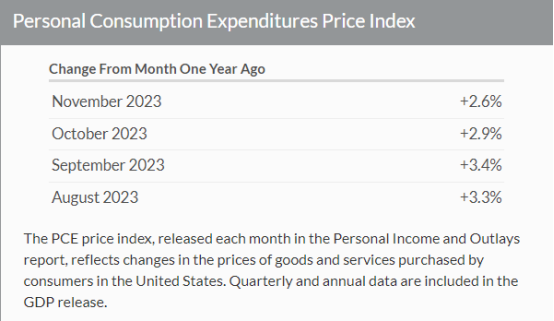

Last week was all about PCE

The PCE prices declined by 0.1% in November, below market expectations of no change while the annual rate cooled to 2.6% from 2.9%, the lowest since February 2021.

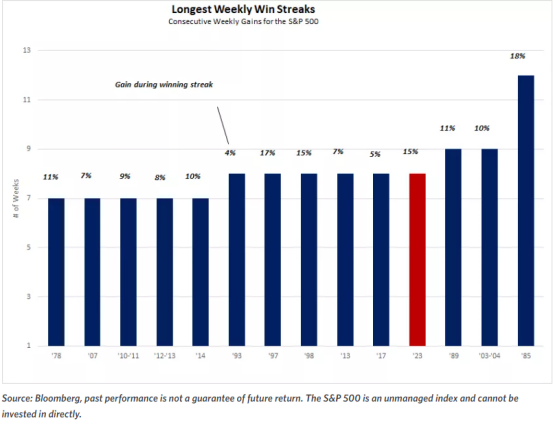

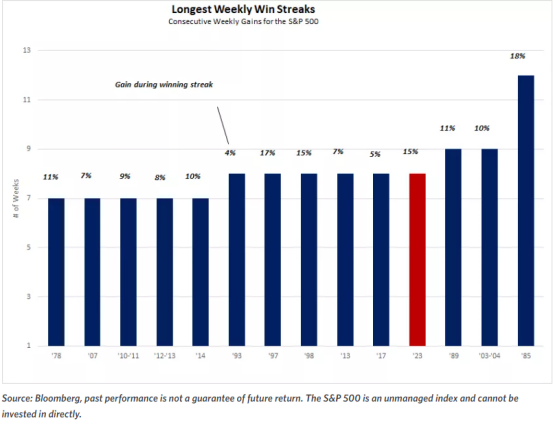

Markets absolutely rejoiced!

Stocks extended their winning streak last week, with the S&P 500 rising for eight consecutive weeks. In the past 50 years, there have been only three longer streaks, with the last occurring 20 years ago.- Edward Jones

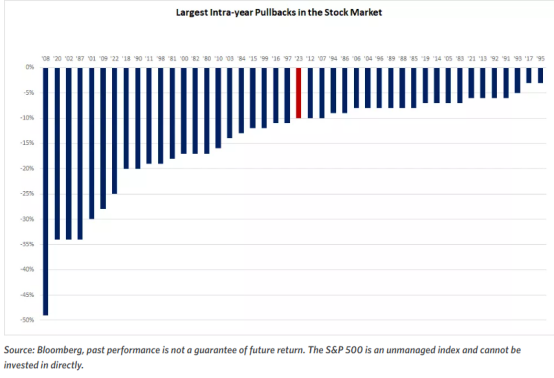

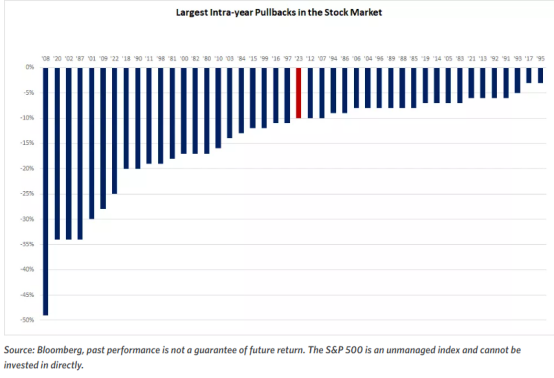

As a side note: 2023 saw two notable pullbacks: an 8% drop during February and March, and a 10% correction from August through October. Looking at the largest intra-year drawdowns in the stock market since 1980, this year’s landed in the middle of the pack. The bear market declines in 1987, 2001-2002, 2008-2009, 2020, 2022 are obvious standouts to the downside. Conversely, 1995 and 2017 are remarkable in that the stock market never experienced a pullback of more than 3% during the year.

