October 10th 2023

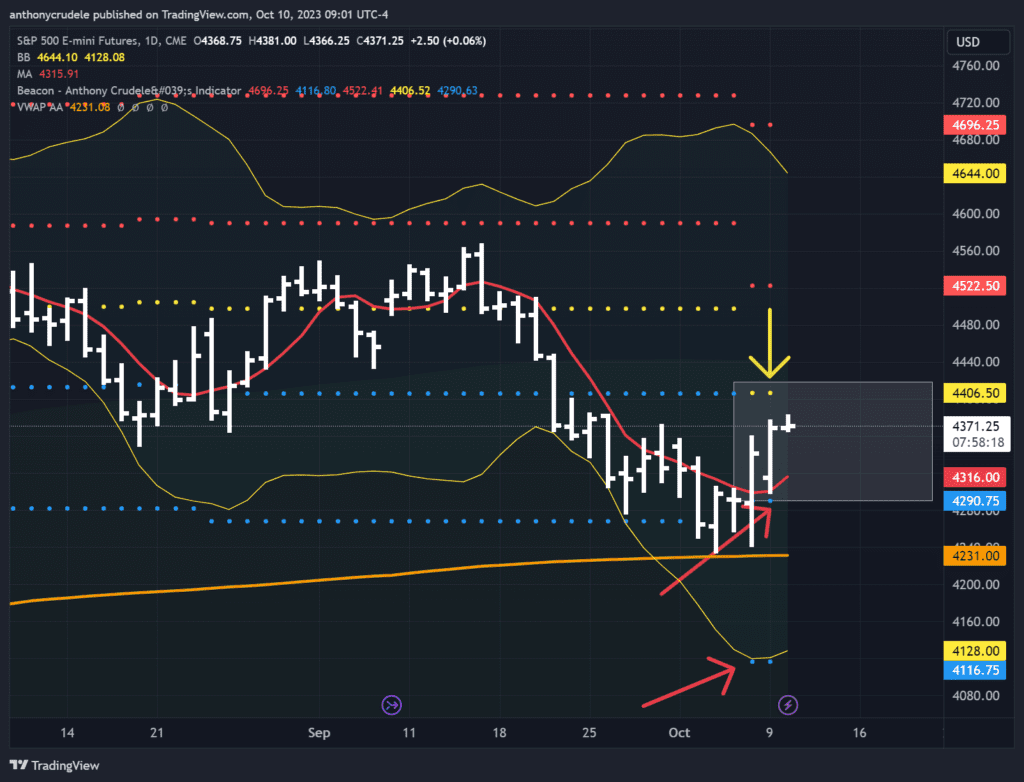

Yesterday showed the importance of patience post major market news. It’s not about our market expectations, it’s about how the market responds to our strategies, guiding our trading approach. Here are two key observations from the charts; firstly, the continuous inward movement of the daily Bollinger bands. This suggests the market remains in contraction mode, likely to continue mean reversion and potentially test my neutral area of 4406.50 in the coming sessions. The second observation is the slope change of the 5-day moving average. Prices are now averaging higher, a shift unseen for weeks.

My strategy: I continue to hold long on the Oct 20th 4400 Calls, pending a test of 4406.50 or a daily close below the five-day moving average – which would prompt me to consider closing the position.

