ISRAEL DELARES WAR

(Please note: I am keeping this post objective in analyzing markets only)

What does this mean for markets and commodities?

Here is a roundup of responses from investors, economists, traders and market strategists to the weekend’s news via Bloomberg:

Gonzalo Lardies, senior equities fund manager at Andbank

“This will add more uncertainty to markets, with inflation and growth taking a step back and geopolitical risk taking center stage. We could expect a spike in volatility, with short-term fixed income becoming again a safe haven, while in cyclical sectors will be in the spotlight.”

Guillermo Santos, head of strategy at Spanish private banking firm iCapital

“Leaving aside the human drama, the consequences of all this should not be especially negative for the financial markets as long as the stability of the region and Iran’s violent expansionism in the field of security do not further complicate the conflict and it is limited to Palestinians and Israelis.

“It is evident that any extension of this to oil-producing countries, Saudi Arabia in the lead, could make the price of crude oil more expensive with negative inflationary effects for the West and would mean higher rates for longer and falling stock markets if the above caused a recession.”

Alfonso Benito, chief investment officer at Dunas Capital:

“I don’t expect the situation to have a meaningful impact on markets. This is a long standing terrible situation but other than some short term volatility it shouldn’t have a big impact.”

Richard Flax, chief investment officer at Moneyfarm:

“The conflict has the potential to hurt broad market sentiment, but it’s not for certain. We think a lot will depend on whether the conflict is contained or widens in scope – for instance on Israel’s northern border – and that could prompt increased concerns about commodities – oil in particular. The oil price has been quite volatile in recent weeks, and another spike could feed into consumer prices in the coming months.”

Anthi Tsouvali, multi-asset strategist at State Street Global Markets:

“The timing of the conflict could not have been worse given the talks between Saudi Arabia and Israel. A conflict in the Middle East has obvious implication in oil prices. Markets will worry about higher energy prices and since we are already in a risk-off environment, that could push equity markets lower.”

“However, given where we are in the business cycle and already slowing global demand, the impact of the conflict would not be as severe as in the previous energy crisis in 1973 as we could potentially see more Saudi Arabian capacity coming into the market if needed to meet demand. Equity markets should see through this in terms of repricing risky assets but sentiment has the potential to stay subdued for longer as the market narrative shifts from soft landing to higher-for-longer and in the long run that would be bad for equity markets.”

George Lagarias, chief economist at Mazars:

“The number one risk for the global economy is the possibility of a third inflation wave, just as the current one is petering out. The flaring of tensions in the Middle East could drive energy prices higher, and undermine the efforts of central banks to bring inflation under control. The geopolitical status quo has become increasingly unbalanced in the past few years, so outcomes from this new crisis could be more open-ended than markets may wish to believe.”

Thomas Hayes, chairman of Great Hill Capital LLC:

“In the short term, we may see a bit of volatility, but when you step back and look company by company as to whether a regional conflict will effect their earnings power — in most cases the answer is no. It’s an unfortunate circumstance but will have little to no impact on aggregate earnings power.”

John Leiper, chief investment officer at Titan Asset Management:

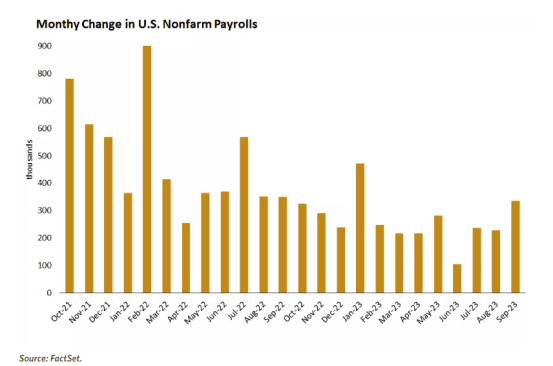

“While the geopolitical set-up is very different to the early ‘70s in the region, there is a real risk that we see a strong reaction from Israel that will upset the Saudi-led negotiations and could see the US bolstering sanctions against Iran, which would see the oil price rise from here. Recent supply restrictions, low US strategic reserves and stronger-than-expected non-farm payroll numbers Friday suggest oil prices could breach 100 dollars a barrel and the recent escalation in tensions add further impetus to that narrative, which may result in a further near-term spike beyond that level.”

