October 11th 2023

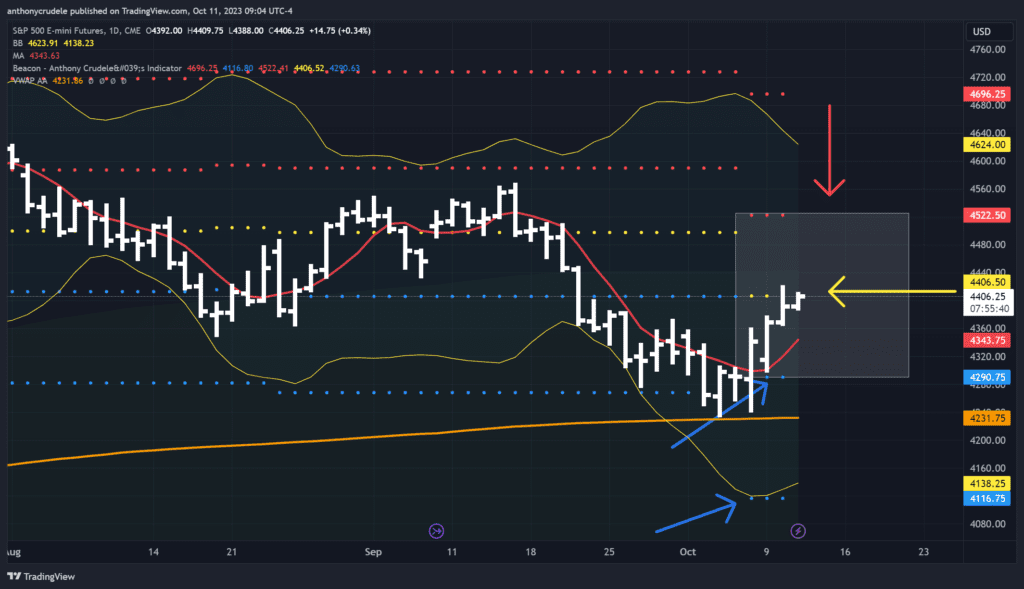

The market opens around a neutral area of 4406.50, well above the 5-day moving average (4343.25). Bulls seem to have the momentum, but expect a lot of back and forth in this neutral spot. I maintain a bullish position, but foresee a two-way tape until multiple daily closes appear above 4406.50, which could put 4522.50 into play.

Here’s my strategy: Using a 3-minute chart, I apply VWAP’s with 3 standard deviation lines from RTH opens. Notice the relative flatness – this suggests we might see a two-way, non-trending tape. The chart’s boxed area (4430-4340) might represent our upcoming session range. I’ll pay heed to those VWAP’s and deviation lines on lows, using futures to go long there with tight stops. The initial long area I’m watching is 4386.50. If not holding, I’ll shift focus to the 4375-65 area, my strongest buying spot.

Although I think it’s likely a two-way tape, I won’t consider shorts. I dislike shorting a market with a 5-day moving average trending upward and daily bollinger bands turning inward.

Keep an eye on the VWAP from today’s open and the VWAP’s and standard deviation lines from past sessions. If they begin to slope, that’ll indicate the favored direction.