Very little data last week (that said check my post on USD at the end about the surprise Moody’s downgrade of the US after the bell on Friday)

Let us dive into the health of the US consumer, which I have been asking our Wednesday Spaces guests about all month

CONSUMER HEALTH

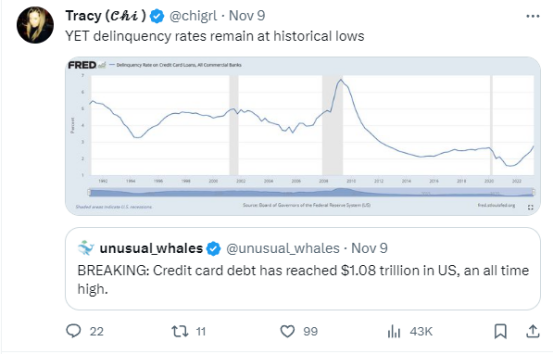

Last week @unusual_whales posted: BREAKING: Credit card debt has reached $1.08 trillion in US, an all time high.

To which I responded

Let us take a closer look at the popular narratives at see what is concerning and what maybe a bit of fear porn

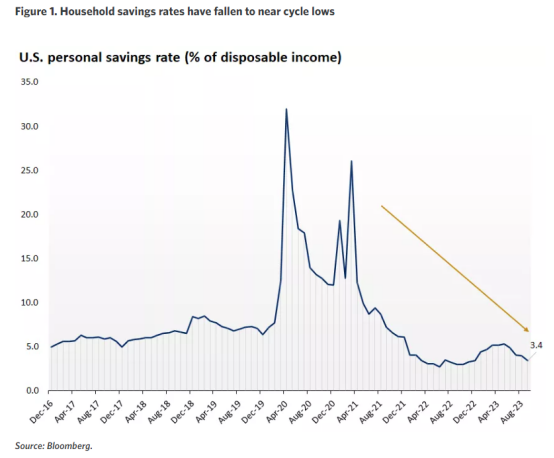

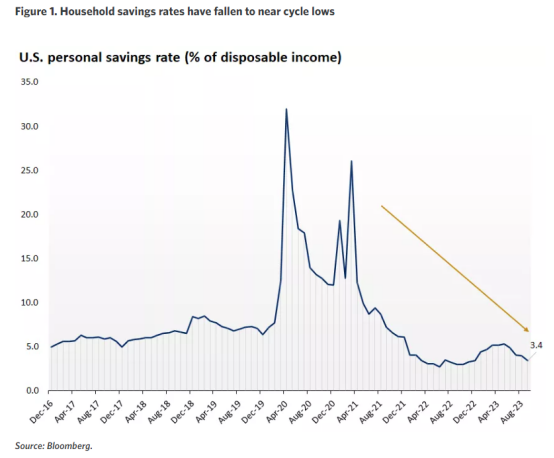

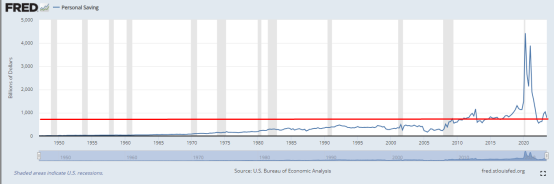

1. Savings rates have declined

Via Edward Jones:

Household saving rates have also declined to near post-pandemic lows, as the chart below highlights, indicating that many consumers are spending much more than usual instead of saving. This comes as costs have risen and stimulus-era savings have declined. Households in lower income brackets may especially be feeling the pinch of lower savings and the need to spend more on both goods and services, as inflation remains elevated.

COMMENTS: While this is true, let us back out a bit beyond 2016…say to 1947 when this data set began

We are still above historical norms. Covid was an anomaly in all respects.

