Markets GREEN

- Hong Kong: Hang Seng closed up +1.29%

- China CSI 300 +0.28%

- Taiwan KOSPI +1.29%

- India Nifty 50 +0.61%

- Australia ASX +1.03%

- Japan Nikkei +0.42%

- European bourses in positive territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

European Gas Pauses Rally As Traders Monitor Australia LNG Talks-BBG

Europe’s rally in natural gas futures took a breather, with traders awaiting clarity on talks between Chevron Corp. and its liquefied natural gas workers in Australia.

Benchmark futures fluctuated Wednesday after surging 37% in the previous three sessions. The Dutch contract briefly hit €50 per megawatt-hour earlier for the first time since April.

Prices jumped this week amid heightened anxiety over supplies, with the region on the cusp of the heating season as it faces its first cold snap in the next few days. While European storage sites are nearly full and will provide a cushion for potential supply pinches, the region needs continuous deliveries to satisfy demand after losing most of its pipeline gas shipments from Russia last year.

Gas markets were already on edge after workers at LNG plants in Australia said last week they plan to resume strikes unless a deal on pay and conditions is reached with operator Chevron. Both sides met on Wednesday, and discussions are scheduled to continue on Thursday.

COMMENTS: Likely we see a pause in the US nat gas as well

China Stocks Gain as Infrastructure Stimulus Bets Aid Sentiment-BBG

Chinese stocks advanced after a report saying Beijing is planning further support for the nation’s struggling economy boosted sentiment.

The Hang Seng China Enterprises Index climbed 1.3% in its fifth day of gains, marking the longest winning streak since July. The CSI 300 Index of mainland shares rose for the first time in three days, though gains fizzled in afternoon trading to just 0.3%.

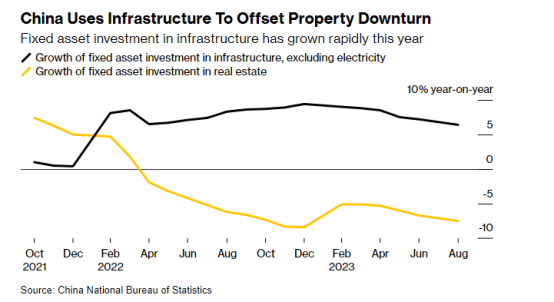

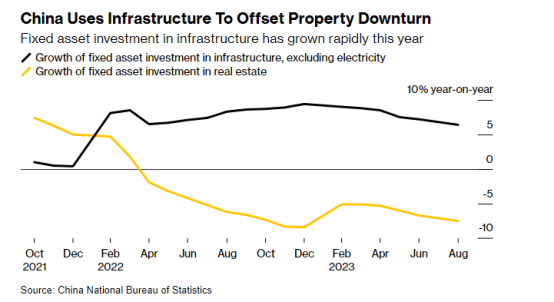

In a fresh effort to shore up the slowing economy, Beijing is considering raising its budget deficit and mulling the issuance of additional debt for infrastructure spending, Bloomberg reported Tuesday. If the measures materialize, they would mark a shift in the government’s stance toward broader fiscal stimulus and offer investors a major confidence boost.

Gains were notable among some property developers listed in Hong Kong. China Evergrande Group ended 23% higher while Sino-Ocean Group Holding Ltd. advanced 11% and Country Garden Holdings Co. rose 4%.

COMMENTS: Global markets in kind responding to the upside

China Budget Revision Would Mark ‘Sea Change’ in Fiscal Strategy-BBG

A rare mid-year revision to China’s national budget to juice the economic recovery with more stimulus would signal top leaders are moving away from a growth model that has piled ever more debt on local governments.

That’s the verdict among economists after people familiar with the matter said policymakers are considering raising the budget deficit for 2023 by issuing at least 1 trillion yuan ($137 billion) in sovereign debt for infrastructure spending — an amount that would push the deficit to well above the 3% cap set in March.

“It’s a big deal that Beijing is thinking of funding this itself,” said Dinny McMahon, head of China markets research at consultancy Trivium China. “This would be an implicit acknowledgment by Beijing that the traditional model of funding infrastructure is broken.”

COMMENTS: This is good news for commodity markets

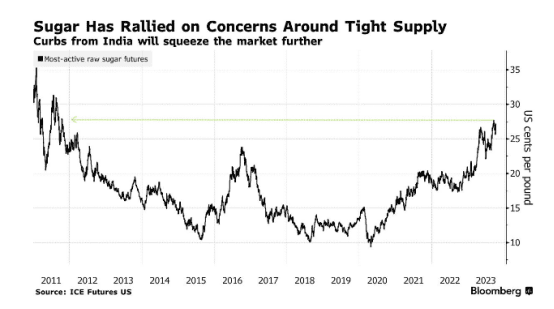

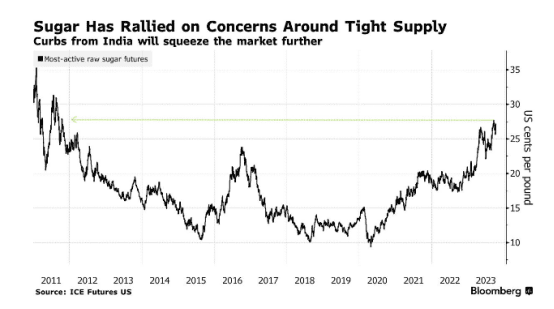

India Set to Restrict Sugar Exports in Threat to Global Supply-BBG

India is expected to impose restrictions on its sugar exports after dry weather parched cane crops in the world’s second-biggest grower, a move that will tighten global supplies of the sweetener.

The South Asian nation is likely to curb shipments during the new season that started Oct. 1, and a decision will be made soon, said people familiar with the matter who asked not to be identified as the talks are confidential. Quotas for some overseas sales can be issued if domestic supply improves, they said.

India introduced a quota system in 2022-23 and restricted sugar exports to about 6 million tons after late rains reduced production, compared with an unrestricted 11 million tons a year earlier.

According to a Bloomberg survey of 14 analysts, traders and millers last month, most said India may not export any sugar this season due to lower output. Two respondents said shipments could total at least 2 million tons.

COMMENTS: Resource nationalism continues, I think we see more and more of this with commodities as we see more and more scarcity

IMF Sees Inflation, Growth Risks If Israel-Hamas War Widens-BBG

The International Monetary Fund’s No. 2 official says that the war between Israel and Hamas could spur inflation and hamper global growth if it turns into a wider conflict that causes a significant increase in oil prices.

Modeling by the organization, whose mandate includes global economic surveillance, shows that a 10% increase in oil prices leads to inflation being 0.4 percentage points higher a year later, Gita Gopinath, the fund’s First Deputy Managing Director, said in an interview with Bloomberg TV’s Francine Lacqua.

Under that scenario, global output falls by 0.15 percentage point. That would add to an already difficult environment for inflation and growth that’s challenging central banks.

It’s a bit early to know the full implications of the conflict, and much will depend on whether it draws in other countries, she said.

“If it turns into a wider conflict, and that causes oil prices to go up, that does have an effect on the economies,” she said. “That’s usually one of the channels through which we see that affecting global numbers.”

COMMENTS: This is looking more and more like it may be a repeat of the 1970’s and that will cause problems for the central banks

US DATA TODAY