February 6th, 2024

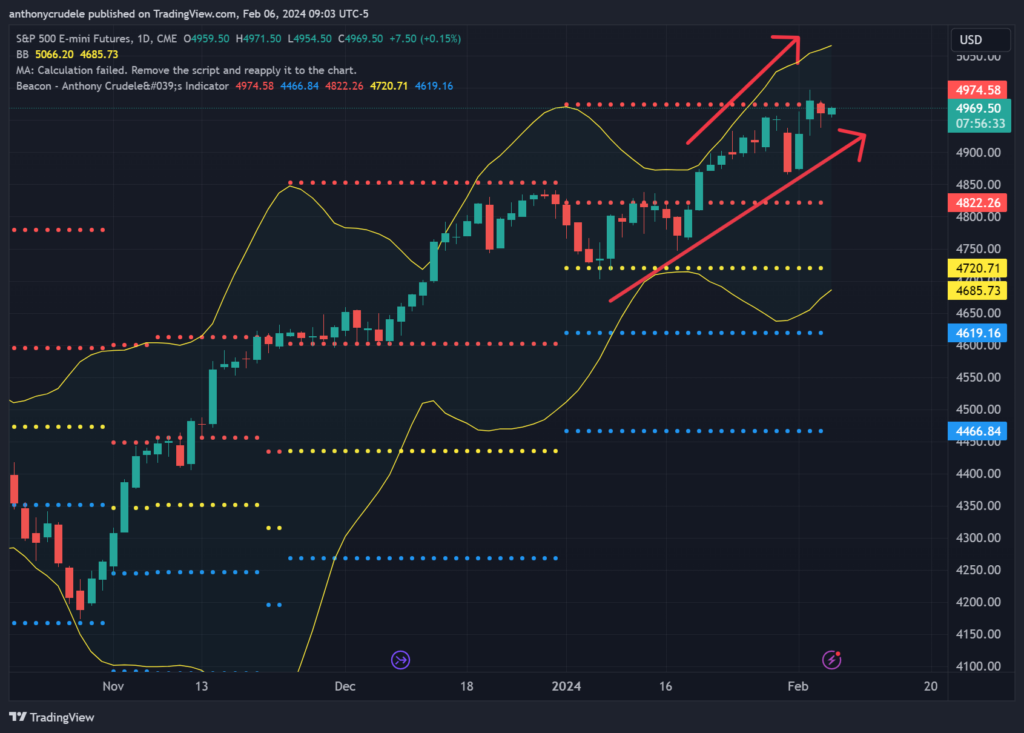

Resilience. By now, we’ve all heard the statistics: the market is being led by the Magnificent Seven, and the rest of the market isn’t doing much. We’ve also all noticed rates continuing to gradually increase, causing us to question if the Indexes would take notice. Additionally, the NQ futures have asset managers the most long in over five years, according to QuickStrike’s COT Data. For now, none of this seems to matter to ES and NQ, demonstrating their resilience as their charts continue to indicate a climb.

In this business, we all learn at some point that what might not matter today could hold significant weight tomorrow. In the era of High-Frequency Trading (HFT), things can be insignificant for months, then suddenly become crucial. In the days of all human trading, risks were accounted for more promptly, as humans tend to think more about risk. Machines, however, relentlessly follow trends, punishing those who oppose them.

For now, my strategy is to steer clear of this market. As an independent trader, managing risk in this situation is beyond my capabilities, even in the short term. As a swing trader and sometimes day trader, I require a clear direction and market environment to rely on. The current environment emphasizes capital preservation.

Important observations include the 10 YR (ZN), which remains weak and continues to pressure the RTY. This is the strongest correlation I see right now. Shorting both markets on rallies appears to be the most straightforward strategy. ES and NQ seem prepped to rally on the daily, and I wouldn’t recommend opposing them just because the ZN and RTY are selling off. A significant selloff in ZN would be required to impact ES and NQ, and we’re not quite there yet.

Keep it light and tight.

Cheers, DELI