February 5th, 2024

10-YR and RTY. Today, I’m still in a ‘wait and see’ mode, as there are a few things on my radar that require close monitoring. Firstly, the 10-YR is nearing a breakout to the downside, which signals higher rates and directly impacts the RTY. If ZN continues its downward trend today, it could weaken the RTY and trigger a significant drop. This could also affect the ES and NQ, albeit to a lesser extent.

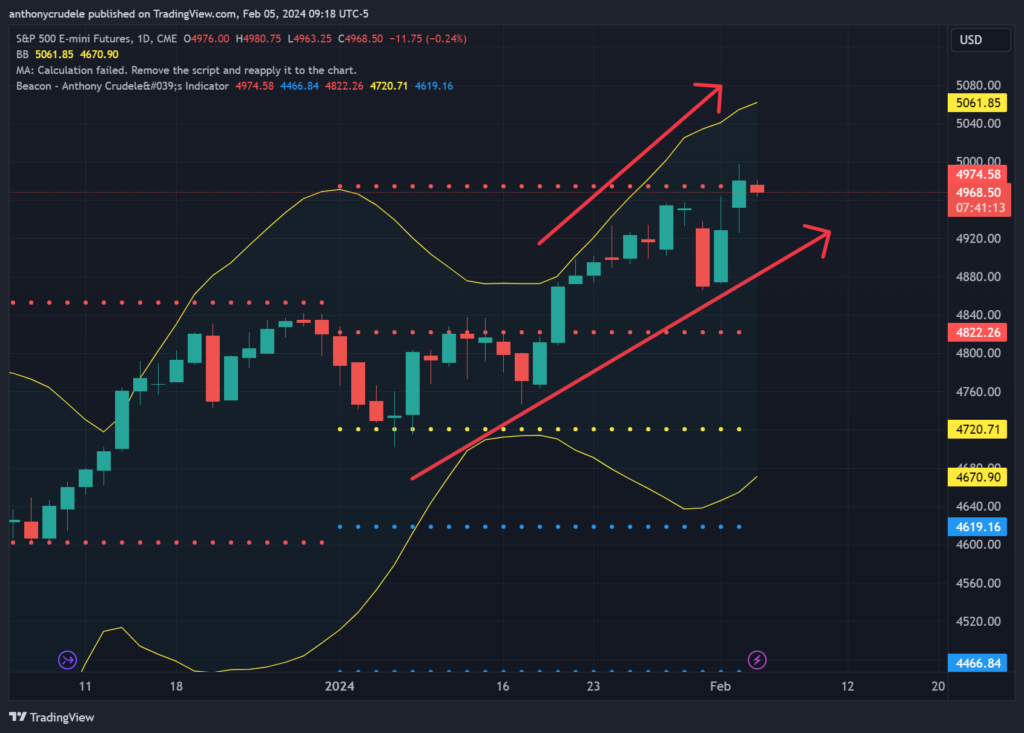

Regarding the technicals of ES and NQ, they are still in range expansion, but are teetering on the edge of mean reversion. The upper Bollinger Bands on the daily chart have moved inward for NQ, but not for ES. This creates an unclear path for my market trading at this time.

One essential element I will observe closely today is NQ’s close. If NQ closes red on a day where NVDA is up another 3%, it may be time for NQ to experience mean reversion.

Small and smart everyone.

Cheers, DELI