June 10th, 2024

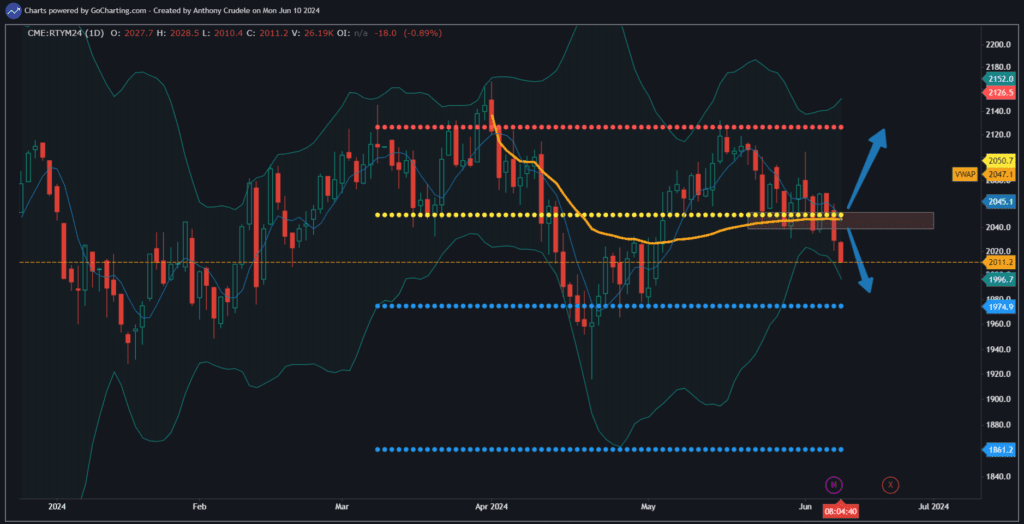

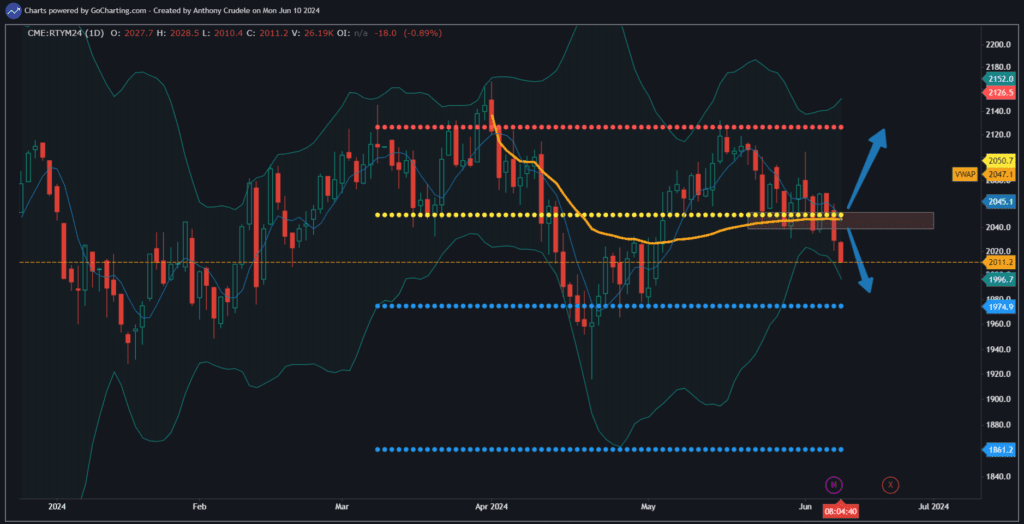

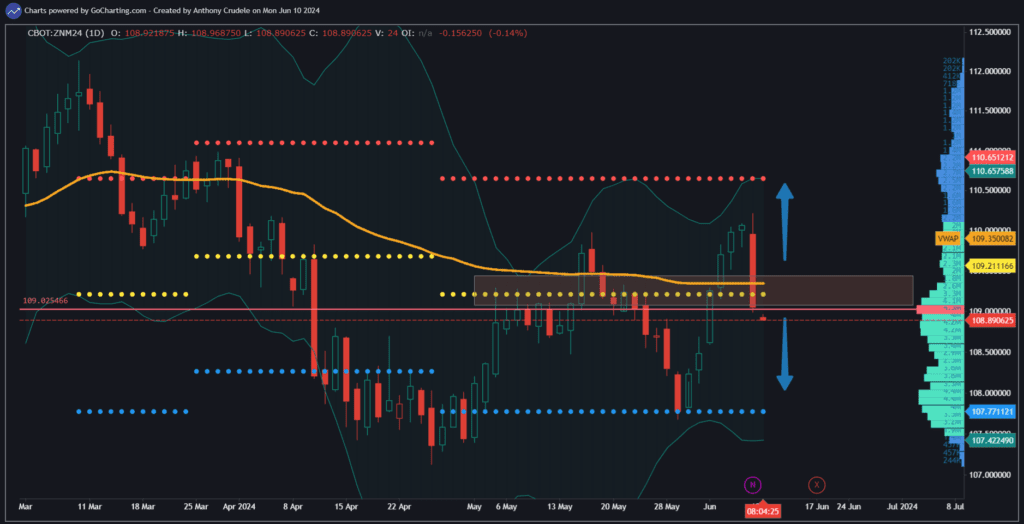

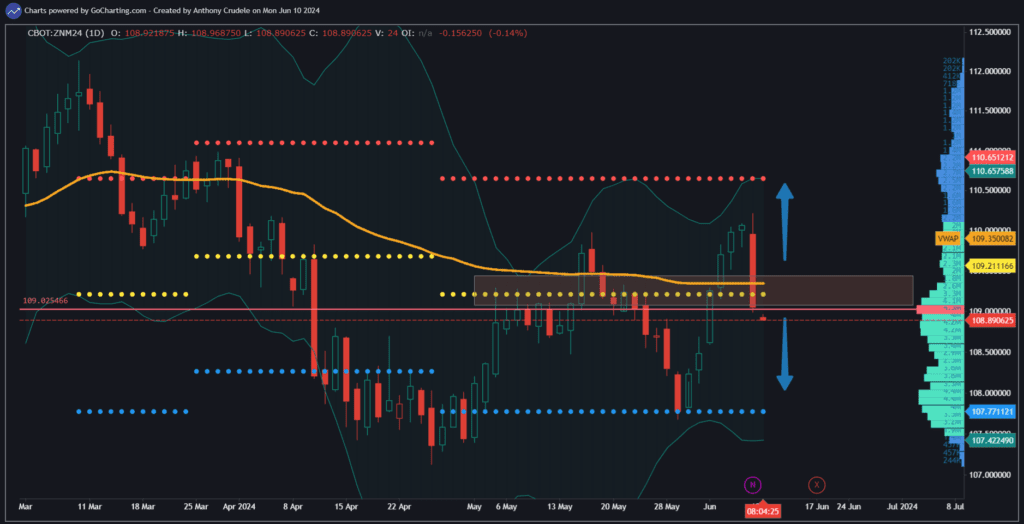

As we approach a busy week filled with data analysis and the FOMC Meeting, my attention is centered on the activity in RTY versus ZN. Given that ZN failed to maintain another rally and now, the RTY correlation comes back into play as it declines alongside it. This is the current narrative for markets.