Mansoor Mohi-uddin, chief economist at Bank of Singapore Ltd.:

“Financial markets will worry about the risk of higher oil prices pushing up global government bond yields. If the conflict widens across the region then oil supplies may be threatened. Any detente between Israel and Saudi Arabia and the potential for increased Saudi oil production will not be possible for either country to undertake if Israel and Palestinians are fighting. If Iran is perceived to be have spurred the hostilities in Gaza and southern Israel then the US is likely to tighten the enforcement of existing sanctions on Iran’s oil exports. All these factors would likely push oil prices up in the near term and therefore increase inflationary fears globally.”

Andrea Tueni, head of sales trading at Saxo banque France:

“I don’t expect a huge impact on European or US markets. The geopolitical risks are of course important depending on how the scale of the conflict evolves. Local stock markets are of course reacting to it but I don’t expect the same impact tomorrow. The only asset class one can look to for a possible reaction is oil but I don’t expect a big surge in prices given there is no impact on supply at the moment. One can’t compare the situation for oil with 1973. If the conflict was to take another dimension if for instance Israel were to directly hit Iranian infrastructure, it would be a whole different story but at the moment it is too early.”

COMMENTS: Some of these people seem like they they are too young to remember the Gulf War. That said, Middle East markets are taking a hit today (they are open on Sundays their market weekend is Friday and Saturday), and depending on how things escalate, I think this could be a bigger issue for at least commodities than most are thinking. I would pay particular attention to gold and oil (check the technicals section of this report for further details).

This situation is a powder keg, and Hezbollah just got involved. I expect other extremists groups such as the Taliban to join in which will only exacerbate the situation.

INFLATION

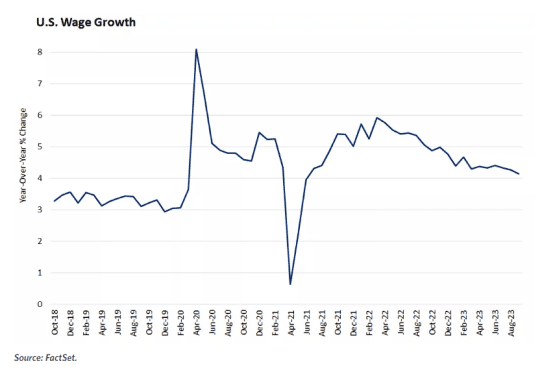

While many are busy talking disinflation, I continue to believe we see stagflation, particularly with events this weekend stoking the inflation fire.

INTEREST RATES

Interesting note from Edward Jones:

- rise in yields may actually prove to be a catalyst for lower rates, insofar that high rates exacerbate restrictive financial conditions and thus stunt economic activity, which would warrant lower rates. In other words, the cure for rising rates may be the rise in rates.

