NOVEMBER CLOSES WITH HUGE GAINS

So what is causing this?

Yes, the Fed is paused in November, but their narrative has not changed..Jerome Powell is still insistent on “higher for longer” and the Fed balance sheet is still rolling off…so where is all this exuberance coming from?

Short and maybe somewhat overlooked answer: Easing Financial Conditions

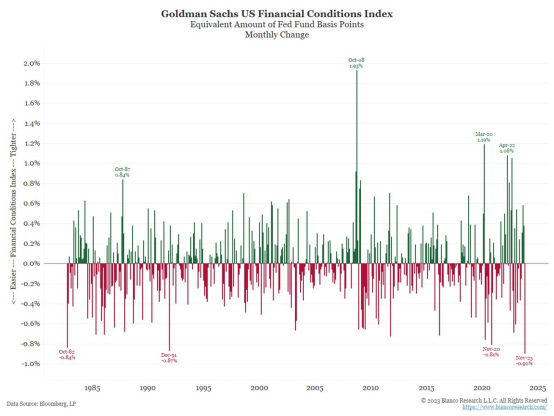

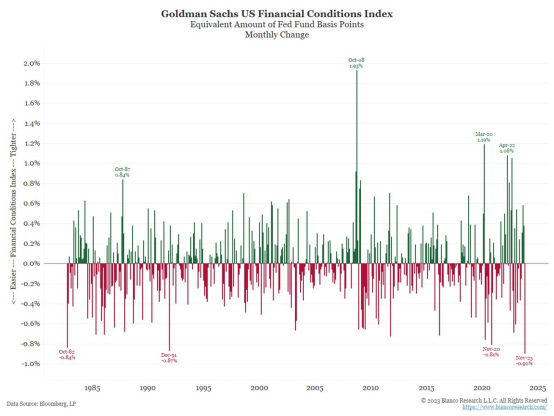

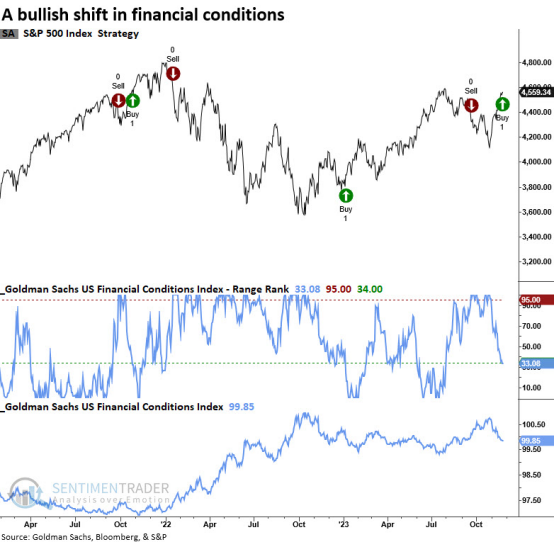

Let us take a peak at the Goldman Financial Conditions Index

Jim Bianco pointed out just yesterday that “I assumed the Goldman Financial Condition Index was merely an index level“

The index actually is:

“actually the equivalent of fed funds basis points (bps). So, November’s record easing of financial conditions was the equivalent of 90 bps of Fed cuts. Or rounding it works out to the financial market’s November rally doing “the work of the Fed” to the tune of four 25 bps cuts in the month of November.”

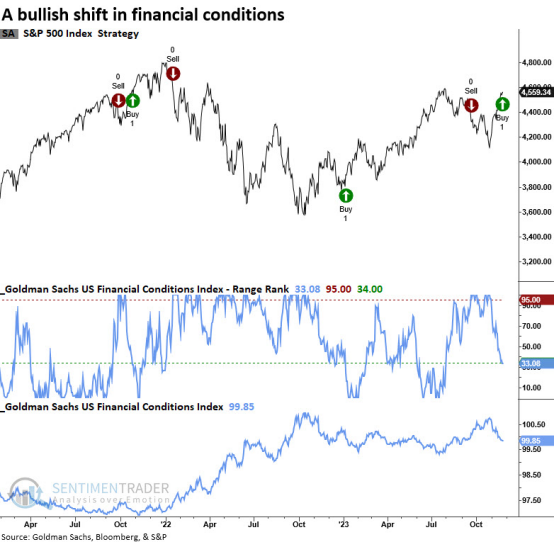

And on November 29th, Dean Christians noted that:

A trading system that uses the Goldman Sachs Financial Conditions Index to assess whether financial conditions are easing or tightening triggered a NEW buy signal for the S&P 500

So what does “Financial Easing or Tightening Conditions” even mean and why are people looking at this metric?