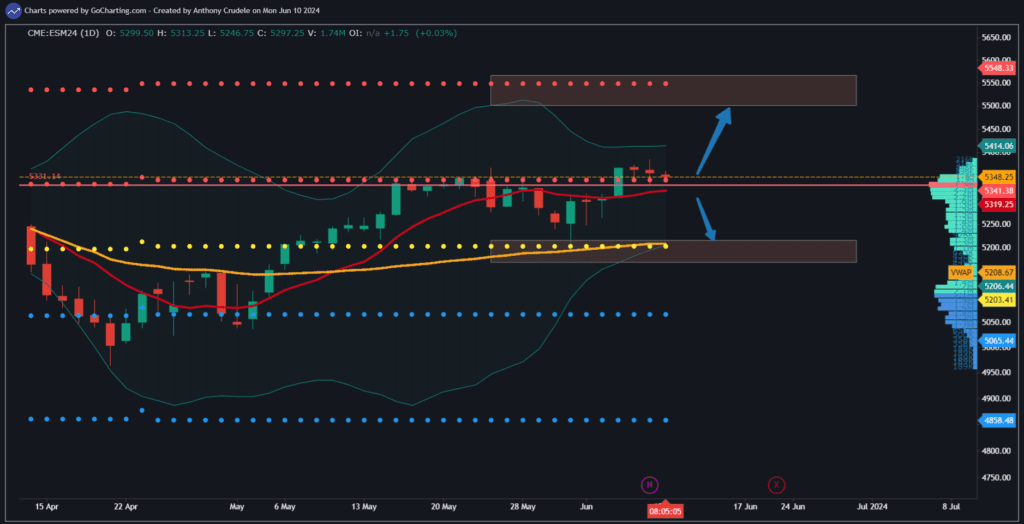

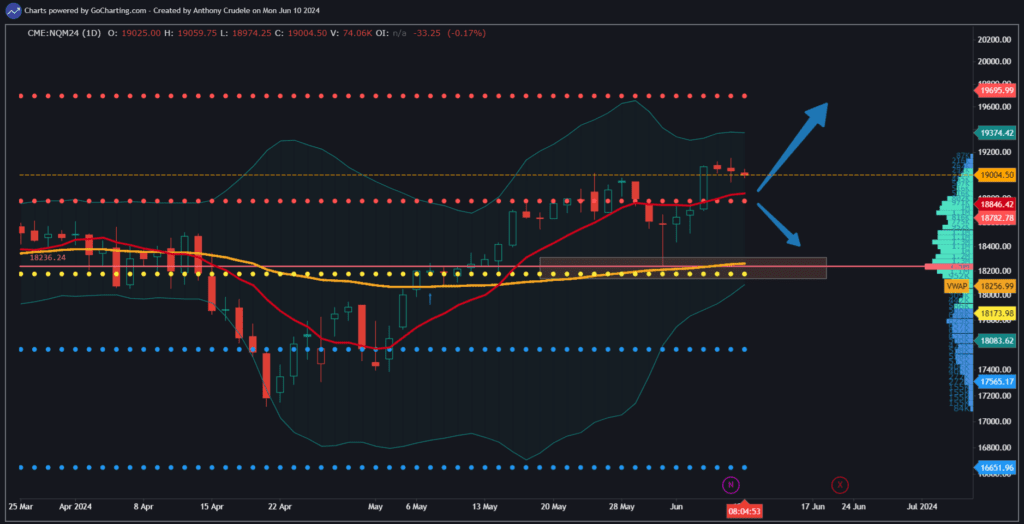

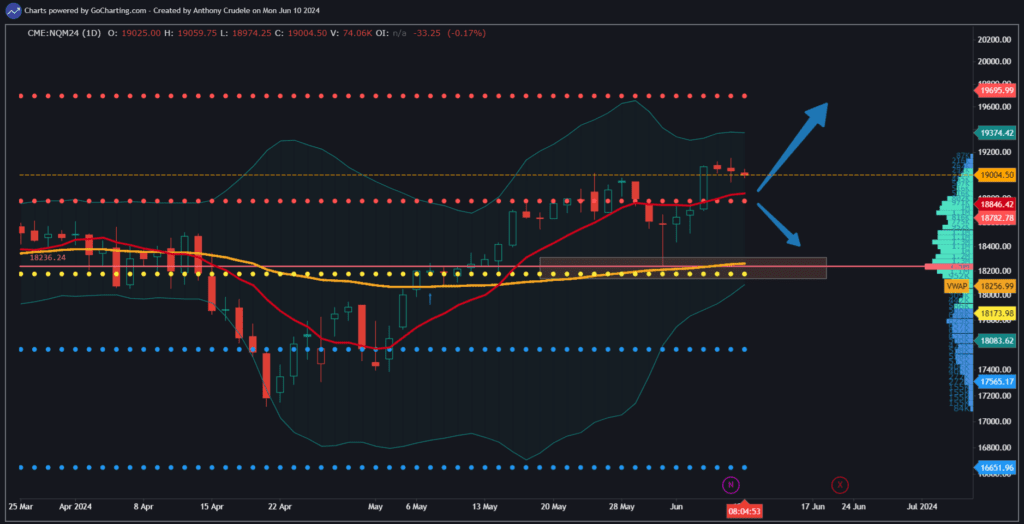

On Friday, I discussed that bull’s momentum seemed to wane for the day. I am still a long-term bull, but short-term momentum appears to be leaning towards the bears. This is likely the case today for ES and NQ as well. It’s hard to envision buyers wanting to step in at these levels in ES and NQ, with rates gradually rising and RTY seemingly edging closer to hitting their yearly lows rather than highs.

What should day traders do in this market environment?

I see the ES and NQ markets are more of a two-way tape, than a bearish tape. Short-term day trading strategies could be executed in both directions, with choppy action expected. Keep it light and tight.

For RTY, I perceive it as a ‘sell the rally’ market with a focus solely on short signals using your day trading strategies. Currently, I don’t see a compelling reason to take on long signals in this market. ZN continues to show weakness, and this confirms to sell the rallies in RTY. This is my preferred method to navigate this tape currently.

In any case, it’s important to remember that this week will be busy for the markets. Light trading sessions are expected today and tomorrow, as the bulk of volume and volatility will likely emerge later in the week. Trade small and smart.

Cheers, DELI