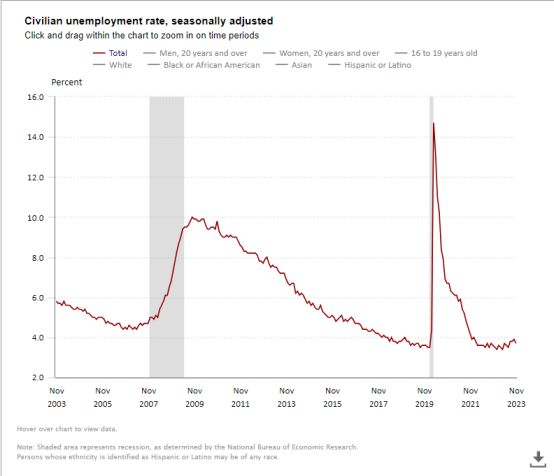

Unemployment numbers could not even deter the rally

Which came in softer than expected

How much is due to flows? Again I encourage you to listen to Anthony Crudele’s spaces with Cem karsan and Andy Constan. If you missed it, here is the LINK

where Cem laid out his bullish thesis based on flows.

My take: It is all about end of year flows and Jan beginning of the year flows, after that I would not get too comfortable

Going into this week, with thin holiday trading (could be volatile), here is what traders really want to keep an eye on.

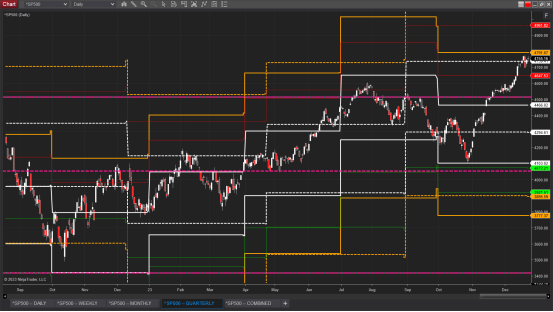

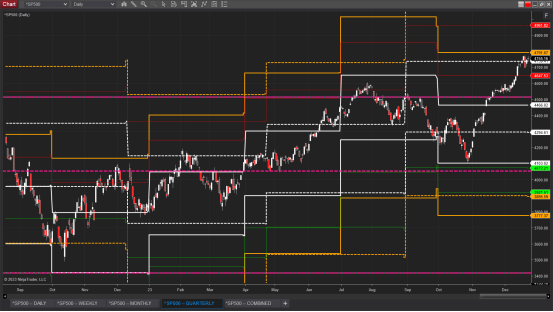

Chart of the week comes from Julie Wade

@julie_wade

Most important chart and analysis for the year. The $SPX. Pink lines = JPM Quarterly Collar $JHEQX, expires Dec. 30, 2023.

That top pink line is the short call that they are way out of position on. The middle pink line is the long put. And the lowest pink line is the short put.

So that long put offsets the losses on strikes above the short call. To a point. We just found that point. They would not let market hit 4800 which it clearly should have after NIRVANA GOLDILOCKS PCE numbers.

COMMODITIES FUNDAMENTAL NOTES

Things keep heating up in the Red Sea, and there was an additional attack by a drone off the India Coast which broadens this region. Notable:

This is the first time Iran has been directly implicated (rather than a proxy by the Houthis) >

Tanker hit off India coast by drone from Iran, says US Tanker hit off India coast by drone from Iran, says USA chemical tanker in the Indian Ocean was hit by a drone launched from Iran on Saturday, the US military says.

