Asia GREEN…Europe RED

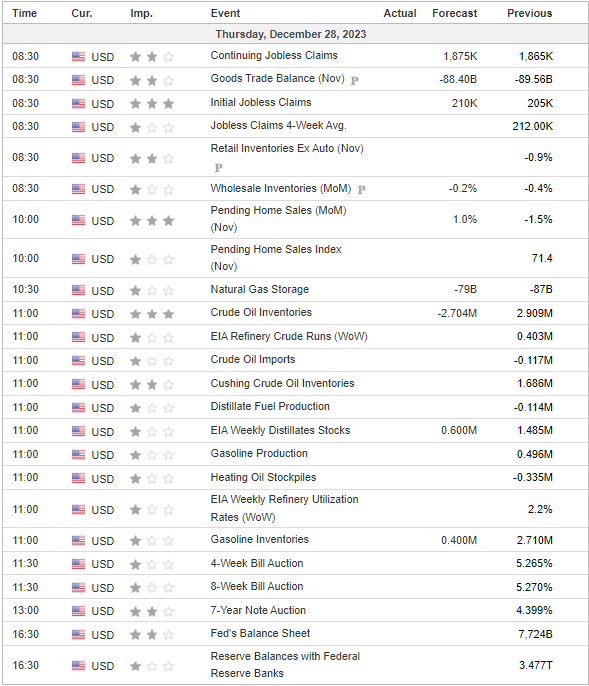

- Hong Kong: Hang Seng closed UP +2.52%

- China CSI 300 +2.24%

- Taiwan KOSPI +1.60%

- India Nifty 50 +0.59%

- Australia ASX +0.86%

- Japan Nikkei -0.39%

- European bourses in NEGATIVE territory so far this morning

- USD -0.22%

TOP STORIES OVERNIGHT

Year-End China Market Rally Takes Hold as Foreign Funds Pile In-BBG

Chinese stocks rallied heading into the year-end, boosted by a rotation into some of 2023’s worst-performing sectors and a supportive global backdrop.

The CSI 300 Index gained 2.3% to cap its best day in five months, as overseas investors bought onshore equities worth 13.6 billion yuan ($1.9 billion) on a net basis in Thursday’s session. A subgauge of industrial stocks — this year’s biggest loser on the CSI 300 — surged the most, climbing nearly 4%. The yuan strengthened in both onshore and offshore markets.

Investors largely attributed the jump to bottom fishing and year-end position adjustments, with some of the most battered renewables leading Thursday’s gain. Solar equipment maker Suzhou Maxwell Technologies Co. rose by the 20% limit while blue-chip Contemporary Amperex Technology Co. ended 5.6% higher.

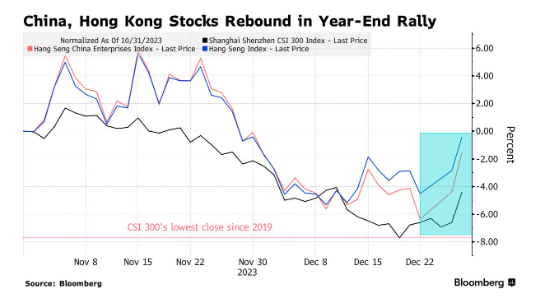

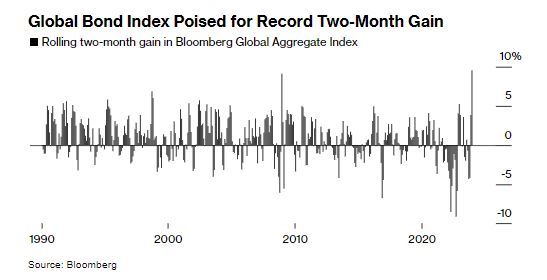

Global Bond ‘Carnival’ Sets Stage for Record Two Months-BBG

The world’s debt market is on track to post its biggest two-month gain on record as traders ramp up expectations that central banks everywhere will slash interest rates next year.

The Bloomberg Global Aggregate Total Return Index has risen nearly 10% over November and December, its best two-month run in data going back to 1990.

While bonds pared gains on Thursday, jitters around recession risks are still percolating across markets. That’s underscoring the case to own debt, with traders betting policymakers may have to aggressively cut interest rates next year to bolster growth.

“What we are seeing now is a bond carnival,” said Hideo Shimomura, a senior portfolio manager at Fivestar Asset Management Co. in Tokyo. “Bond investors have been hibernating and now I feel that their explosive desire is to come out of their lair.”

COMMENTS: This market was so short, I have been saying for sometime we could get an epic squeeze. I think this has more room to run as positioning shifts.

London gold price benchmark breaks all-time high, LBMA says-Reuters

London’s gold price benchmark hit an all-time high of $2,069.40 per troy ounce at an afternoon auction on Wednesday, surpassing the previous record of $2,067.15 set in August 2020, the London Bullion Market Association (LBMA) said.

“I can think of no clearer demonstration of gold’s role as a store of value than the enthusiasm with which investors across the world have turned to the metal during the recent economic and geopolitical turmoils,” said LMBA’s chief executive officer Ruth Crowell.

COMMENTS: Gold futures are literally at daily resistance, $2095, a solid close over would be very bullish. That said beware of profit taking into the last two days of trading for the year. Also, markets are super thin.