There are generally four components to financial conditions analysis:

- The US Dollar

- Corporate bond spreads

- Equity market levels

- The level of interest rates at different maturities

BUT if we look specifically at the Goldman index, referenced above, there are seven components:

- Federal funds rate

- 10-year Treasury yield

- 30-year fixed mortgage rate

- Triple-B corporate bond yield

- Dow Jones total stock market index

- Zillow house price index

- Nominal broad dollar index

For a better look under the hood when analyzing this index, JPM describes it best here:

Changes in each of these components in isolation influence the economy in different ways. In general, a stronger dollar acts to restrain growth via reduced demand for exports. Higher corporate bond spreads restrain lending growth and corporate investment. Lower equity prices suppress growth in consumer spending through the wealth effect, and finally, the overall level of interest rates is a key component of mortgage rates and corporate borrowing rates. It is through this lens of financial conditions, broadly defined, that we should view current Fed policy.

When the Fed raises the short rate, their goal is to suppress latent inflation pressure, and tighter financial conditions are the transmission mechanism through which this occurs. The short rate, by itself, does not influence the economy at large.In reality, Fed policy changes act to influence the factors discussed above, which in turn influence the broader economy. And to complicate matters, an incremental change in the short rate does not always have the same incremental effect on financial conditions, i.e., the transmission mechanism of monetary policy is not constant. For this reason, it’s critical to watch not only what the Fed says (and ultimately does), but how the markets react. A disproportionate reaction in the markets to a given action by the Fed is likely to be met with resistance in the opposite direction.

If we look at the sum of the seven components of financial, this month was a wopper for markets.

The Growing Importance of Measuring Financial Conditions

Economists look at financial conditions because the federal funds rate alone isn’t sufficient for assessing the outlook for the economy.

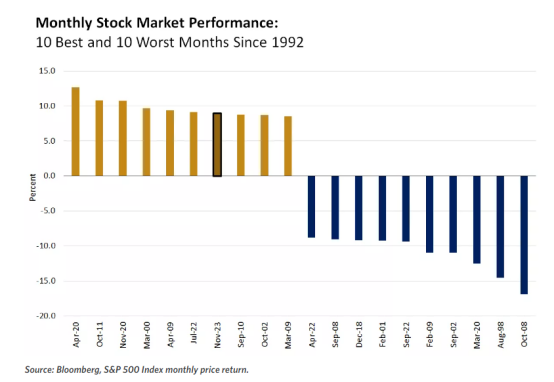

THE 60/40 DREAM RALLY

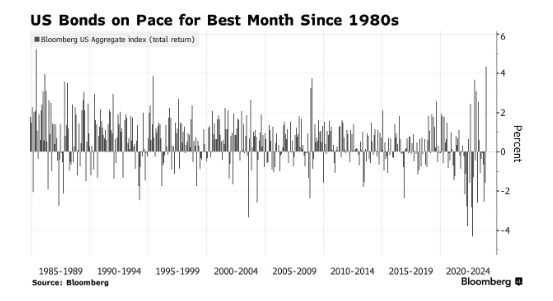

The Bloomberg 60/40 index has gained almost 7% this month and is set for one of the biggest monthly wins in recent year

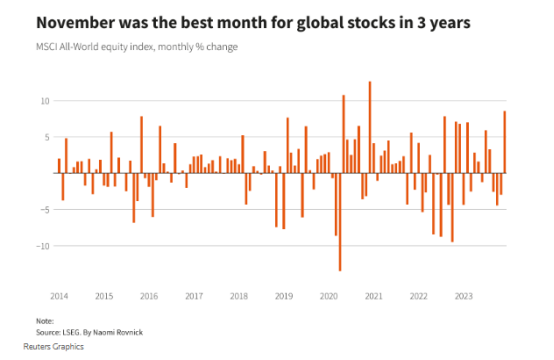

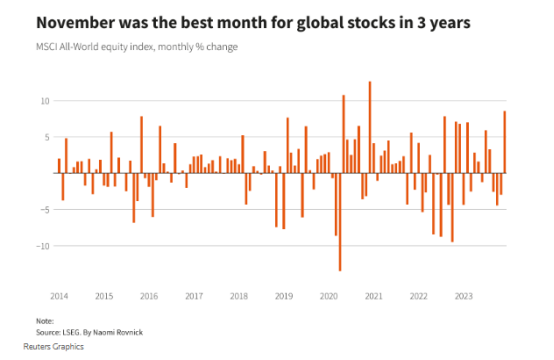

November was the best month for global stocks in 3 years

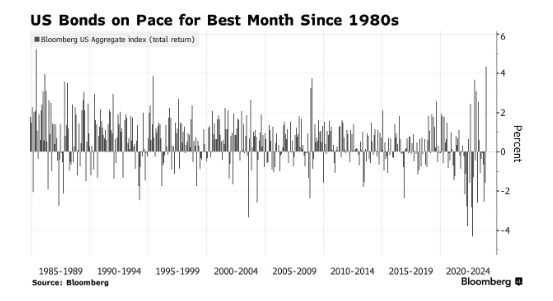

US Bonds on pace for the best month since the 1980’s

The question remains…how long can this last?

Keep your eye on financial conditions

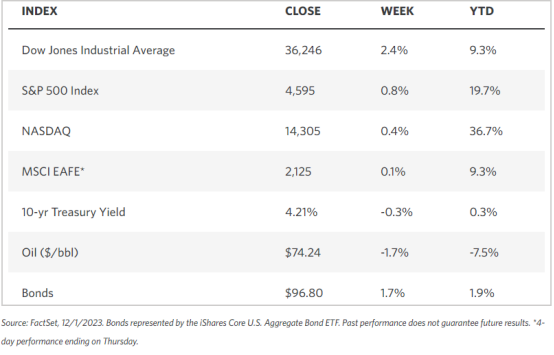

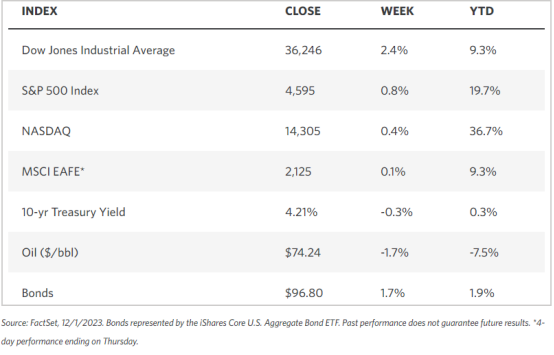

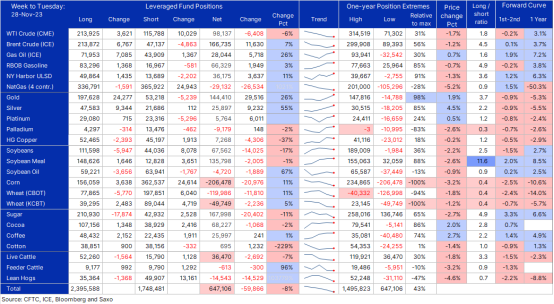

MARKET STATS THIS WEEK

TECHNICALS

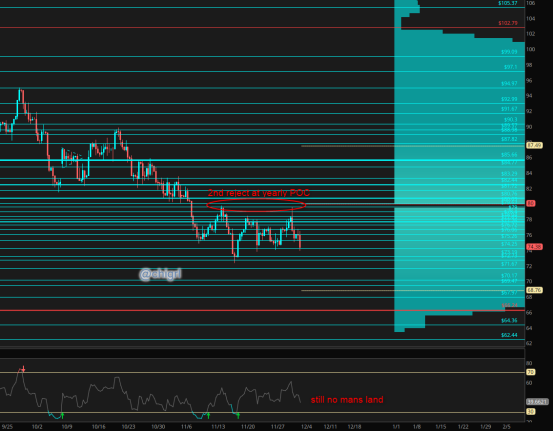

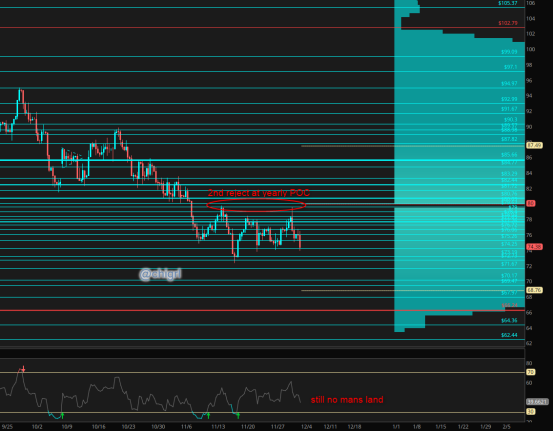

Crude Oil

Last weeks OPEC meeting was disappointing for the markets. The markets expected a cohesive stance on more cuts, but OPEC just ended up rolling over the cuts that were to end December 31, 2023 to the end of Q1 2024 and let individual countries state their voluntary cuts.

Here are the voluntary cuts

OPEC + Voluntary Cuts Q12024

Saudi Arabia 1M bpd (extension of current cuts)

Algeria 51K bpd additional

UAE 163K bpd additional

Oman 42K bpd additional

Kuwait 135K bpd additional

Kazakhstan 82K bpd additional

Iraq 211k bpd additional

Russia 500K bpd production (extension of current cuts) and 300K bpd in oil exports and 200K bpd in fuel exports

