October 9th 2023

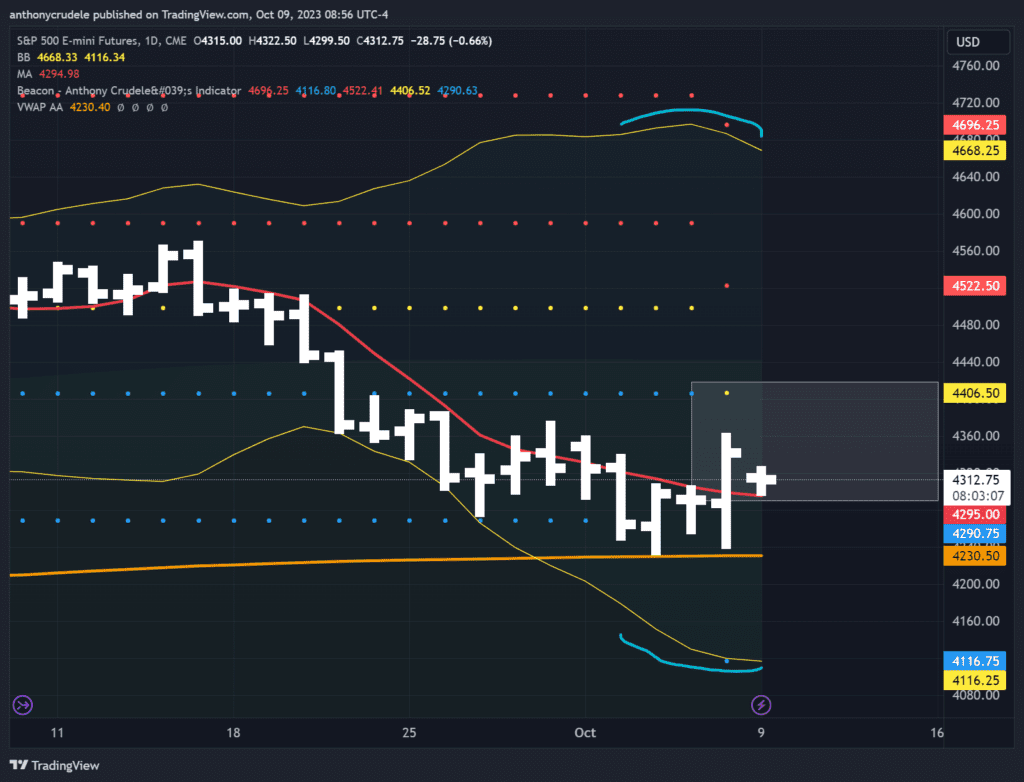

We’ve had some time now to let the market process the saddening news over the weekend. So far, the equity markets have been only somewhat affected. Stepping back and looking at the technicals, the market is showing several key indicators. Friday’s close was above the 5-day moving average, the overnight low remained above the 5-day ma (4294.75) and the daily Bollinger bands are now retracting. The contracting Bollinger bands signify range contraction which typically suggests mean reversion. According to my Beacon Indicator, a new range of 4290-4406.50 is likely to be agreed upon.

Here’s my strategy: I plan to buy futures and options if we touch around 4290. I’ve already started purchasing some ES 4400 call options due on October 20 at an initial price of 16.75.

The downside is at 4290 and if it doesn’t hold, we may need to tread cautiously as further downfall could follow. I’ll trim my positions during the day but will stay bullish for 4406.50 in the coming sessions if the close is above 4290.

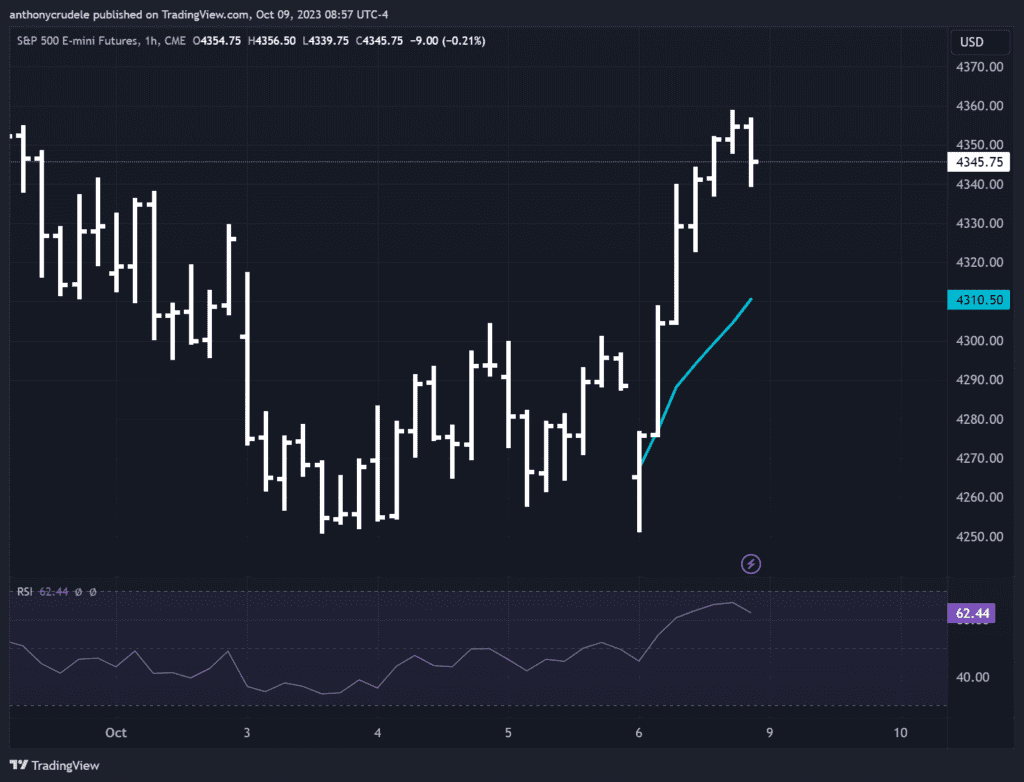

I’m also eyeing Friday’s VWAP which is at 4310. If it holds this morning, the overnight gap might get filled which can also be an area to lean on for long positions.

It’s crucial to stay tuned to rates. The Bond desks may be closed today, but the futures market is still running. Lower rates could be beneficial for the bullish push in equities, and higher ones may hinder it.