A fire on board the Chem Pluto was extinguished. There were no casualties.

Iran has not commented.

The US said the Chem Pluto was hit by “a one-way attack drone fired from Iran”. It is believed to be the first time the US has publicly accused Iran of targeting a ship directly.

In addition, the Houthi’s have also said that they would expand attacks to the Mediterranean Sea (I highly doubt this is even a logistical possibility given Turkey’s presence there)

Also notable, is that the US coalition let Operation Prosperity Guardian is showing signs of falling apart

Via G-Captain

France has agreed to remain but under the condition they do not have to follow American orders. They declined to comment on deploying more naval forces. Spain and Italy both left.

(this site updates often so if you are interested in this data, check back often)

Meme going around twitter right now-eek!

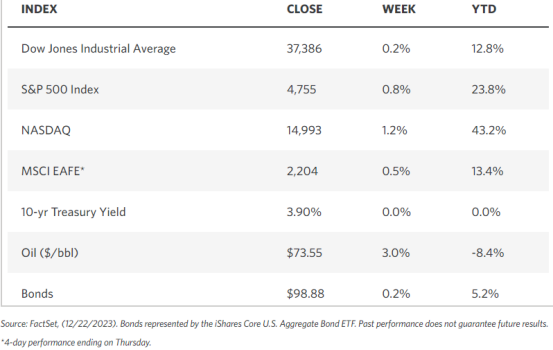

