June 12th, 2024

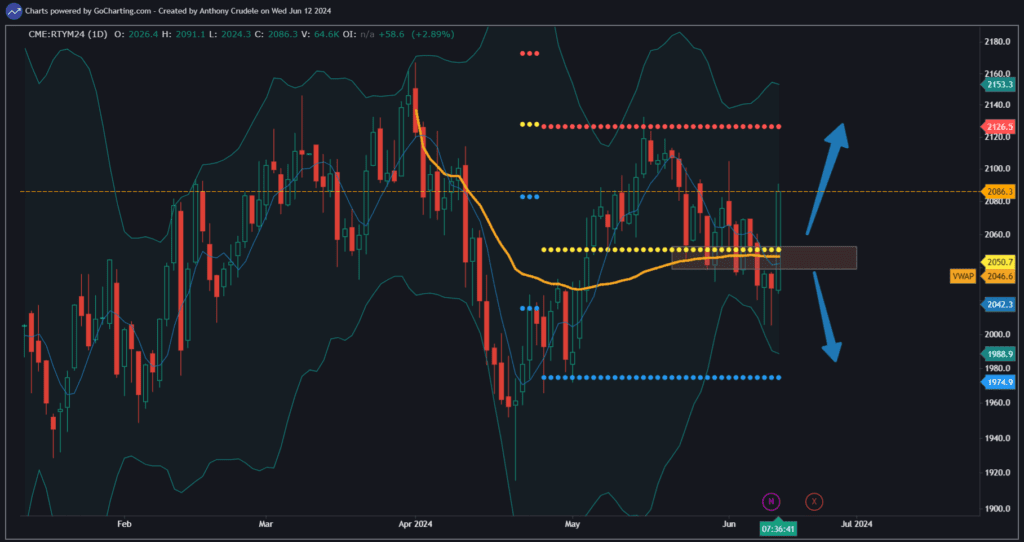

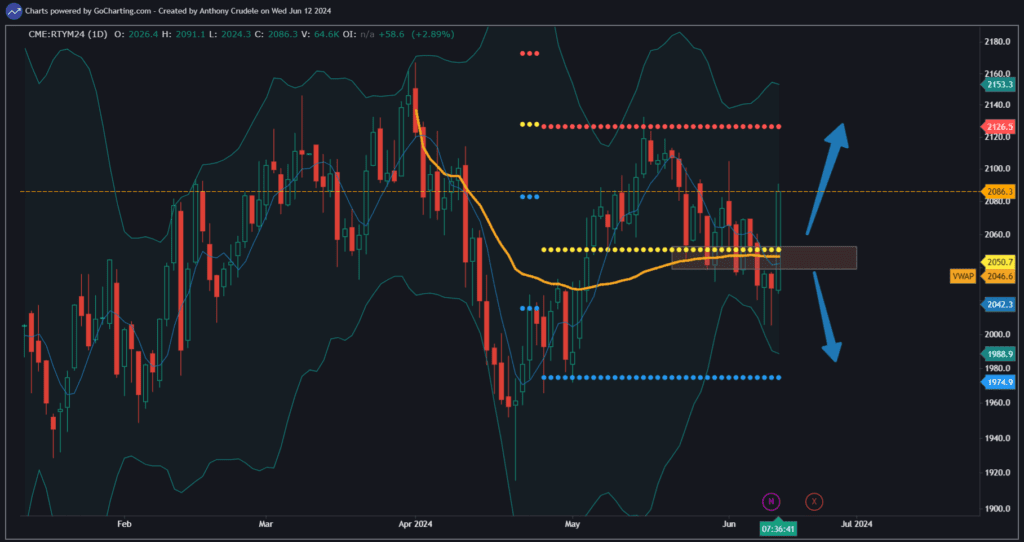

This morning’s story is the rally in the 10 YR (ZN), a full-force surge resulting from the CPI data that turned out a bit softer than anticipated. This rally in ZN, lowering yields, is just the spark needed by the bulls at this moment. It’s lit a fire under the RTY, triggering a full-participation rally across all indexes. Unless the Fed takes a hawkish stance today (highly unlikely), this market is set for another significant upward shift.

As I’ve recently been discussing, it’s all about momentum. The bulls are controlling, but when the market stalls at highs, you either see a two way tape or a tape that incites new money to enter or makes the shorts nervous, pushing us further up. The bulls have that edge again and it’s not something to overthink.

This market has room to rally, and I wouldn’t stand in the path of this steam train. With the Fed’s decision impending, I anticipate a market that will likely ascend further or merely pause and wait for the decision, not a market likely to pull back. Be cautious and strategic. This tape has both technical and fundamental support, so don’t let FOMO grip you.

Cheers, DELI