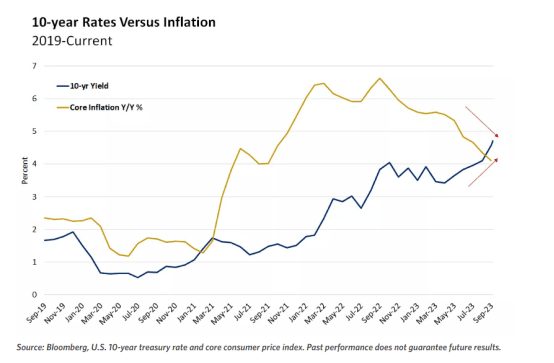

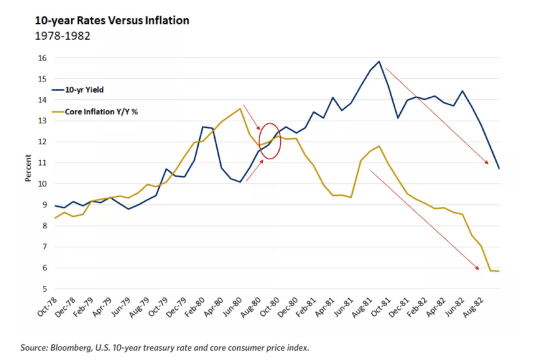

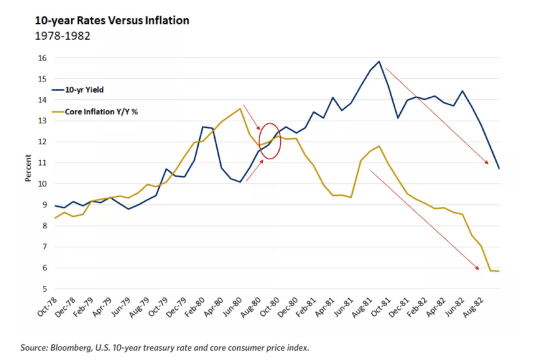

- While the path of least resistance may be higher bond yields for a while longer, we think falling inflation, slower economic growth, and the end of the Fed’s hiking campaign will ultimately prove to be a more powerful influence. Looking back over the last 50 years at instances when core inflation rose above 10-year rates (as was the case recently), core inflation peaked, on average, a bit more than a year before the peak in interest rates. Core inflation peaked in September of 2022, which suggests a peak in rates may not be far off. In those previous experiences, over the 12 months following the peak in rates, the 10-year yield declined by an average of 1.9% and the S&P 500 gained an average of 20.3%.

Inflation is falling, which we think will ultimately help arrest the rise in interest rates.

They seem to be using 1978-1982 a their model

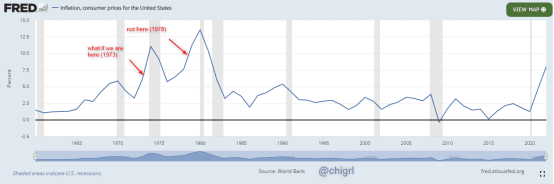

COMMENTS: What if we are just at 1973 and not 1978?

Ironically the same year of the Yom Kippur War and the ensuing oil embargo, featuring all the same players.

NATURAL GAS

Via S&P Global:

In Q4 2023, Europe anticipates the first significant year-on-year gains in gas and power demand since the crisis, but prices remain sensitive to supply disruptions despite gas storage levels already above 95%

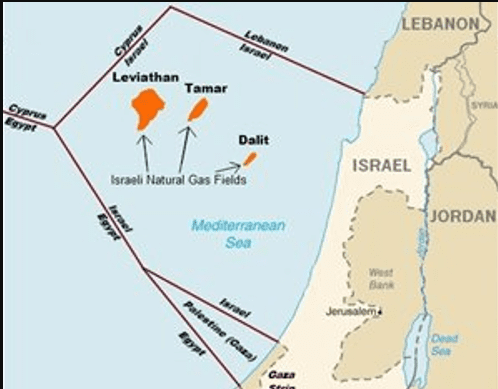

COMMENTS: This Israeli War could cause major disruptions in the gas market that some may not be prepared for. There are huge offshore gas field offshore Israel, and Egypt is also a major gas and oil supplier.

