September 30th, 2024

The stage is set for EOM and EOQ, and for now, the momentum is stalled for the bulls. End of the month is typically my favorite day of the month to trade futures because the last 5-10 minutes of the day are typically a one-way move. Through order flow tools, if aggressive buying or selling comes in, it can be a move to grab onto with a tight stop and could run for a quick scalp.

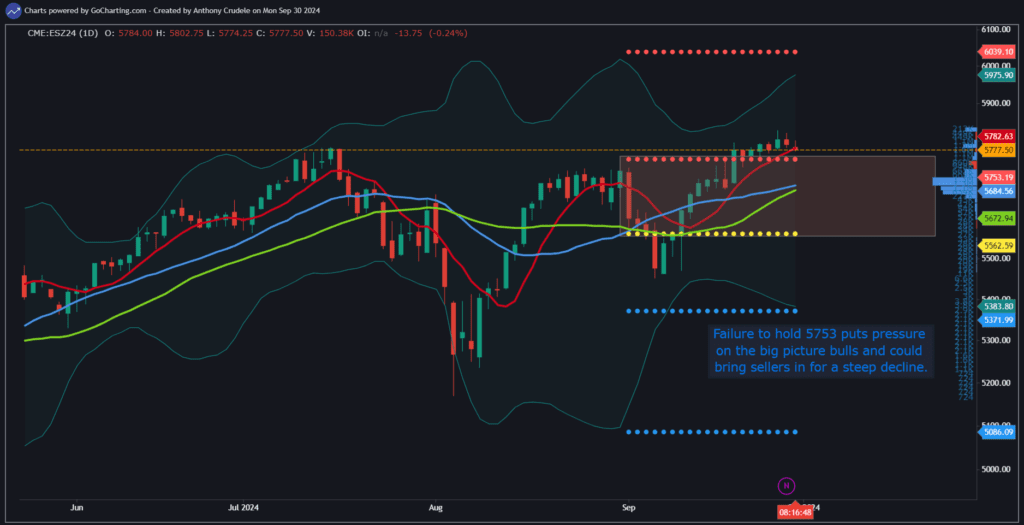

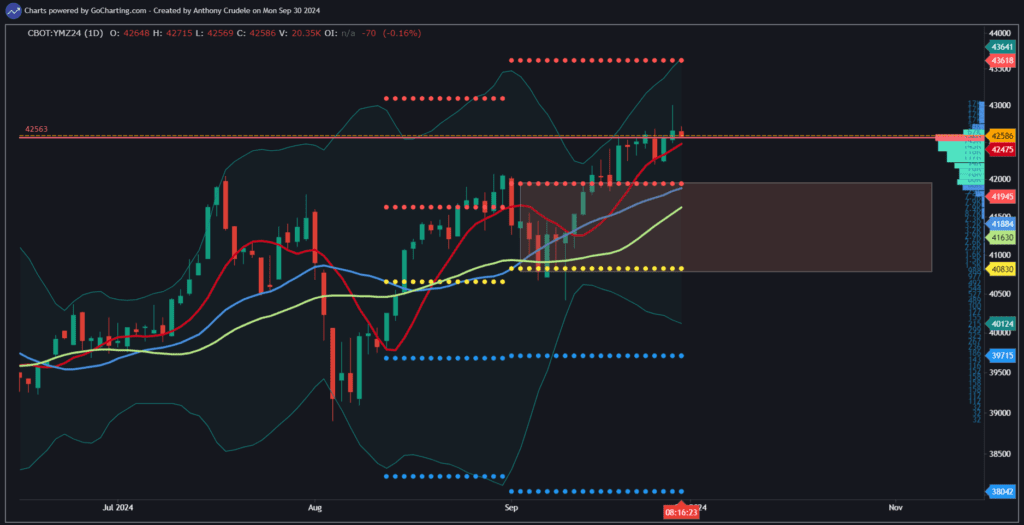

Because the momentum is stalled for the bulls as we come in lower today, I can see some weak-handed longs come in and take us a bit lower out of the gates this morning. Overall, the primary trend remains up so any dips in ES or YM, I expect a minimal decline.

