Pretty GREEN out there

- Hong Kong: Hang Seng closed UP +1.74%

- China CSI 300 +0.35%

- Taiwan KOSPI +0.42%

- India Nifty 50 +0.97%

- Australia ASX +0.03%

- Japan Nikkei +0.80%

- European bourses in POSITIVE territory so far this morning

- USD -0.03%

TOP STORIES OVERNIGHT

Wall Street Quants Warm Up to Zero-Day Options Amid Trading Boom-BBG

Banks such as Citi, JPMorgan adding 0DTEs in systematic trades

At Citi, Cancelli and his colleague Guillaume Flamarion have led a charge into 0DTEs, bundling them up in a wide range of volatility-related products that hedge downside, harvest premium and juice up relative-value trades. In their view, there’s one big benefit from something with a shelf life shorter than 24 hours: minimal risk of being caught out by unfavorable overnight market moves.

At BNP Paribas SA, the QIS team has also added 0DTEs in their lineup of short-vol strategies. Thanks to a lack of exposure to after-market swings, the new trade has shown little lockstep moves with others focusing on long-dated contracts, and that makes it a favorable diversifying tool for clients, according to Xavier Folleas, head of QIS at the firm.

COMMENTS: Incredible! They are using these with a short vol strategy, what this means is that they are longing the market against short vol option, this is bullish, adding to this grind higher.

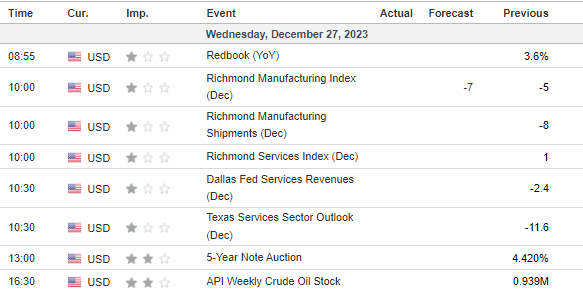

Shipper Hapag-Lloyd Says Red Sea Route Still Too Dangerous-BBG

Shipping giant Hapag-Lloyd AG said it will keep its vessels away from the Red Sea even after the launch of a US-led taskforce to protect the key route from militant attacks.

The container liner said it will continue to reroute its vessels via the Cape of Good Hope, a detour of several thousand miles. It follows a spate of attacks on merchant ships — by Yemeni rebels acting in support of the Palestinians — on a route that handles about 12% of global trade.

For some companies, the taskforce has provided reassurance. A.P. Moller-Maersk A/S, the world’s second-largest container line, said it was preparing to resume shipping through the Red Sea. Another liner, CMA CGM also said on Tuesday it was devising plans to gradually increase the number of ships it sends through the Suez Canal. Oil prices have risen since the attacks stepped up, but traders are still not pricing in major disruptions.

COMMENTS: Keep an eye on the Red Sea. This is actually starting to get bullish oil now, as added fuel costs to take the journey around to Cape could add up to 500K bpd extra consumption. Also watch news from Maersk, if they decide not resume routes through the Suez Canal, this would be very bullish oil.