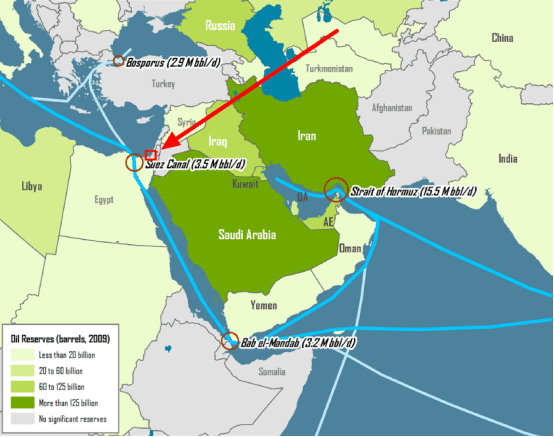

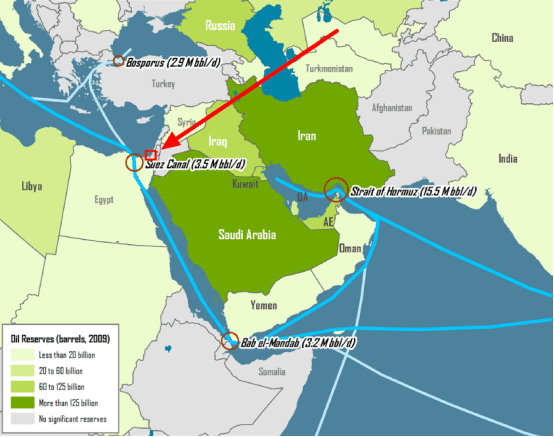

Lets not forget the Suez Canal as a major transit for not only oil and gas but tons of other goods and the Strait of Hormuz (the largest oil and gas transit). Should any of these get shut down, that would be a MAJOR problem for global trade, and extremely inflationary as global supply chains would be impacted.

Also watch shipping rates and shippers, I think these will jump on geopolitical risks in these areas.

Israeli offshore gas fields ($CVX operate Leviathon and Tamar)

Suez Canal and the Strait of Hormuz

NON-FARM PAYROLLS

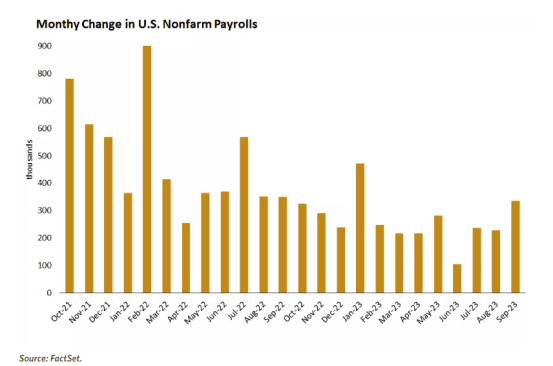

COMMENTS: Despite the strong headline number, the underlying was weak, hence the rally after the initial move on the number Friday.

Average weekly hours 34.6 v 34.4 (Aug)