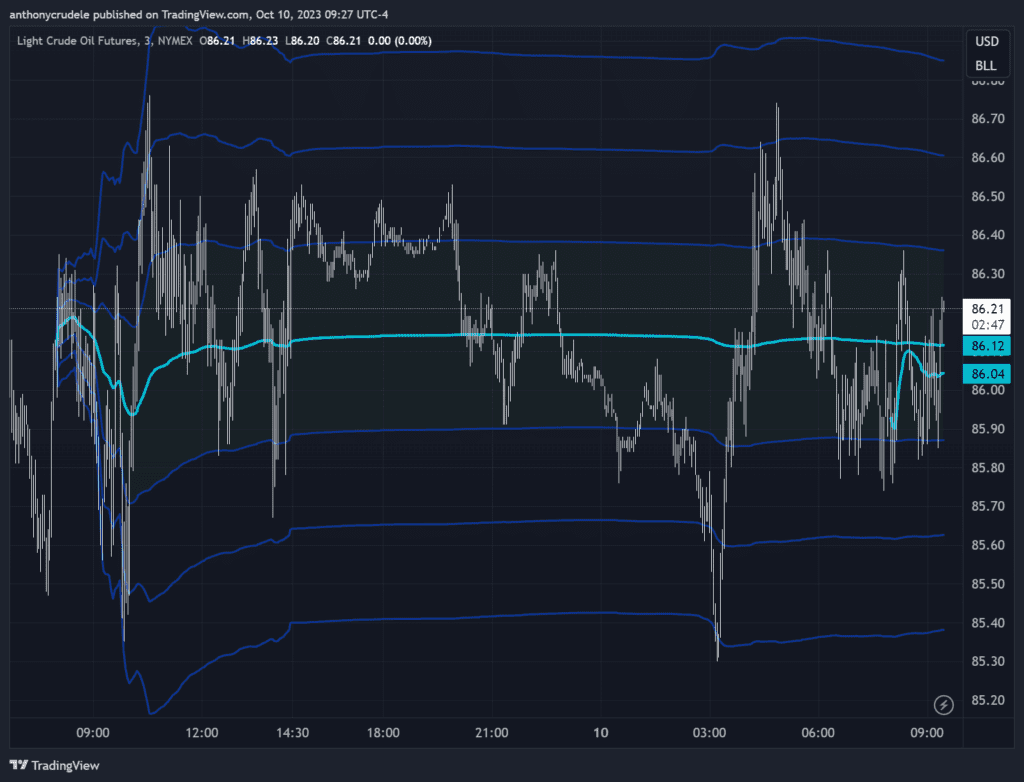

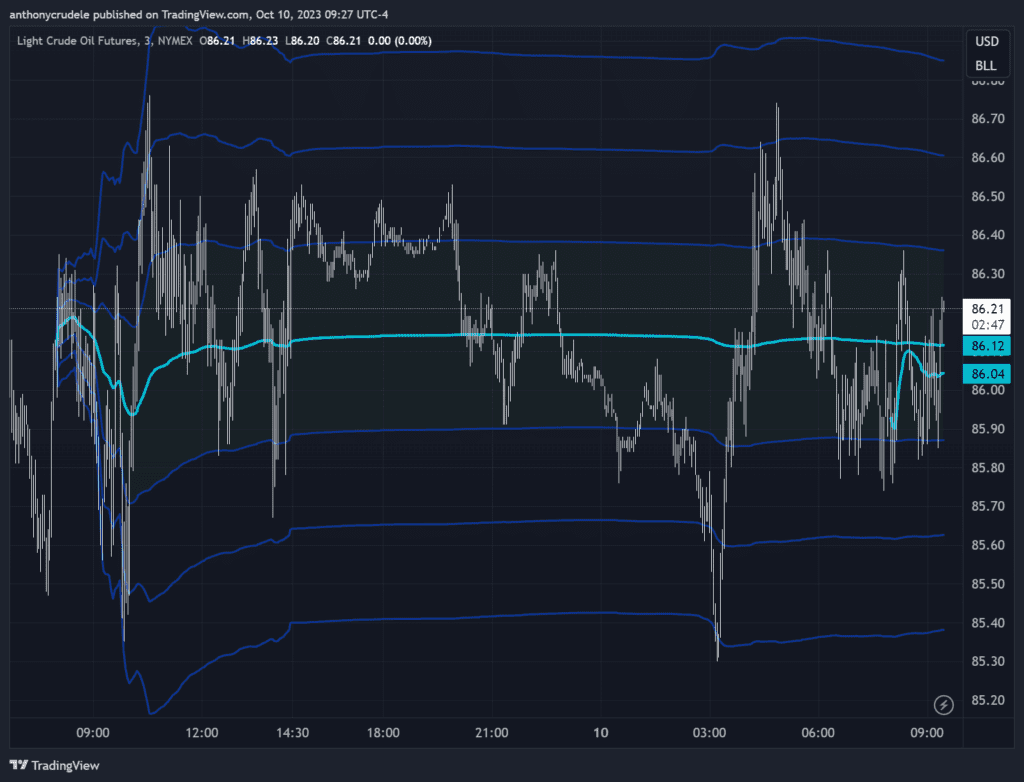

Intra-day, I’ll watch the 3-minute opening range and VWAP’s relative performance. It could be a choppy session if the VWAP doesn’t rise above the opening range and I’ll refrain from trading in that event. If it breaks above the opening range high, I’ll trade futures long side, managing risk and targets with standard deviation bands.

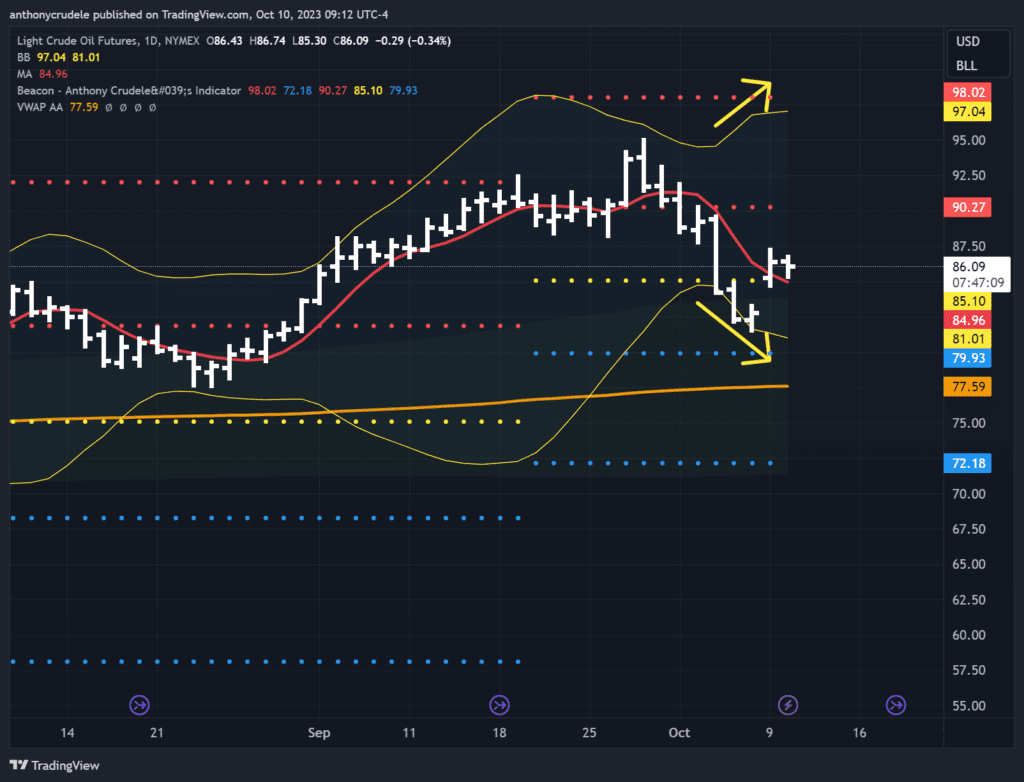

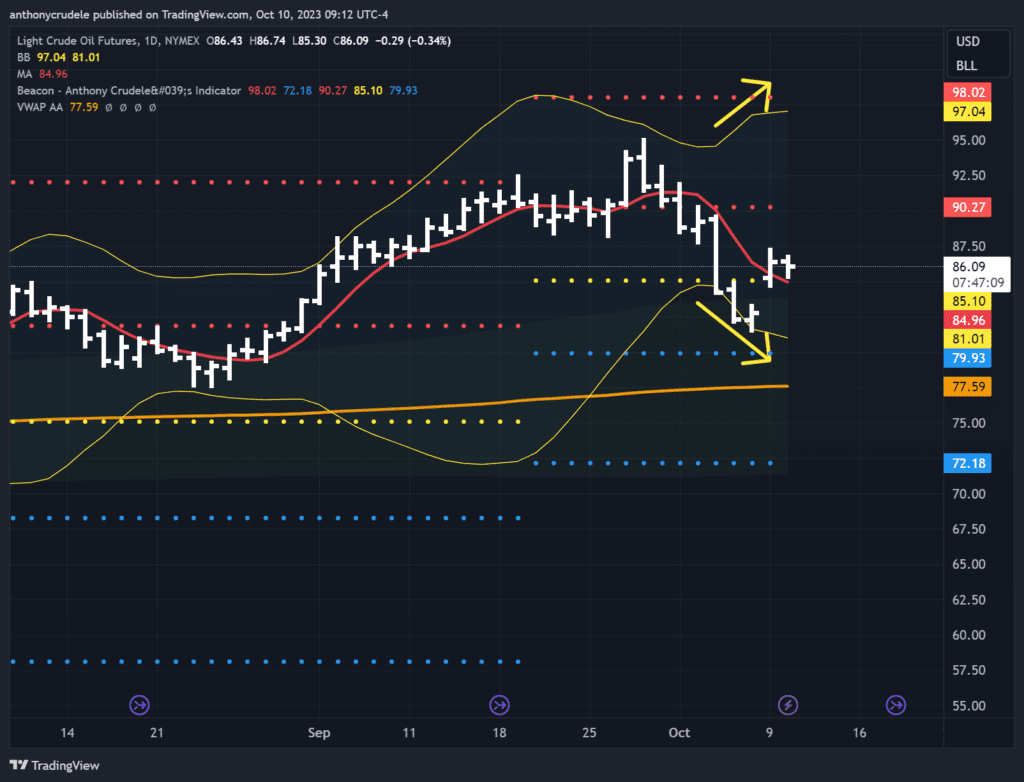

A quick review of Oil: Despite the bullish macro factors, the daily chart remains ambiguous and I’m steering clear for now. I’ll share more when I have a clear signal.

For a deeper dive into CL, examine yesterday’s 3-minute chart with a VWAP from the open and 3 standard deviation lines. The flatness is key, revealing no slope. This strongly suggests a range-bound market, not a trending one. If you’re trading CL today, monitor how the VWAP and standard deviation lines behave from 8 am ET onward.