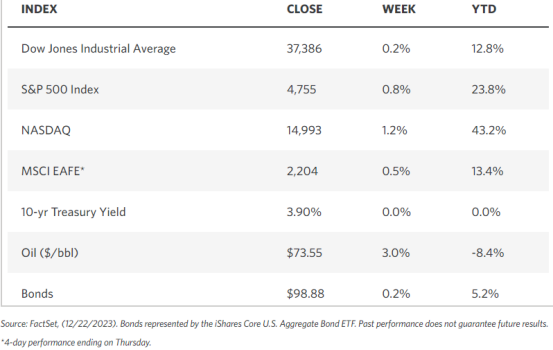

WEEKLY MARKET STATS

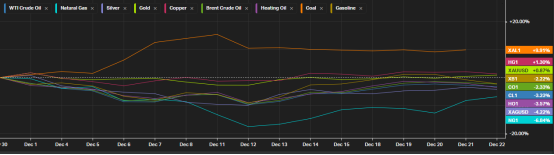

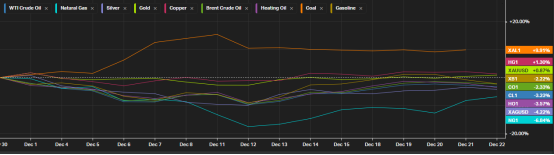

COMMODITIES PERFORMANCE MTD

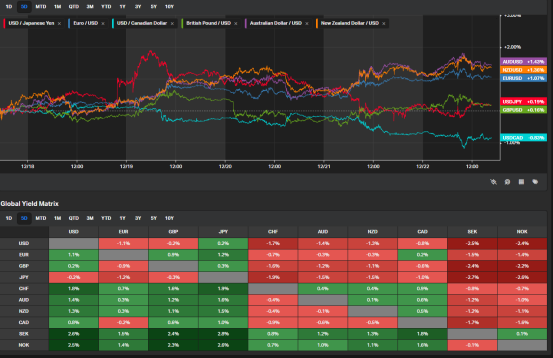

FX PERFORMANCE LAST WEEK

TECHNICALS

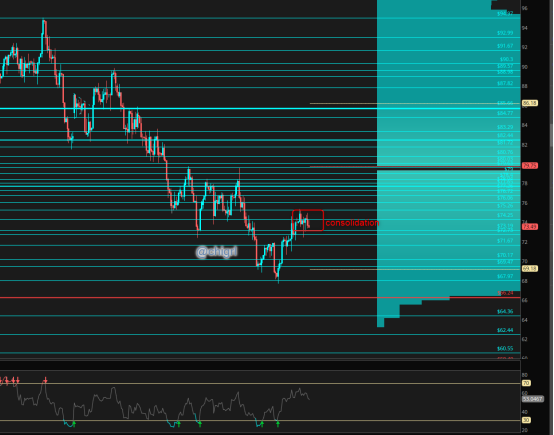

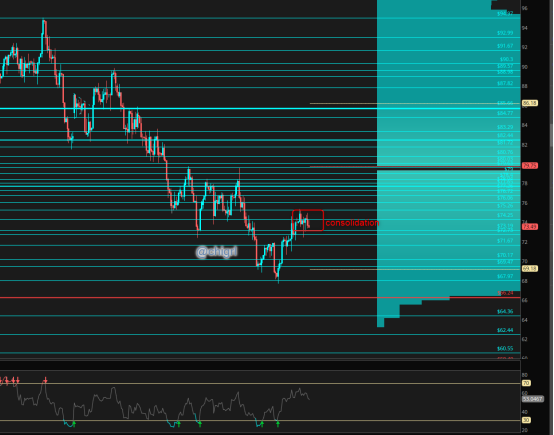

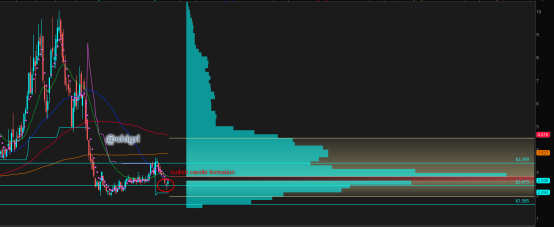

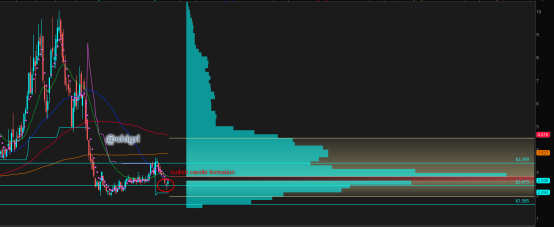

Crude Oil

Last week I noted that: We could see a further advance in prices as geopolitical issues seem to be escalating after hitting 72.59…

Indeed we hit a high of 75.37 last week

We have been consolidating since December 20th

Given the escalation this weekend …possible we see more upside

Also notable:

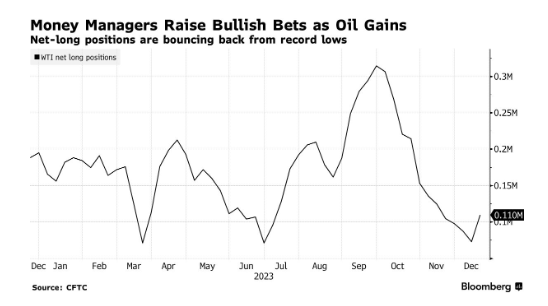

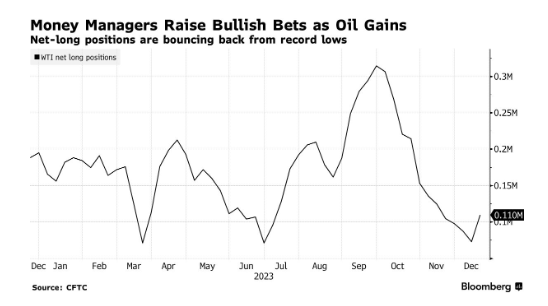

Hedge funds turned more bullish on oil for the first time in almost three months via the CFTC report on Friday