Average weekly earnings $1,124.54 v $1,163.06 (Aug) hours up, earnings down

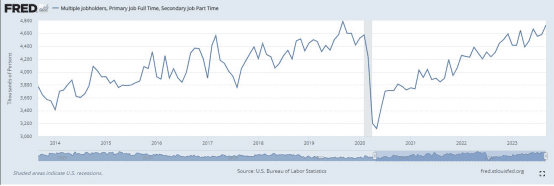

Full Time employment is actually down -692k over just the last 3 months

In this last report we had -22K full time workers and +151K part time workers

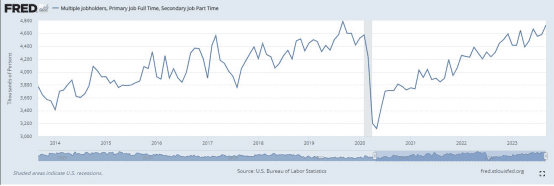

Multiple Jobholders, Primary Job Full Time, Secondary Job Part Time

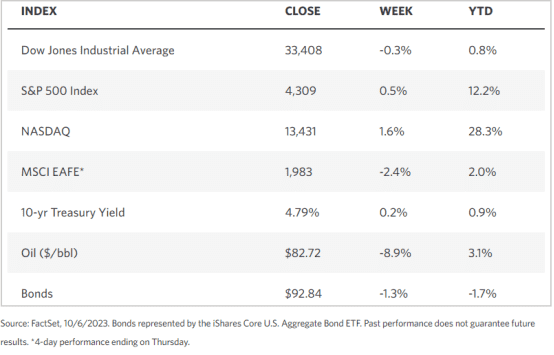

MARKET STATS

TECHNICALS

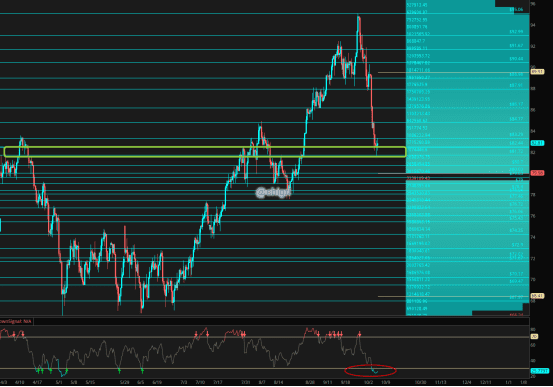

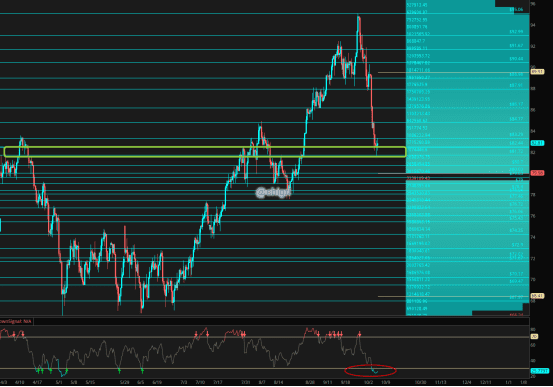

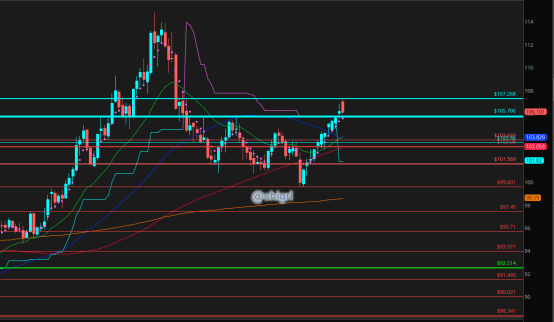

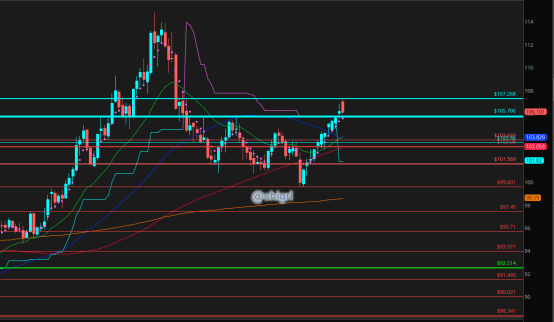

Crude Oil

Last week I noted: We keep working off over bought conditions nicely for the last two weeks ….this is good news for oil markets.

With this weekend’s event, likely we see a reactionary gap up in oil, and depending on how things unfold, this could create a strong move to the upside.

Technically we are oversold and in a nice supply zone

(note: my chart has not printed a long yet)

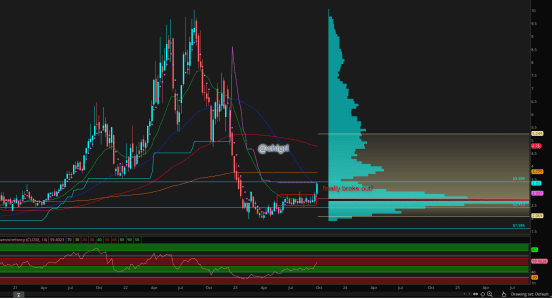

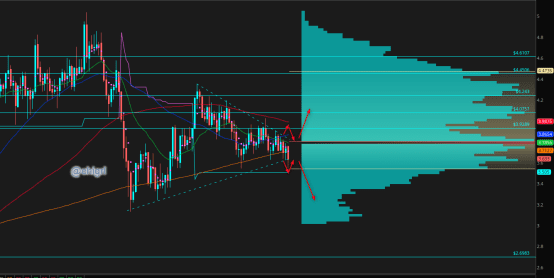

Nat gas

On August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (finally getting paid on this, though I did say not to expect much from September)

We saw a move up in prices last week due to the fact that Chevron strikes in Australia may be reignited.

Current events in Israel along with higher demand expected in Europe could create an explosive price environment with market participants being so short, months of consolidation, and volatility at all time lows

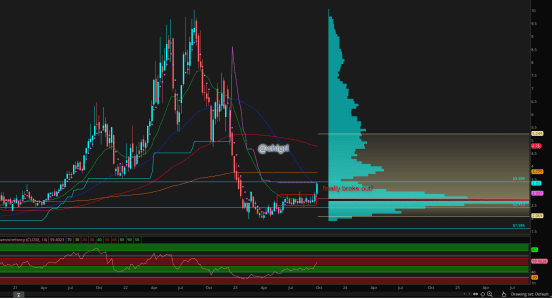

Copper

For the past few weeks, I have noted: Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market and the better than expected data out of China this last week.

If you are bearish inclines, we saw the break and retest last week

That said…

Goldman Sachs has reported that China’s demand for many major commodities has actually been growing at “robust rates,” thanks in large part to its booming clean energy sector.

According to GS, China’s demand for copper is up 8% Y/Y, while demand for iron ore and oil are up by 7% and 6%, respectively, exceeding the bank’s full-year expectations. China’s green copper demand rose 71% in July from a year ago “This strength in demand has largely been tied to a combination of strong growth from the green economy, grid and property completions.

The most significant strength has come on the renewables side where related copper demand is up 130% y/y year-to-date, led by surging solar related demand,” the Goldman report has observed

I still remain bullish

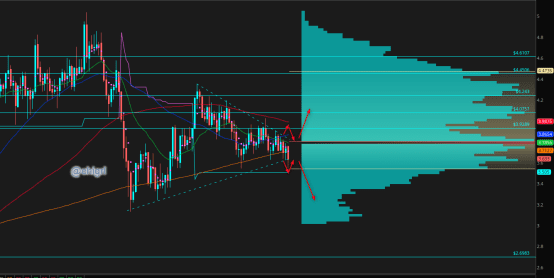

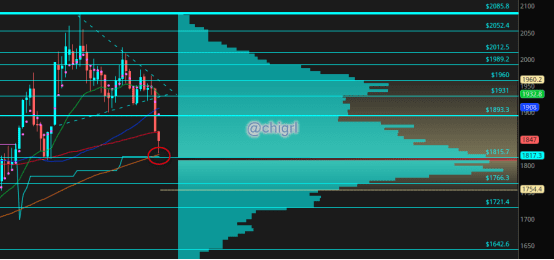

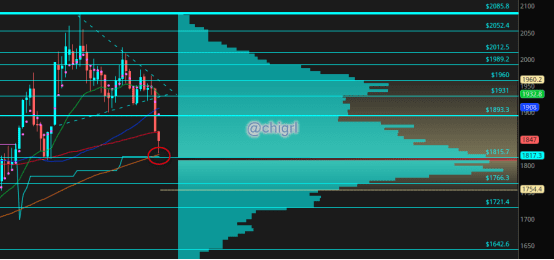

Gold

Last week I noted: Gold broke down from that triangle, interesting point we ended up last week, that said I think a more interesting level is that 1800-1817 level for a swing trade higher

We pretty much got there and with this current situation in Israel, we could see a significant bounce

Also a squeeze with short positioning being so high

USD $DXY

I was totally wrong last week, I thought we would have seen a pullback given the technicals, not a move higher, that said we ended the week flat from the prior week

This week could be really volatile

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.