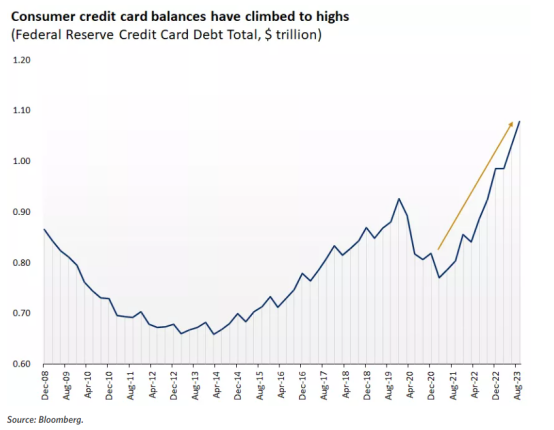

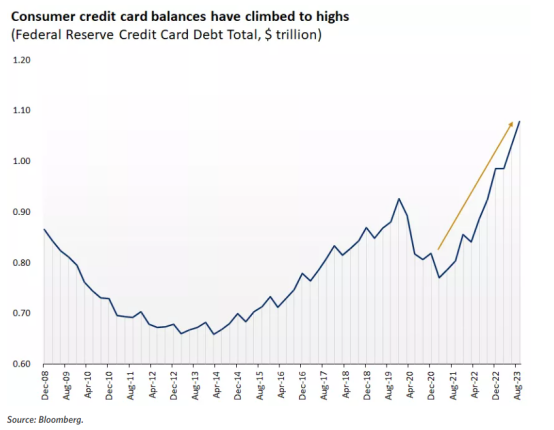

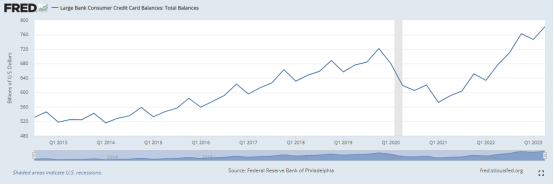

2. Credit card balances have increased

Via Edward Jones:

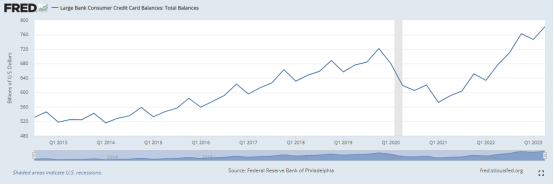

The total credit card debt in the U.S. has risen to over $1 trillion as of the third quarter of 2023, its highest on record.

COMMENTS: Agreed this is concerning …even if we look on a longer time horizon

Large banks consumer credit card balances

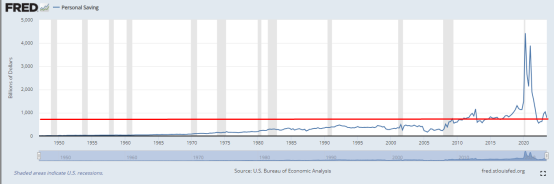

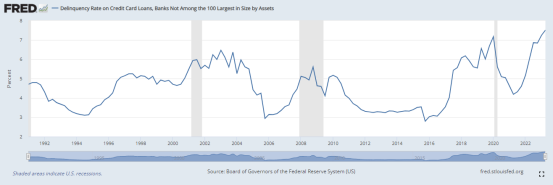

3. Delinquencies are ticking up

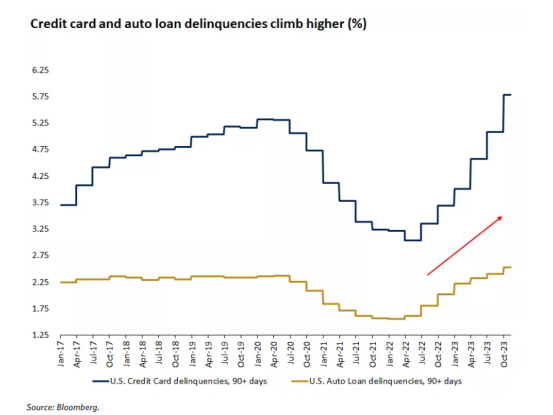

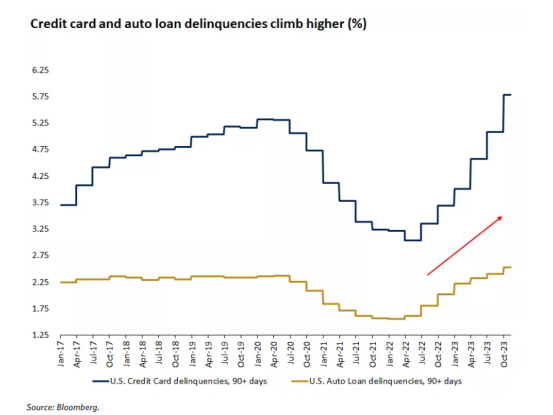

As household credit card balances have risen, delinquency rates on credit cards, and in areas like auto loans, have also ticked higher, as highlighted in the chart below. While these have not yet risen to be in line with prior recessionary periods, the trends are worth monitoring. Households may have to adjust spending plans in the months ahead to meet debt obligations, which could mean lower consumption overall.– Edward Jones

COMMENTS: While this is true, I believe we really need to break this down further. (I am using the max data for this)

Delinquency Rate on Credit Card Loans, Banks Ranked 1st to 100th Largest in Size by Assets

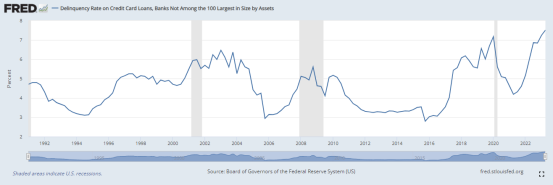

Delinquency Rate on Credit Card Loans, Banks Not Among the 100 Largest in Size by Assets

So what does this tell us?

It tells us that this economy is biting lower income, higher risk consumers.

Unfortunately the Fed discontinued auto loan delinquencies n 1966…so I do not have access to that date.

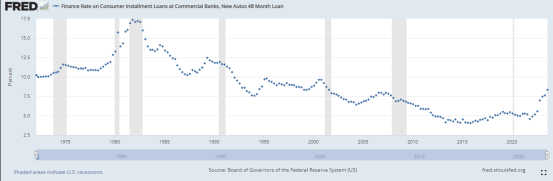

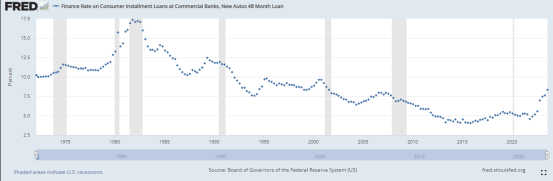

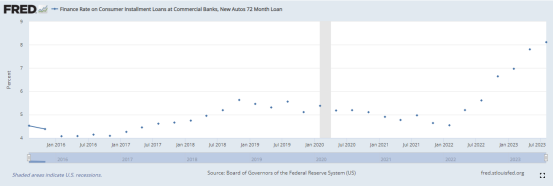

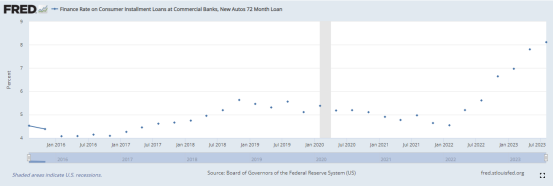

But what I can tell you is that consumer installments loans at consumer banks on auto loans is increasing quickly and at higher loan months

Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 48 Month Loan

Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 72 Month Loan

This is ungood as consumers are pushing out loan obligations at increasingly higher rates.

