.

“It could be anything between, hopefully, days or weeks but of course there are also scenarios to think about when it takes longer,” Rolf Habben Jansen, chief executive of German container carrier Hapag-Lloyd, which has stopped sailing the Red Sea, told Bloomberg TV.

COMMENTS: In the longer term, this is going to throw supplychains in havoc again and depending on how long this last, could spark inflation. In the short term, I still like container shipper and now tankers.

ProShares to launch S&P 500 ETF with zero-day call options-Reuters

ProShares expects to launch an exchange-traded fund (ETF) Wednesday that uses the short-dated options commonly referred to as “zero days to expiry” on the Standard & Poor’s 500 index.

The fund’s goal is to offer investors both the additional income that traditional options contracts may sacrifice, as well as upside potential should the stock market extend its rally.

The S&P 500 High Income ETF (ISPY.Z) will write daily call options against the underlying index, generating additional income while giving investors exposure to the index’s upside as well as any increase in the value of the options themselves.

The new ETF will trade on the CBOE BZW Exchange and have a fee of 0.55%.

“It’s offering what we believe is a better balance between the opportunities for income and appreciation” as well as the first ETF to employ such a covered call strategy using short-dated options, said Simeon Hyman, global investment strategist at ProShares.

COMMENTS: This sounds like a disaster waiting to happen. My advice…stay away! The derivative market grows. Get ready for even more options to hit the market.

US to hold Gulf of Mexico oil auction after string of delays-Reuters

The Biden administration on Wednesday will hold an auction of oil and gas leases in the Gulf of Mexico following several delays due to litigation over the drilling industry’s impact on an endangered species of whale.

The sale will likely be the last opportunity for oil and gas companies to bid on Gulf of Mexico acreage until 2025, according to the administration’s five year schedule, which includes a historically low number of planned lease auctions.

The U.S. Bureau of Ocean Energy Management (BOEM) will open and announce bids on an online broadcast beginning at 9:00 a.m. in New Orleans (1500 GMT).

COMMENTS: Traders will be watching carefully who wins these bids, likely giving their stock prices a boost.

Aurubis CEO says he expects strong copper market to continue in 2024-Reuters

A strong copper market with firm demand for copper products is expected to continue in 2024, the CEO of Aurubis AG (NAFG.DE), Europe’s biggest copper producer, said on Wednesday.

Demand was underpinned by the moves towards renewable energy and other trends, Roland Harings said during a press conference about the company’s full year results.

COMMENTS: This is inline with what other producers are saying, particularly with 600KT taken off the market between Panama and production cuts in South America.

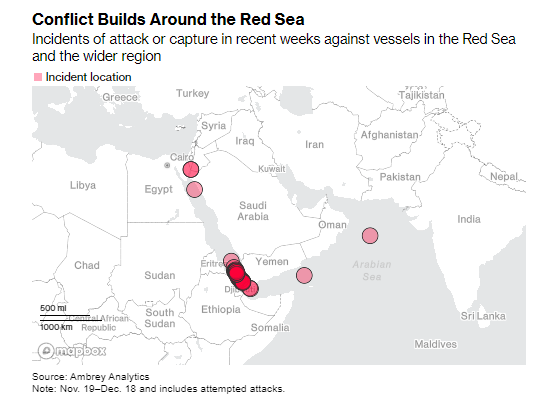

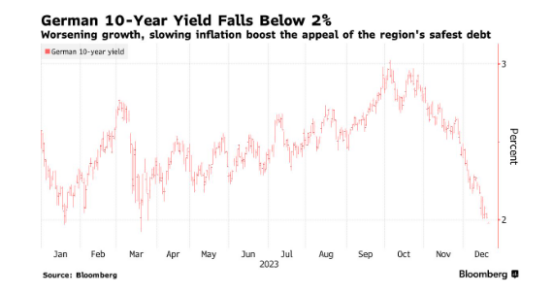

Global Bonds Rally as Softer UK Inflation Boosts Rate-Cut Bets-BBG

Global bonds rallied, sending benchmark yields to multi-month lows, as a softer-than-expected UK inflation figure encouraged traders to bet on more interest-rate cuts next year.

Germany’s 10-year yield fell below 2% for the first time since March, while the equivalent UK rate reached the lowest since April. In the US, the benchmark Treasury yield dipped to a five-month low.

Investors resumed bets on aggressive monetary easing by the world’s major central banks after data showed inflation in the UK eased more than expected in November. Traders now bet on at least five quarter-point rate cuts from the Bank of England next year and six from the Federal Reserve and the European Central Bank.

“UK inflation figures add to the bond market’s festive mood,” said Christoph Rieger, head of rates research at Commerzbank AG. “The data adds to the mounting evidence that global inflation has begun to crumble on a broader basis.”

COMMENTS: Merry Christmas to bond traders!

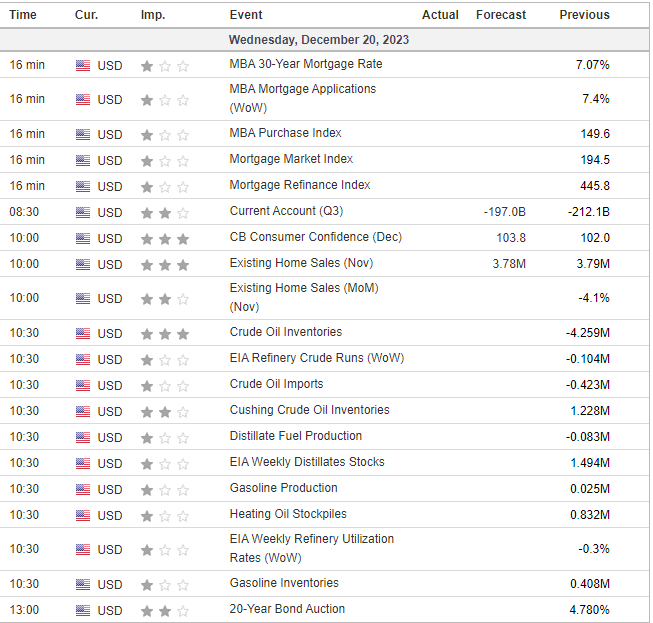

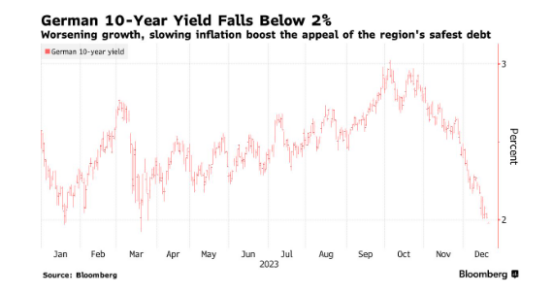

US DATA TODAY