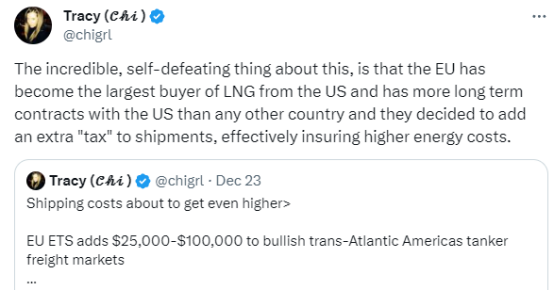

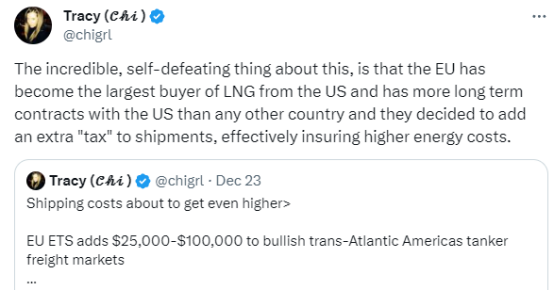

Nat gas

Weekly candle pattern is bullish, but fundamentals remain weak.

That said, notable higher shipping costs are coming after Jan 1 to Europe

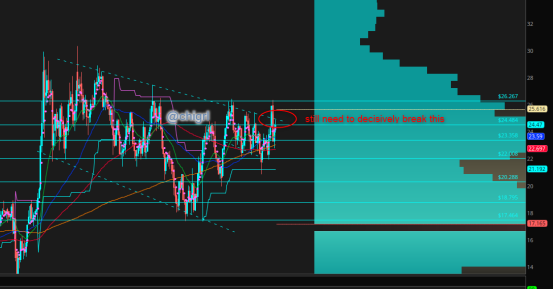

Gold

Here we are AGAIN

Gold is loving the market factoring rate cuts, the question is will be decisively move higher into 2024?

RSI is sitting at 59…in the middle of nowhere…so I expect some volatility may be a possibility

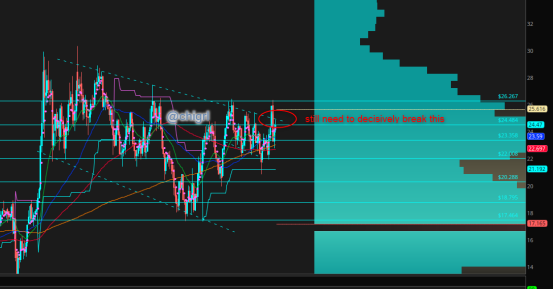

Silver

Last week I noted: I still remain bullish (longer term). Weekly support held …possible nice set up for a short term trade higher

Indeed we had an up week!

Thin trading may make this market almost impossible to trade this week, stay nimble

Copper

This market has been trading beautifull, technically speaking, that said, the 100 day is still proving to be a challenge

Over this and this market could fly.

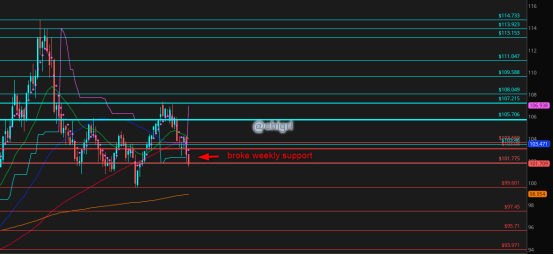

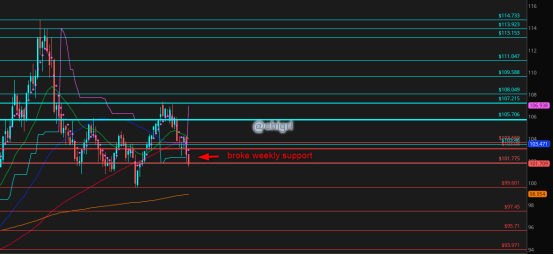

$DXY USD

USD broke weekly support last week, fueled by the market factoring rate cuts next year.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions