Last week was all about FOMC

Although rates were unchanged as the market expected, it was Powell’s dovish tone that sparked a market rally and the bond market to price in 6 (!) rate cuts with the Fed dot plot pricing in three.

The “dot plot” pointed to three rate cuts in 2024: While there was uncertainty ahead of the meeting around what the Fed’s new set of economic projections would reveal, particularly around the path of interest rates, the Fed did not disappoint the markets. Not only did the new “dot plot” indicate that the Fed would likely not raise rates again, but it also pointed to three potential rate cuts next year, more than the two cuts that the September estimates had indicated. The estimates also indicate seven cuts over the next two years, bringing the fed funds rate to 2.9% by 2026, well below the current 5.25% – 5.5%.-Edward Jones

What does all this mean for traders?

In simple terms, do not fight the trend in the short term.

That said protection is REALLY cheap right now and there are warning signs everywhere.

LONGER TERM SIGNPOSTS

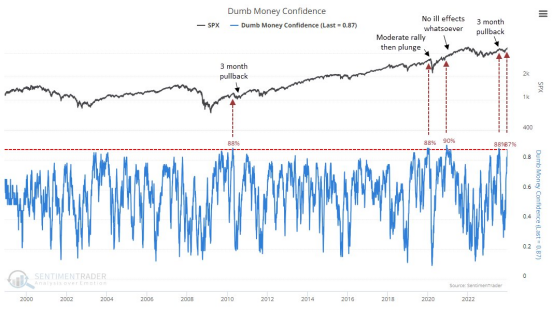

Retail traders are all-in again. Confidence just jumped to the 3rd-highest reading in 25 years. It was no problem at all in 2021. Other than that, very high Confidence typically precedes modest gains at best until sentiment resets.-Jason Goepfert

A $6 trillion cash hoard could fuel more U.S. stock gains as Fed pivots-Reuters

Investors wondering whether markets can continue their torrid rally are eyeing one important factor that could boost assets: a nearly $6 trillion pile of cash on the sidelines.

Soaring yields have pulled cash into money markets and other short-term instruments, as many investors chose to collect income in the ultra-safe vehicles while they awaited the outcome of the Federal Reserve’s battle against surging inflation. Total money market fund assets hit a record $5.9 trillion on Dec. 6, according to data from the Investment Company Institute.

The Fed’s unexpected dovish pivot on Wednesday may have upended that calculus: If borrowing costs fall in 2024, yields will likely drop alongside them. That could push some investors to deploy cash into stocks and other risky investments, while others rush to lock in yields in longer-term bonds.

Cash has returned an average of 4.5% in the year following the last rate hike of a cycle by the Fed, while U.S. equities have jumped 24.3% and investment grade debt by 13.6%, according to BlackRock data going back to 1995.