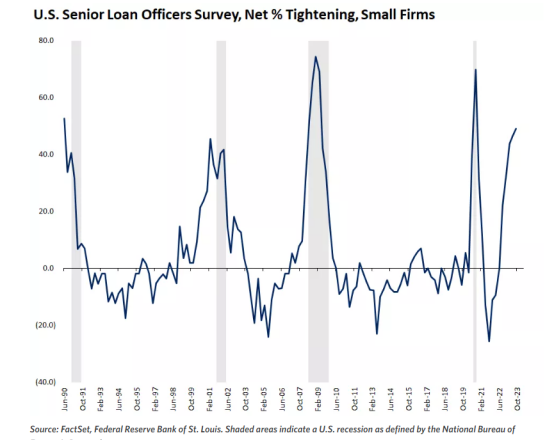

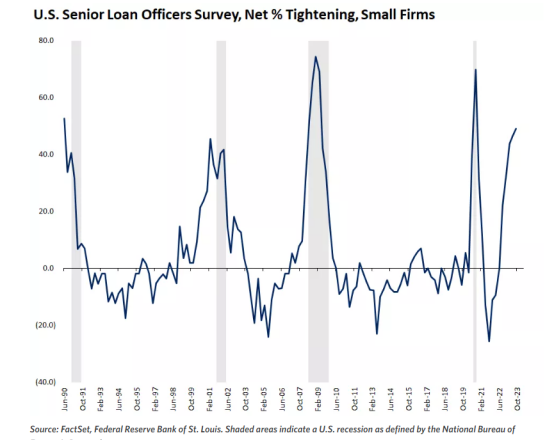

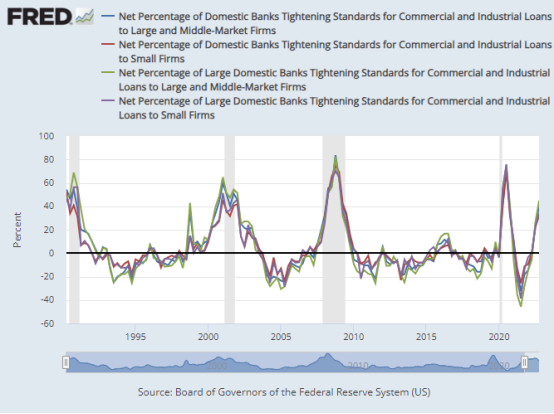

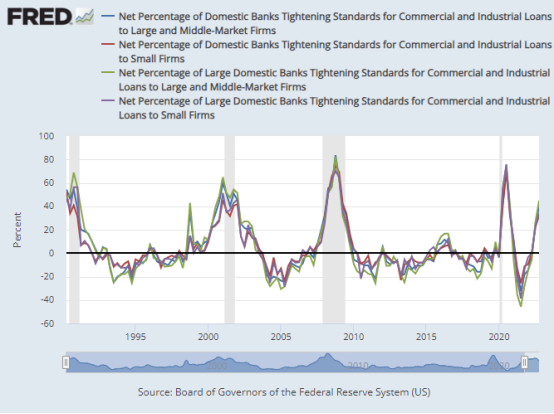

4. Bank lending standards remain tight

Bank tightening remains elevated, making it harder for consumers and businesses to secure loans

COMMENTS: This is true …how worrisome is it remains to be seen with the federal government handing out money like chicklets per the IRA act.

IN SUM: So at the end of the day what does this all mean?

The younger generations and lower income are beginning to feel real pain, but does this bring down the US economy?

With fiscal spending on steroids (and I see no end to this anytime soon), corporations will continue to benefit as will the upper echelon consumers, so I am not sure we are in for a real crash anytime soon.

STOCK MARKET HEALTH

Lyn Alden made a comment this week, that I feel needs to be shared

SIDE NOTE: TREASURY AUCTIONS

I came a cross a thread posted in 2022 by James Lavish that I think explains a lot for those not familiar with treasury auctions and though helpful to share…I rarely see posts that are easily digestible for the novice, yet hearty enough for the experts

Treasury auctions can give us clues to the health or problems of the entire US financial system. But what are those clues and how can you tell?

It is a long thread, but it is really informative and easy to understand for those not familiar with the bond market, he does a great job of explaining everything…here is a link