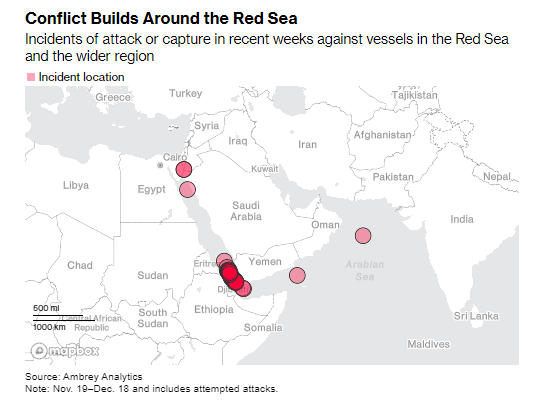

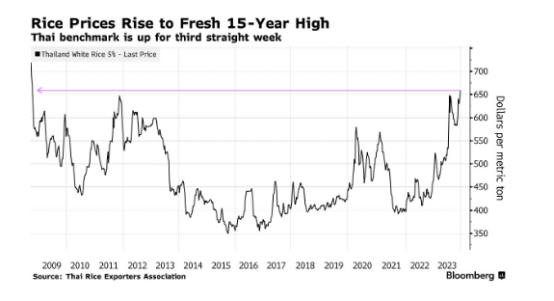

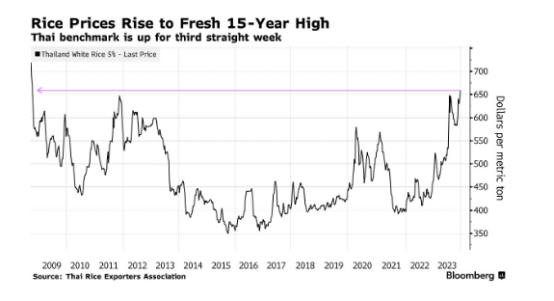

Prices of a Vital Food, Rice, Just Surged to a Fresh 15-Year High-BBG

Rice prices surged to a fresh 15-year high, fueled by strong demand and lingering supply concerns.

Thai white rice 5% broken — an Asian benchmark — climbed for a third straight week to reach $659 a ton on Wednesday, according to the Thai Rice Exporters Association. That’s the highest since October 2008 and brings the increase in prices to about 38% this year, after top shipper India restricted exports and dry weather threatened production.

COMMENTS: Bullish rough rice ZRF24, the US contract.

Global 2024 staple food supplies to be strained by dry weather, export curbs-BBG

High food prices in recent years have prompted farmers worldwide to plant more cereals and oilseeds, but consumers are set to face tighter supplies well into 2024, amid adverse El Nino weather, export restrictions and higher biofuel mandates.

Global wheat , corn and soybean prices – after several years of strong gains – are headed for losses in 2023 on easing Black Sea bottlenecks and fears of a global recession, although prices remain vulnerable to supply shocks and food inflation in the New Year, analysts and traders said.

“We have El Nino weather forecast until at least April-May, Brazil is almost certainly going to produce less corn, and China is surprising the market by buying larger volumes of wheat and corn form the international market.”

India’s next wheat crop is also being threatened by lack of moisture, which could force the world’s second-largest wheat consumer to seek imports for the first time in six years as domestic inventories at state warehouses have dropped to their lowest in seven years.

Come April, farmers in Australia, the world’s No. 2 wheat exporter, could be planting their crop in dry soils, after months of intense heat curbed yields for this year’s crop and ended a three-dream run of record harvests.

This is likely to prompt buyers, including China and Indonesia, to seek larger volumes of wheat from other exporters in North America, Europe and the Black Sea region.

COMMENTS: Bullish wheat, which looks like it could be breaking out on the daily chart. A close over the 200-day would confirm. $WEAT likely the best play for this.

Dollar touches five-month low on rate cut hopes in thin market-Reuters

The dollar slipped to a five-month low on Wednesday and the euro touched a four-month peak on expectations that the Federal Reserve could soon cut interest rates, but thin year-end trading flows limited moves.

With many traders out for holidays, volumes are likely to be muted until the New Year.

The dollar index , which measures the U.S. currency against six rivals, fell to 101.41, its lowest level since July 28. The index is on course for a 1.9% drop in 2023 after two straight years of strong gains, driven by the anticipation of Fed rate rises and then the Fed’s actual rate increases to battle inflation.

“Overall, from a global perspective, I expect markets to remain quiet,” said Jens Magnusson, chief economist at SEB.

“We still have strong equity markets and that is likely to hold through to New Year. If nothing happens geopolitically then currency markets will stay fairly calm over the next few days.”

The recent weakness in the dollar – the index is set to clock a second straight month of losses – has been spurred by the markets anticipating Fed rate cuts next year, denting the dollar’s appeal.

COMMENTS: As always keep an eye on USD, lower dollar supports commodity prices as well as equities

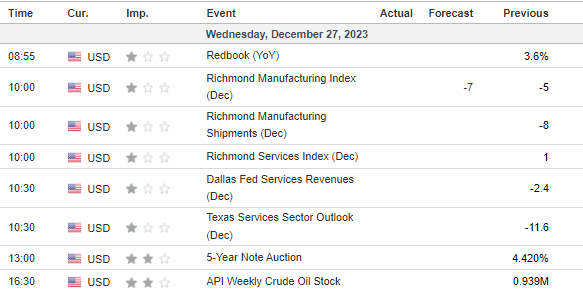

US DATA TODAY