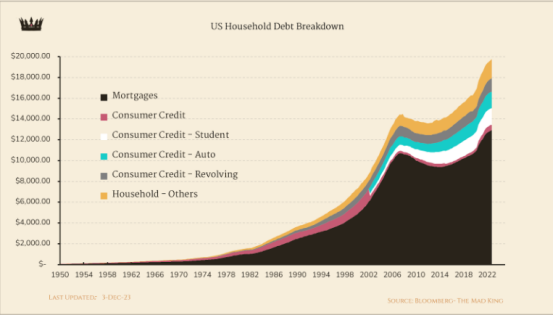

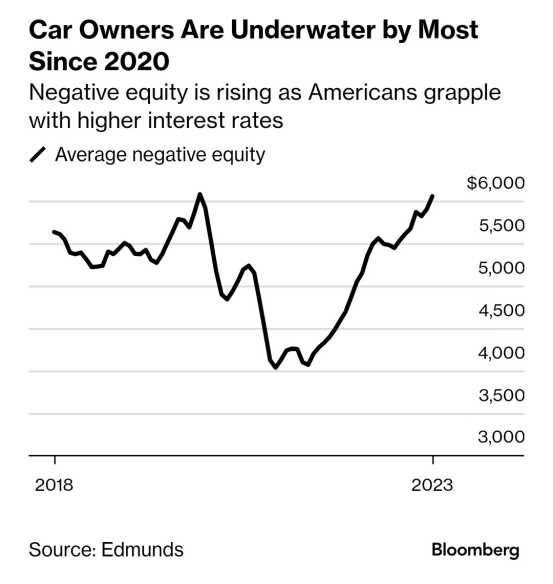

US Household Debt

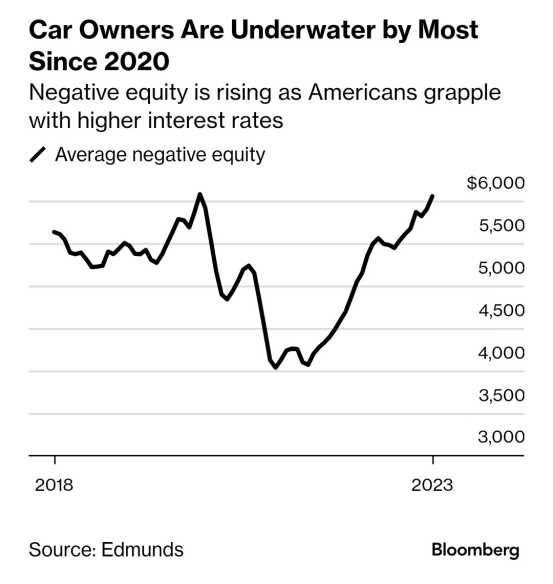

‘Underwater’ Car Loans Signal US Consumers Slammed by High Rates In November, people with negative equity were underwater by an average of $6,054, the most since April 2020 and well above pre-pandemic averages, according to automotive information firm http://Edmunds.com Inc. It’s a precarious spot for many Americans, coming after a twin surge in car buying and interest rates has strained finances and fueled an uptick in automobile repossessions.

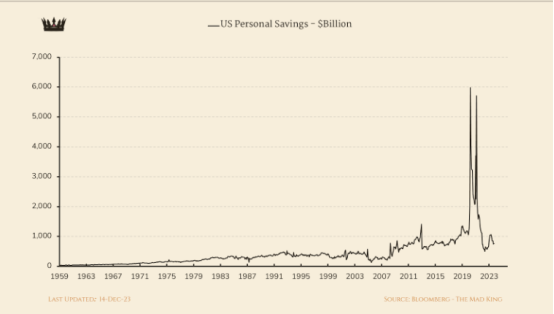

Personal Savings

That fact that the narrative is that people are waiting to buy at the TOP..this is insane! (see point #2)

COMMENTS: VIX call spreads are literally insanely cheap right now.

For example: When I say cheap H24 15/18 is 0.81

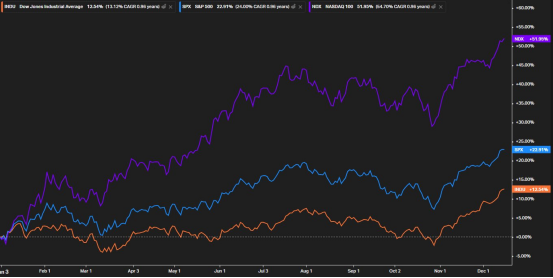

Given that literally EVERYONE and their grandmother is long MAG 7 …if there is a retrace in markets, Nasdaq will fair the worst as people head for the exit doors.

/NQ put spreads are also really inexpensive right now

This is not investment advice, but to state the obvious, you want to cover you’re a** when its cheap, not when you have to.

Side note: This Wednesday spaces will be very informative for all levels of traders…I hope you can join us! I do not want to give away too much that we will be discussing!