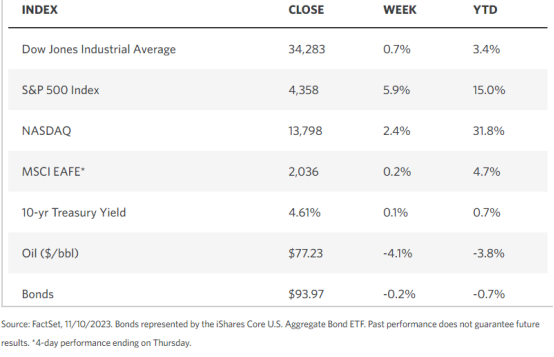

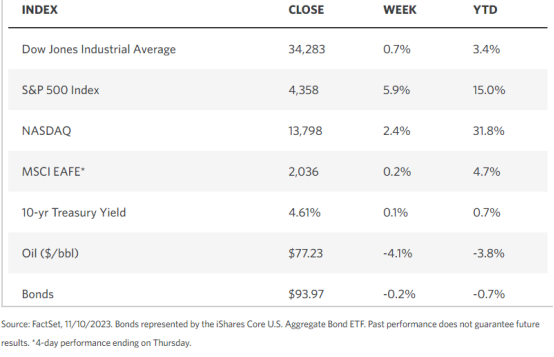

WEEKLY MARKET STATS

TECHNICALS

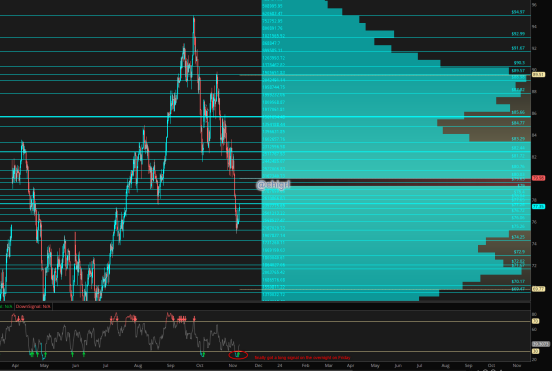

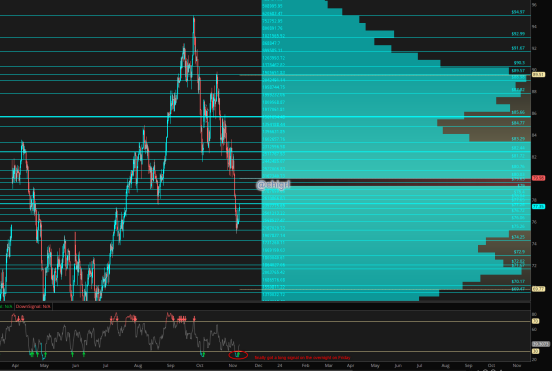

Crude oil

The most interesting aspect of this market is that via COT: Oil bullish bests have fallen the most since 2008

I finally got a buy signal on my swing chart…and at a notably interesting point.

That said, it does not mean it can not go lower, but this was enough to prompt me to buy calls in MCL and USO on Friday for Jan 24 expiry

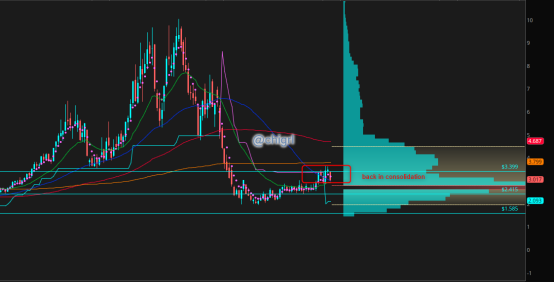

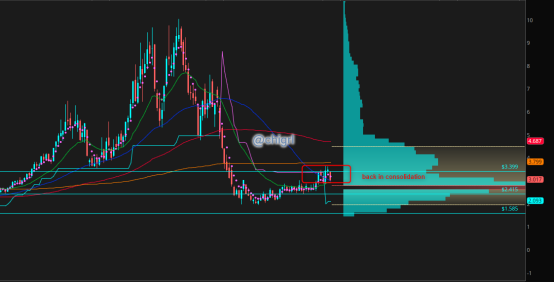

Nat Gas

This market is back in consolidation. BUT above the stagnate market for most of this year.

Again, I think this best play for this market are equities rather than futures or ETF’s.

I remain long two companies that have solid production and distribution capabilities in the US

Gold

Silver

Still waffling, but the bigger picture keeps getting more bullish

Copper

Copper is still stuck

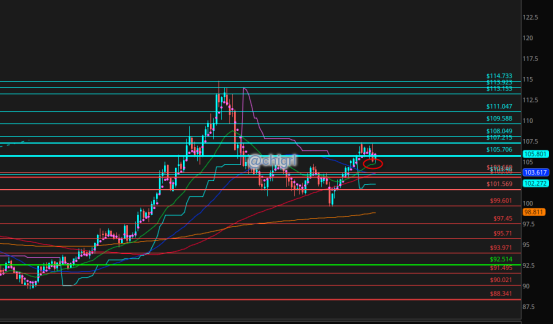

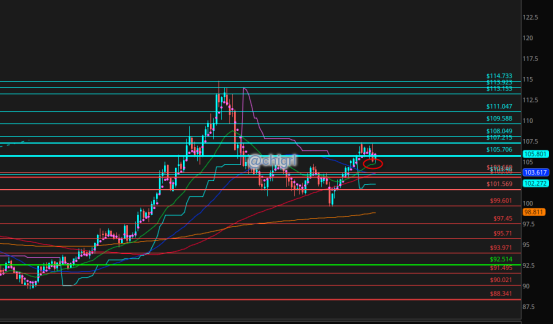

USD $DXY

Bounce off the 21 day …we could see a leg higher, that said the Moody’s down grade on US debt after the close on Friday, may cause a pullback in USD when banks open today/tonight…KEEP AN EYE ON USD OVERNIGHT

Moody’s was the last of the three ratings agencies to downgrade US. S&P Global Ratings stripped the US of its top score in 2011 and Fitch Ratings downgraded the US government in August of this year. TBH not sure how the market will digest this. My gut says they will look past it after an initial reaction. Credit rating was changed from stable to negative

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.