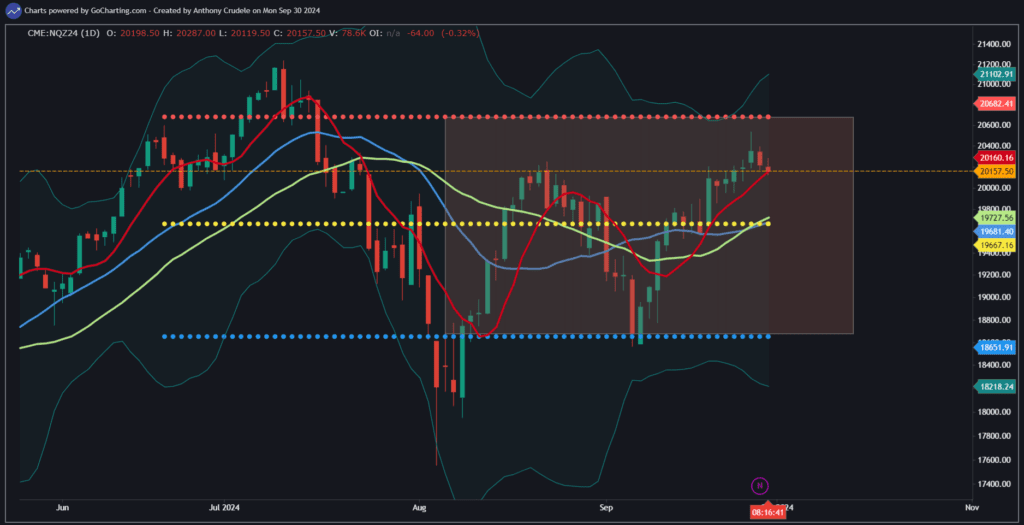

However, for NQ, the charts are still showing a two-way tape, and I can see them leading to the downside in a weak tape today.

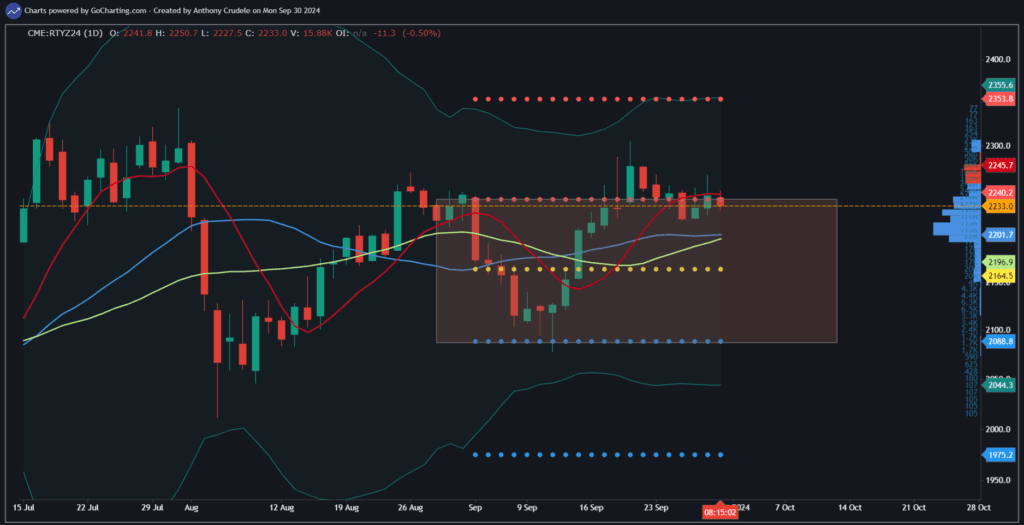

RTY is just a head-scratcher for me at the moment. We’re in a rate-cutting environment, and they should have an underlying bid from the macro side, but the charts are messy. They try to get bullish only to come right back down. It’s a frustrating trade for those trying to be long small caps, and for now on the futures side, I’m just staying away from it.

I do think if they get slammed this morning, that will spill over to ES and YM because it takes away from their momentum, and we could see longs get a little nervous and do some selling.

EOM is all about the last 5-10 minutes for me, and I will not trade until then. In the morning and midday today, expect some random moves as volume will shoot in and out for EOM/EOQ. Just keep it light and tight.

Cheers,

DELI