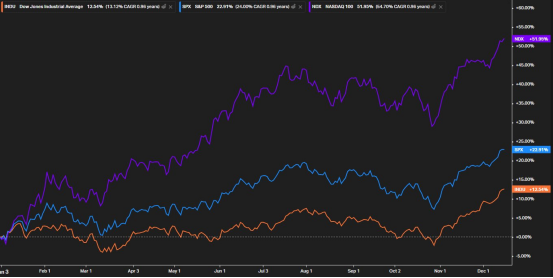

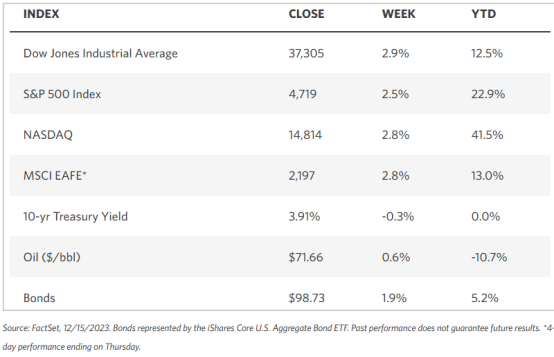

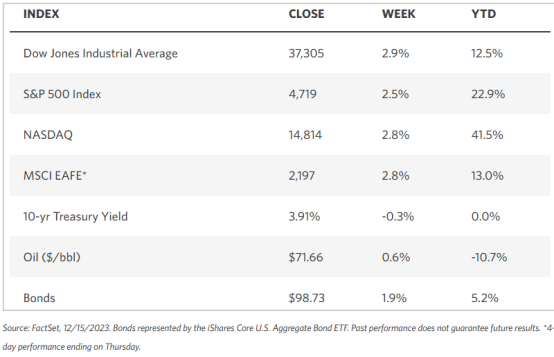

RECAP OF MARKETS THIS WEEK

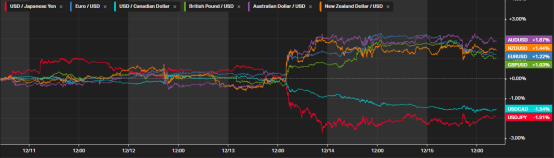

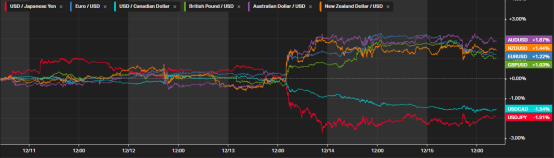

FX last week

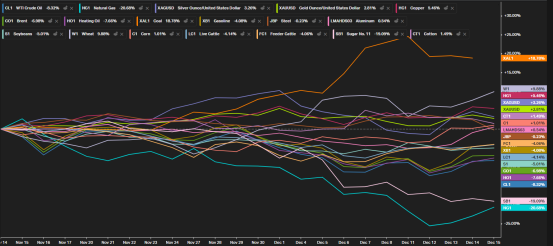

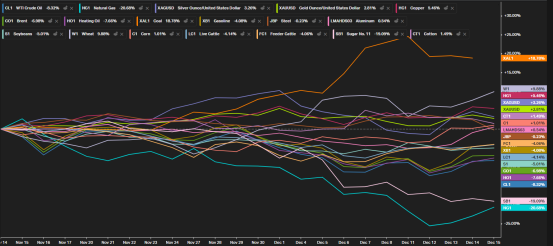

Month to date commodity performance

US Indices 5 day performance (last week)