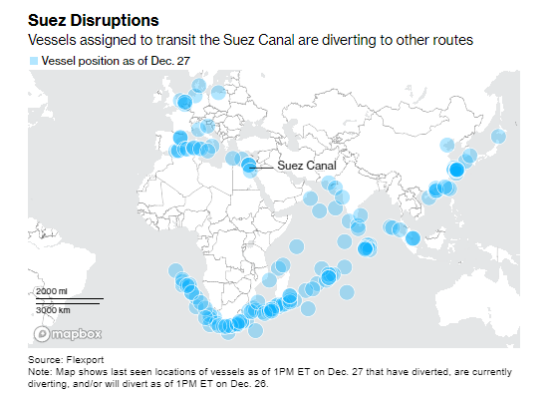

Half of Red Sea Container-Ship Fleet Avoids Route After Attacks-BBG

Half of the container-ship fleet that regularly transits the Red Sea and Suez Canal is avoiding the route now because of the threat of attacks, according to new industry data.

The tally compiled by Flexport Inc. shows 299 vessels with a combined capacity to carry 4.3 million containers have either changed course or plan to. That’s about double the number from a week ago and equates to about 18% of global capacity.

The diverted journeys around Africa can take as much as 25% longer than using the Suez Canal shortcut between Asia and Europe, according to Flexport. Those trips are more costly and may lead to higher prices for consumers on everything from sneakers to food to oil if the longer journeys persist.

COMMENTS: Extra fuel consumption will not show up in the data for another 3-4 weeks. In the meantime, oil remains weak on sentiment and lack of participation in the market. Inventories today, but I do not expect much from this market, over the next two days unless the Houthis start lobbing missiles at Aramco again. That said, Friday could see a rally as it is a big risk being short into a long weekend with the geopolitical issues.

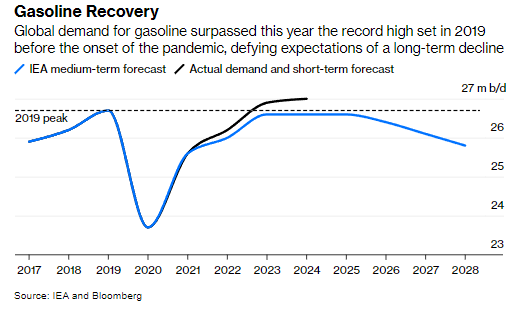

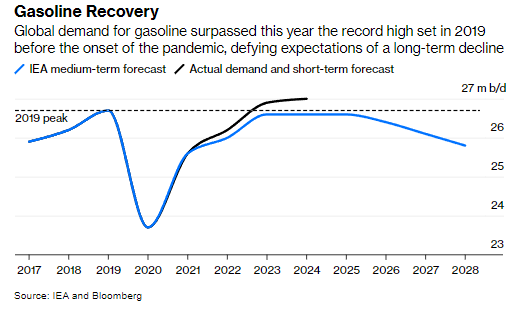

The Peak in Gasoline Demand Turns Out to Be a Mirage-BBG

As the climate crisis garners increased attention, the fuel is destined to play an outsized role in the energy transition — an early indicator of whether the shift away from fossil fuels is happening, and at what speed. The theory was that as EV cars became more popular, gasoline demand would be “disproportionally” impacted, the IEA predicted in its most recent five-year oil outlook, released in June. “This means that the fuel is likely to exhibit the earliest and most pronounced peak in demand” of all fractions of the oil barrel, it added.

While consumption would recover this year, it wouldn’t reach pre-pandemic levels; the outlook was for a gentle, but constant, downward trend. In the middle of the year, the IEA predicted that gasoline usage would “never return to 2019 levels,” when demand reached 26.7 million barrels a day. Instead, consumption rose to about 26.9 million barrels a day this year, according to the latest IEA figures.1 And 2024 is poised for another, even if small, increase, to just above 27 million barrels a day. As thing stand, the peak in gasoline demand has been delayed by five years, to 2024 from 2019. And I won’t be surprised if, once more data are available and forecasts are updated, the peak is pushed forward even further.

COMMENTS: This is just of interesting to note. That said, until sentiment shifts, it is not going to mean much for gasoline in the short term (this week) as far as trading.

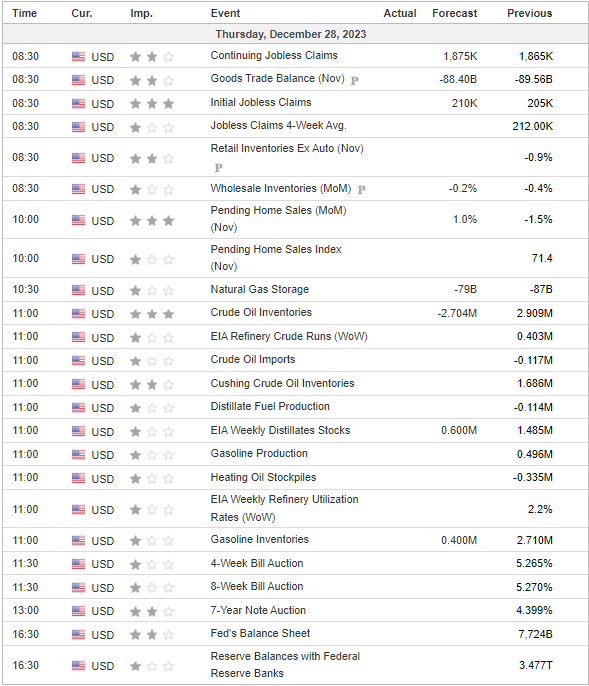

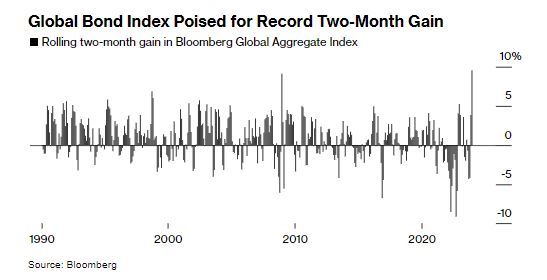

US DATA TODAY