June 11th, 2024

ES and NQ continue to showcase bullish tendencies in the medium to long term. However, short-term momentum appears to have stalled as we await data and the FOMC Announcement. I anticipate a thin tape and possible two-way action in these markets.

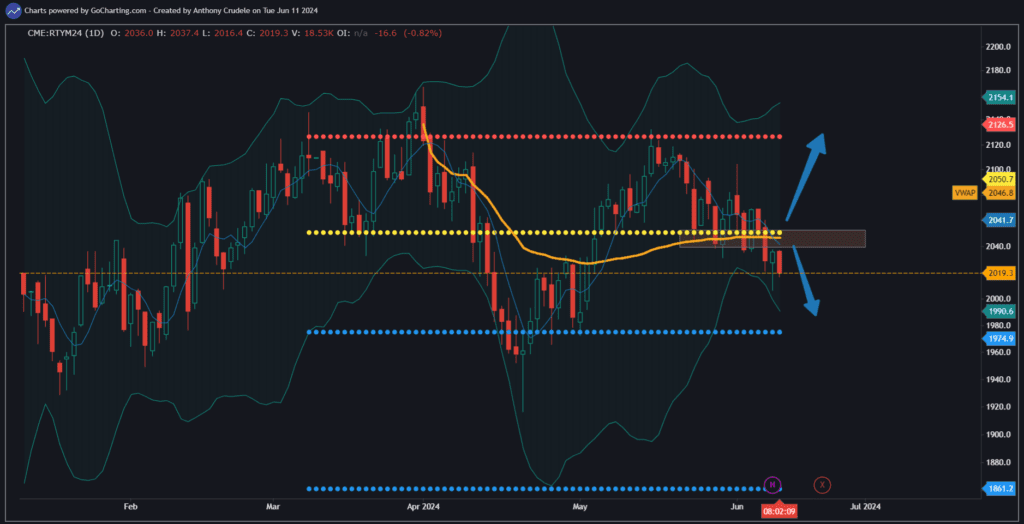

Regarding RTY, it remains a ‘sell the rallies’ market. Its Bollinger Bands are widening, suggesting a range expansion and a potential for a continued downward trend. This dynamic could change with a dovish Fed, adding a layer of complexity to today and tomorrow’s trading decision prior to the announcement. If the Fed leans even slightly hawkish, it’s plausible RTY could trend significantly lower.

So, what’s the strategy for day traders in this scenario?

Personally, I’m sitting out today’s and tomorrow’s sessions due to the lack of an edge right now. The aim of my morning note is to provide insights that take you beyond your short-term strategies, aiding you to better position yourself for the day’s trade. However, for now, that trade is small or not at all.

If you’re trading and detect signals aligned with your short-term strategy, ES and NQ may present opportunities for trading in both directions. But remember, don’t let greed drive your expectations and be prepared for a choppy tape.

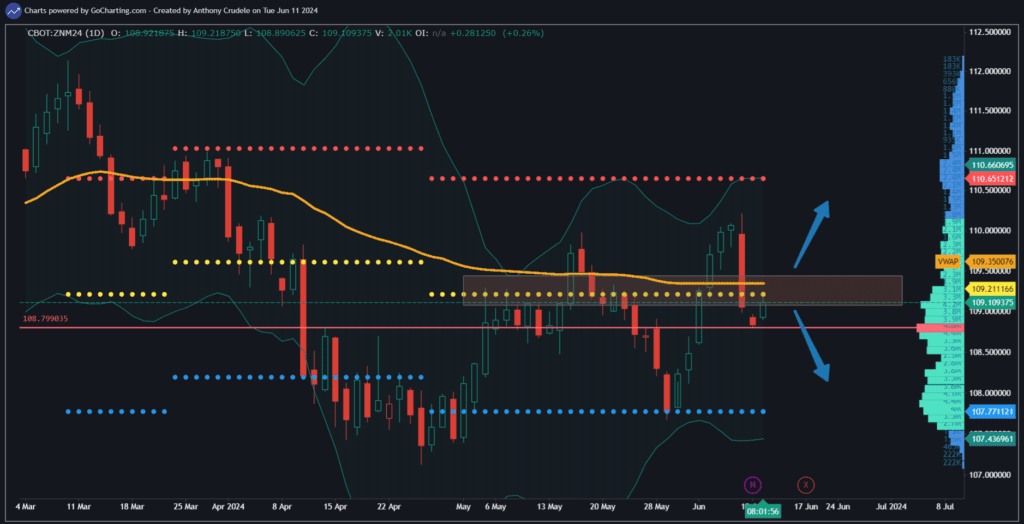

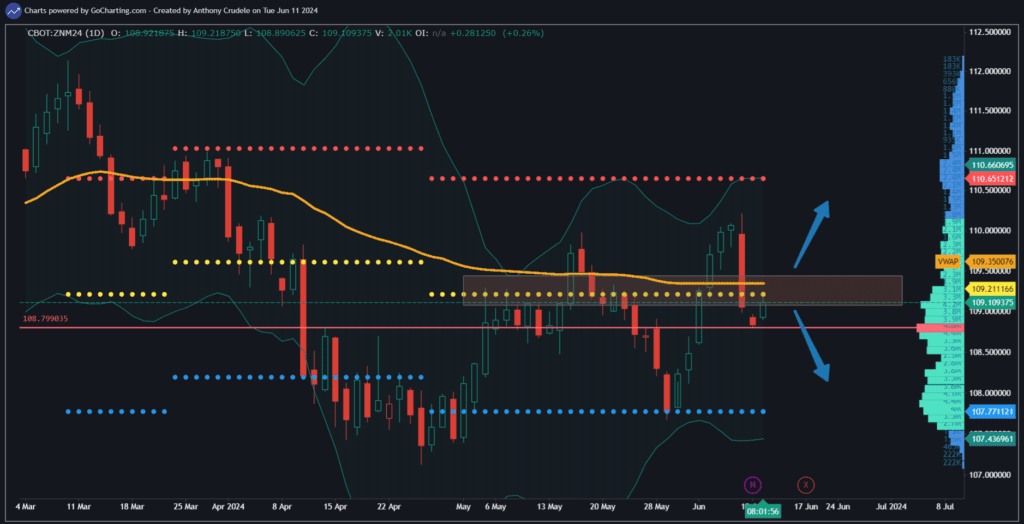

For those trading RTY, I see it as a ‘sell-the-rally’ market with a focus on short signals. Currently, there’s no compelling reason to consider long signals in this market. The continued weakness in ZN serves as solid confirmation to sell the rallies in RTY.

Stay small and smart. The real action is likely to unfold later in the week. Avoid boxing yourself into a corner before potential bigger opportunities present themselves.

Cheers, DELI