TECHNICALS

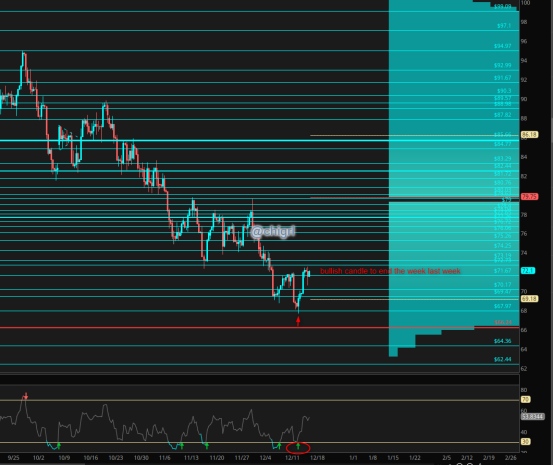

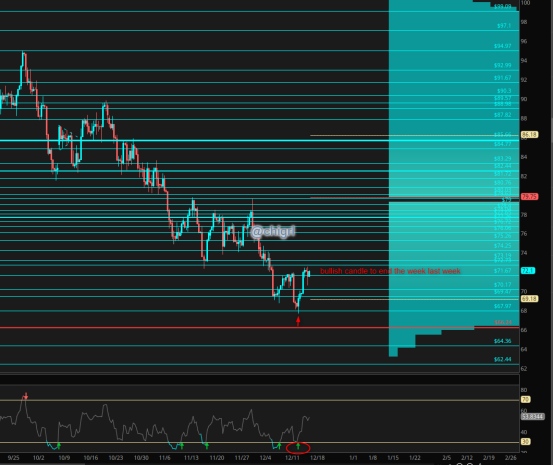

Crude oil

Last week I noted that I finally got a swing long trade signal at 67.97

Been a nice ride to 72.59

Given the fact that the US is now talking about taking on the Houthis militarily

Via Reuters today:

US weighs strike options to deter Houthis from more Red Sea attacks Top Biden administration officials are actively weighing options to strike back at Houthis in Yemen after the Iran-backed group launched new attacks on naval and commercial ships in the Red Sea on Saturday, according to two U.S. officials. The Biden administration has been reluctant to respond militarily against the Houthi attacks on commercial shipping in recent weeks for fear of provoking Iran, which backs Hamas and Hezbollah in Yemen as well as the Houthis. Previously, the Pentagon had recommended the administration not do so. But a significant uptick in attacks in recent days could potentially lead top U.S. national security officials to change their calculus.

We could see a further advance in prices as geopolitical issues seem to be escalating.

Nat Gas

Last week I noted that we could gap down ..indeed we did …that said, that weekly candle is actually bullish

If you are new to chart and candlestick patterns, this site is invaluable: The Pattern Site

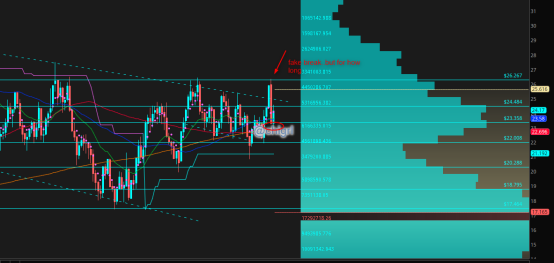

Gold

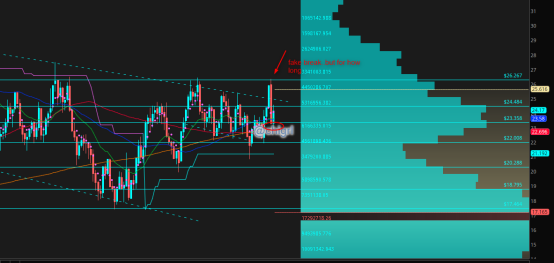

Silver

I still remain bullish (longer term). Weekly support held …possible nice set up for a short term trade higher

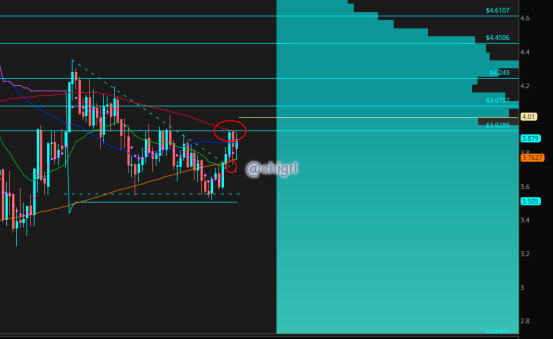

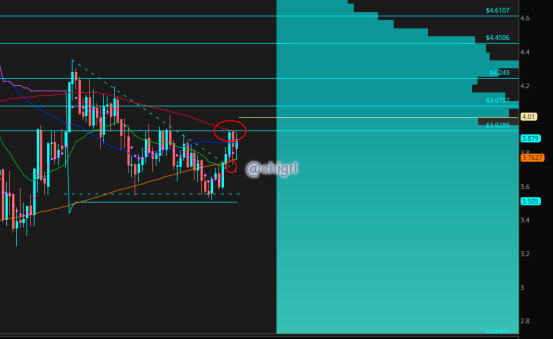

Copper

I note last week: We had beak out of the triangle and retest of the breakout last week.

That 100 day still proving to be a challenge, if we can make it over, shorts could get squeezed and it could fly

USD $DXY

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.