Total cuts: 2.184M bpd

NEW cuts (non-extension): 684K bpd

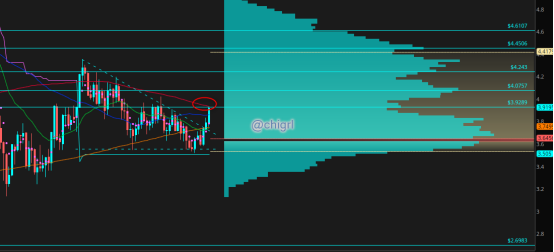

I would love to buy this market just a tad lower for a swing trade given seasonality, positioning and geopolitical risks

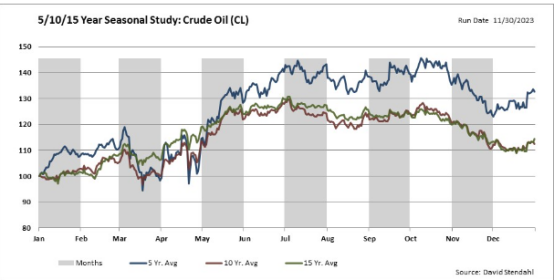

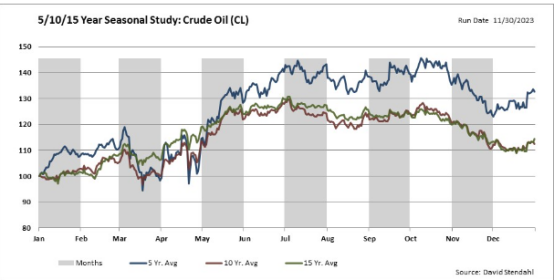

Seasonal

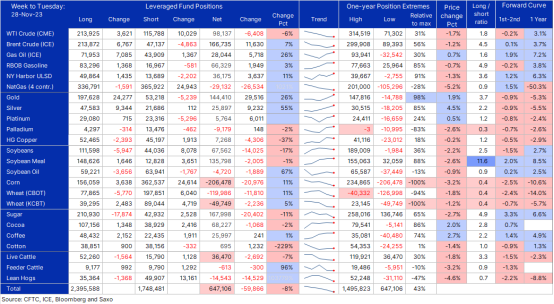

CFTC

Geopolitical Risk

Natural Gas

Needs to bounce here…that said in the short term…there still remains no bullish case for this market ..longer term…I remain bullish

This week I actually covered this market extensively with one of the most seasoned veteran traders I know. You can catch the replay HERE

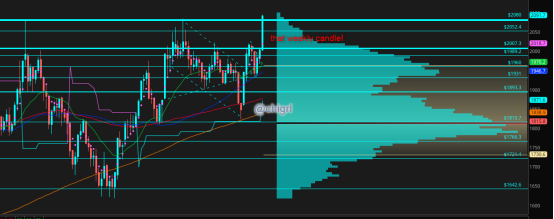

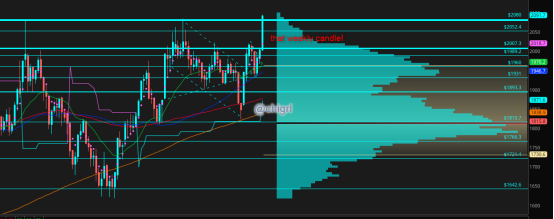

Gold

Last week I noted that: “Defying all odds, this chart is looking bullish as ever, we have a double bullish pattern”

That was at 2003…this week we closed at 2091…well done if you caught this move!!

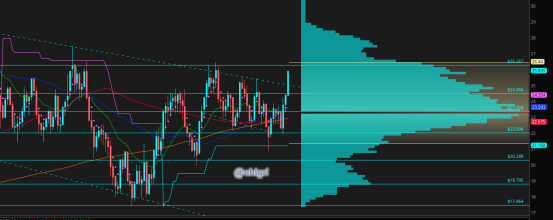

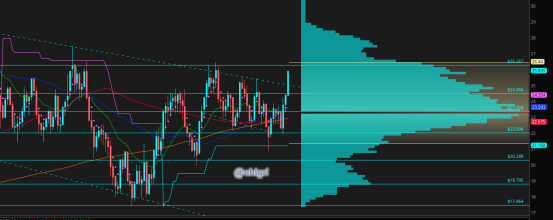

Silver

Last week I noted: Silver is the wild child but I remain bullish…this has not changed

That weekly candle is brilliant

If you missed my podcast on silver last week…you can access it HERE

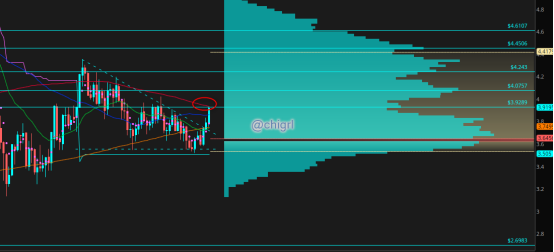

Copper

Overall, I am still bullish this market, great job if you played the breakout last week that I pointed out…that said, caution here for short term traders. For long term investors, I remain bullish

USD $DXY

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.